J.P. Morgan’s head of wealth administration says shoppers are more and more viewing Bitcoin as an asset class.

JP Morgan Asset & Wealth Administration CEO Mary Callahan Erdoes says the banking big’s shoppers see bitcoin as an asset class and “wish to make investments.”

The remarks got here in a video clip from “Bloomberg Wealth with David Rubenstein” launched Tuesday by the media outlet, however that was first recorded on June 7.

When requested by Rubenstein whether or not she would facilitate transactions for shoppers who love Bitcoin, Erdoes appeared to defer, arguing it’s “blockchains and digital currencies” which are “altering completely different monetary markets.”

She went on to comment that there’s debate as as to whether Bitcoin is an asset class or not, however that JP Morgan’s shoppers more and more consider it’s.

“Numerous our shoppers say that’s an asset class, and I wish to make investments, and our job is to assist them put their cash the place they wish to make investments,” she mentioned.

Erdoes clarifies that JP Morgan doesn’t view “Bitcoin as an asset class, per se.” She factors out that solely time will show Bitcoin as a retailer of worth and implied that the volatility of the bitcoin value in U.S. {dollars} was considered one of JP Morgan’s reservations.

In April it was introduced JP Morgan deliberate to permit rich shoppers to put money into Bitcoin by a forthcoming actively managed fund. They are going to probably change into the second largest financial institution to supply entry to bitcoin, second to Morgan Stanley.

As of July, the wealth administration divisions at main banks together with Goldman Sachs, JPMorgan Chase and Financial institution of America don’t at the moment enable their advisors to supply direct bitcoin investments. Nonetheless, JP Morgan does present publicity to prospects by investments in corporations like MicroStrategy, Sq., and Tesla, who maintain bitcoin in reserve.

The corporate has additionally been hiring for roles for its blockchain unit Onyx, a undertaking which was introduced in October of 2020 to mirror their “dedication to innovation, and to construct a “extra inclusive monetary system.”

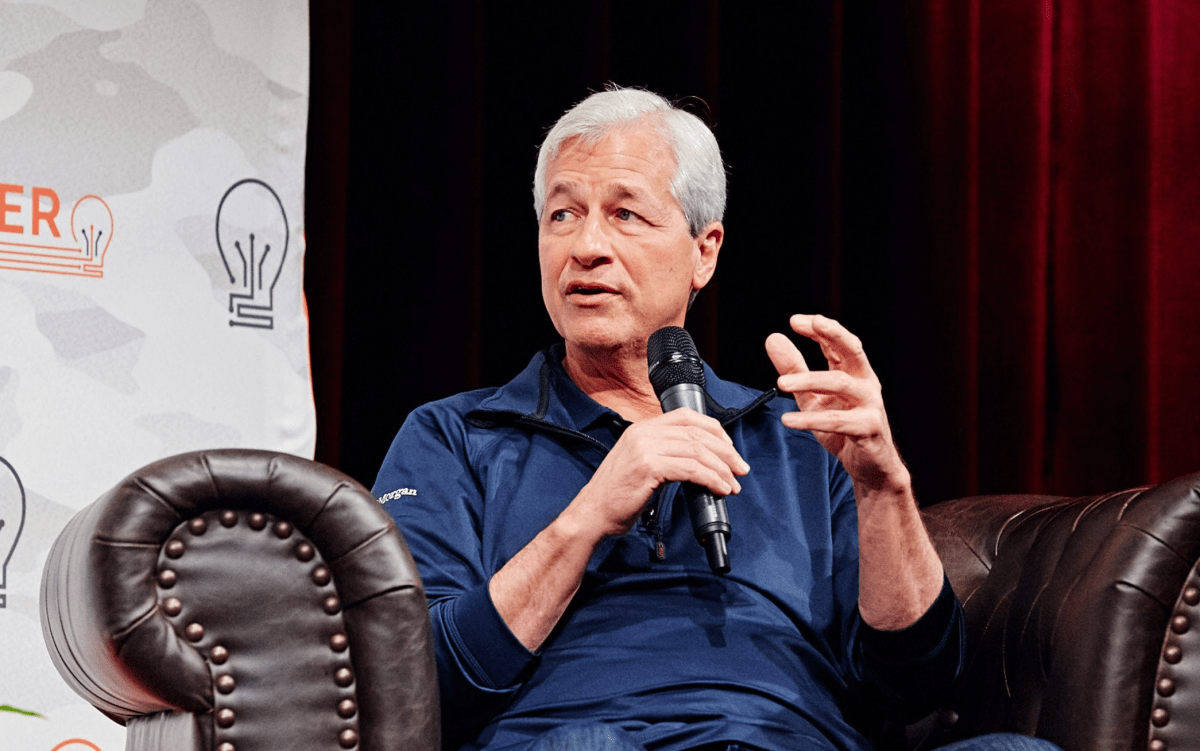

Jamie Dimon picture through JP Morgan Fb

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.