Mr. Cooper Group Inc. COOP concluded the sale of its title enterprise — Title365 — to Mix Labs, Inc. on Jun 30 for $500 million.

The deal quantity consisted of $450 million in money and a retained curiosity of 9.9%. Accordingly, the corporate has recorded an after-tax acquire of round $350 million.

Administration famous that the divesture is “one other step we’re taking to remodel Mr. Cooper into the main non-bank mortgage firm”. The transaction is a strategic match because it improves the corporate’s liquidity and tangible guide worth, providing larger scope to increase its core enterprise and improve shareholder worth.

Mr. Cooper has been enterprise initiatives to weed out non-core companies in its efforts to give attention to progress of core servicing and originations companies. Not too long ago, the corporate entered a definitive settlement to divest its Reverse servicing portfolio to Mortgage Property Administration, LLC and its associates.

The sale of the portfolio, which operates beneath the Champion Mortgage model, will shrink Mr. Cooper’s servicing portfolio by round $16 billion in unpaid principal steadiness, and trim the steadiness sheet by round $5 billion in house fairness conversion mortgage and different belongings.

Chris Marshall, vice chairman, president and CFO of Mr. Cooper, remarked, “Measured from inception, Champion Mortgage has been a worthwhile operation for Mr. Cooper, however it’s not a cloth driver of our enterprise. This transaction strengthens our enterprise mannequin, simplifies our monetary statements, and permits us to reallocate liquidity into our core operations.”

Whereas Wachtell, Lipton, Rosen & Katz acted as authorized advisor, Houlihan Lokey acted because the monetary advisor to Mr. Cooper on each transactions.

The transactions are poised to enhance the corporate’s profitability and enhance liquidity, which will be channelized to higher-growth segments. Given the low mortgage charges and powerful homebuyers demand, there are respectable prospects for mortgage originations. Therefore, Mr. Cooper is well-poised to capitalize on the favorable pattern.

Presently, Mr. Cooper carries a Zacks Rank #3 (Maintain). You possibly can see the entire listing of at present’s Zacks #1 Rank (Sturdy Purchase) shares right here.

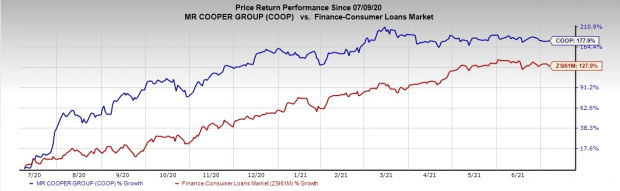

Previously 12 months, shares of the corporate have soared 177.9% in contrast with the 127.9% rally of the business it belongs to.

Picture Supply: Zacks Funding Analysis

Picture Supply: Zacks Funding Analysis

Higher-Ranked Shares to Think about

Over the previous 30 days, Ally Monetary Inc.’s ALLY earnings estimates for the present 12 months have been revised 1.4% upward to $6.36. The corporate carries a Zacks Rank #2 (Purchase) at current.

OneMain Holdings, Inc.’s OMF earnings estimates for 2021 have been revised marginally upward in a months’ time at $9.48. The corporate carries a Zacks Rank #2 at current.

Regional Administration Corp.’s RM earnings estimates for 2021 have been unchanged in a months’ time at $6.02. The corporate carries a Zacks Rank #2 at current.

5 Shares Set to Double

Every was hand-picked by a Zacks knowledgeable because the #1 favourite inventory to realize +100% or extra in 2020. Every comes from a special sector and has distinctive qualities and catalysts that might gasoline distinctive progress.

A lot of the shares on this report are flying beneath Wall Avenue radar, which offers an ideal alternative to get in on the bottom flooring.

At present, See These 5 Potential Residence Runs >>

Click on to get this free report

Regional Administration Corp. (RM): Free Inventory Evaluation Report

Ally Monetary Inc. (ALLY): Free Inventory Evaluation Report

OneMain Holdings, Inc. (OMF): Free Inventory Evaluation Report

MR. COOPER GROUP INC (COOP): Free Inventory Evaluation Report

To learn this text on Zacks.com click on right here.

Zacks Funding Analysis

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.