Worth investing is definitely one of the vital fashionable methods to search out nice shares in any market setting. In spite of everything, who wouldn’t wish to discover shares which can be both flying beneath the radar and are compelling buys, or supply up tantalizing reductions when in comparison with truthful worth?

One method to discover these firms is by a number of key metrics and monetary ratios, a lot of that are essential within the worth inventory choice course of. Let’s put New Jersey Sources Company NJR inventory into this equation and discover out if it’s a good selection for value-oriented traders proper now, or if traders subscribing to this technique ought to look elsewhere for prime picks:

PE Ratio

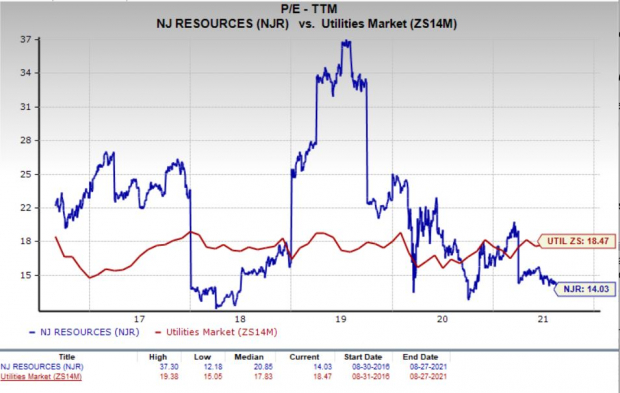

A key metric that worth traders all the time have a look at is the Value to Earnings Ratio, or PE for brief. This exhibits us how a lot traders are keen to pay for every greenback of earnings in a given inventory, and is definitely one of the vital fashionable monetary ratios on the earth. The perfect use of the PE ratio is to match the inventory’s present PE ratio with: a) the place this ratio has been previously; b) the way it compares to the common for the business/sector; and c) the way it compares to the market as an entire.

On this entrance, New Jersey Sources has a trailing twelve months PE ratio of 14.03, as you’ll be able to see within the chart beneath:

Picture Supply: Zacks Funding Analysis

This degree truly compares fairly favorably with the market at massive, because the PE for the S&P 500 stands at about 25.57. If we concentrate on the long-term PE development, New Jersey Sources’ present PE degree places it beneath its midpoint over the previous 5 years.

Picture Supply: Zacks Funding Analysis

Additional, the inventory’s PE compares favorably with the Zacks Utilities sector’s trailing twelve months PE ratio, which stands at 18.47. On the very least, this means that the inventory is comparatively undervalued proper now, in comparison with its friends.

Picture Supply: Zacks Funding Analysis

We also needs to level out that New Jersey Sources has a ahead PE ratio (worth relative to this yr’s earnings) of simply 17.03, which is tad increased than the present degree. So it’s truthful to count on a rise within the firm’s share worth within the close to time period.

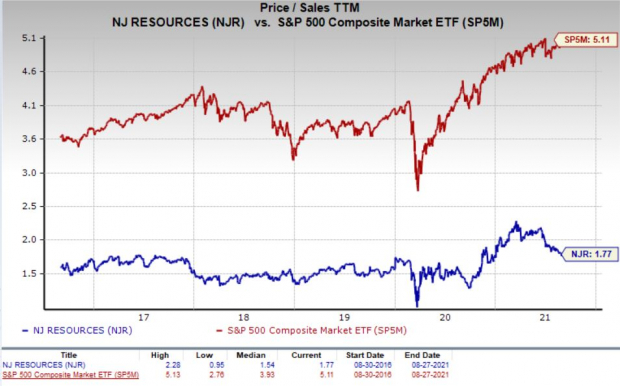

P/S Ratio

One other key metric to notice is the Value/Gross sales ratio. This method compares a given inventory’s worth to its whole gross sales, the place a decrease studying is mostly thought of higher. Some individuals like this metric greater than different value-focused ones as a result of it appears at gross sales, one thing that’s far more durable to govern with accounting methods than earnings.

Proper now, New Jersey Sources has a P/S ratio of about 1.77. That is decrease than the S&P 500 common, which is available in at 5.11 proper now. Additionally, as we will see within the chart beneath, that is beneath the highs for this inventory specifically over the previous few years.

Picture Supply: Zacks Funding Analysis

If something, NJR is within the decrease finish of its vary within the time interval from a P/S metric, suggesting some degree of undervalued buying and selling—no less than in comparison with historic norms.

Broad Worth Outlook

In mixture,New Jersey Sources presently has a Zacks Worth Rating of A, placing it into the highest 20% of all shares we cowl from this look. This makes New Jersey Sources a strong alternative for worth traders.

What Concerning the Inventory General?

Although New Jersey Sources could be a good selection for worth traders, there are many different components to think about earlier than investing on this title. Particularly, it’s value noting that the corporate has a Progress Rating of F and a Momentum Rating of C. This provides NJR a Zacks VGM rating — or its overarching elementary grade — of A. (You may learn extra concerning the Zacks Type Scores right here >>)

In the meantime, the corporate’s latest earnings estimates have been encouraging. The present yr has seen 5 estimates go increased previously sixty days in comparison with three decrease, whereas the complete yr 2021 estimate has seen three upward revision in comparison with one downward in the identical time interval.

This has had a constructive impression on the consensus estimate although as the present yr consensus estimate has risen by 19.7% previously two months, whereas the complete yr 2021 estimate has improved by 1.4%. You may see the consensus estimate development and up to date worth motion for the inventory within the chart beneath:

NewJersey Sources Company Value and Consensus

NewJersey Sources Company price-consensus-chart | NewJersey Sources Company Quote

Regardless of this constructive development, the inventory has a Zacks Rank #3 (Maintain), which signifies expectations of in-line efficiency from the corporate within the close to time period.

Backside Line

New Jersey Sources is an impressed alternative for worth traders, as it’s exhausting to beat its unimaginable line up of statistics on this entrance.

Nonetheless, with a sluggish business rank (amongst backside 22% of greater than 250 industries) and a Zacks Rank #3, it’s exhausting to get too enthusiastic about this firm total. In truth, over the previous two years, the Zacks Utility – Gasoline Distribution business has clearly underperformed the market at massive, as you’ll be able to see beneath:

Picture Supply: Zacks Funding Analysis

So, worth traders would possibly wish to anticipate business developments to show round on this title first, however as soon as that occurs, this inventory could possibly be a compelling choose.

Breakout Biotech Shares with Triple-Digit Revenue Potential

The biotech sector is projected to surge past $2.Four trillion by 2028 as scientists develop remedies for hundreds of illnesses. They’re additionally discovering methods to edit the human genome to actually erase our vulnerability to those illnesses.

Zacks has simply launched Century of Biology: 7 Biotech Shares to Purchase Proper Now to assist traders revenue from 7 shares poised for outperformance. Suggestions from earlier editions of this report have produced positive factors of +205%, +258% and +477%. The shares on this report might carry out even higher.

See these 7 breakthrough shares now>>

Click on to get this free report

NewJersey Sources Company (NJR): Free Inventory Evaluation Report

To learn this text on Zacks.com click on right here.

Zacks Funding Analysis

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.

www.nasdaq.com