There was a lot discuss concerning the virtues of investing in industries which were positively ranked by Zacks. These are those within the high 50% of 250+ Zacks-classified industries. Traditionally, this group has been seen to outperform the underside 50% by an element of two to 1. So investing in it’s a no-brainer. However do you have to keep away from the underside 50% totally? Let’s discover out.

It’s essential to say on the outset that in inventory investing, we’re typically targeted on growing the percentages of success. So if there’s any system, or components for those who like, that will increase these odds, we should always take note of it. Selecting a sexy business is because of this. It’s primarily based on the understanding that there are optimistic components working in favor of an business that may doubtless have an effect on all gamers.

Take for instance, conventional retailers which can be seeing elevated footfall, as America will get more and more vaccinated and folks flip to extra events, outings and work. This phenomenon is optimistic for all conventional retailers, whether or not they’re promoting attire, footwear, magnificence merchandise, or different items. So it’s a single issue influencing numerous firms. And by selecting shares from the retail business, we will leverage the resurgent demand that the entire business is having fun with.

However not all industries are as homogenous, if we will name it that. The element firms inside some industries cater to materially totally different finish markets, which make them topic to materially totally different circumstances. So in such circumstances, the broad components, whether or not optimistic of unfavorable, could not have an effect on all gamers in the identical manner.

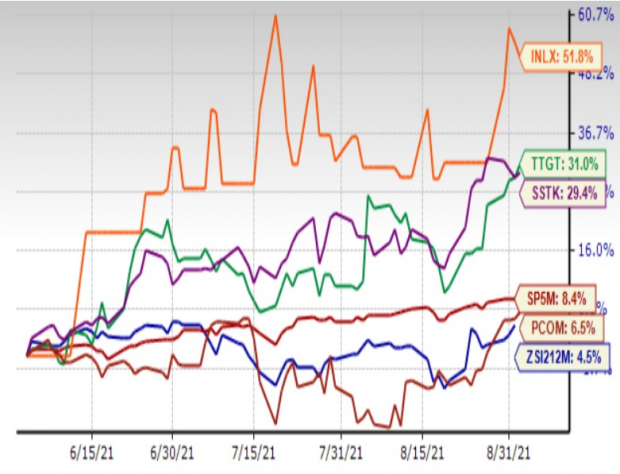

Let’s take the instance of the Web – Content material business, which is within the backside 21% of Zacks-ranked industries. The business’s worth efficiency reveals important deterioration via July adopted by restoration within the second half of August. So whereas it’s down 2.05% yr up to now, it’s up 4.5% within the final three months.

Clearly, all shares throughout the business aren’t equal as a result of INLX, SSTK, TTGT and PCOM appreciated 51.8%, 29.8%, 29.6% and 6.4%, respectively, throughout the similar three months. On the similar time, LOV declined -44.7%, ANGI -21.1%, BCOV -17.1%, IS -4.9%, YELP -1.3%, and so on.

A fast have a look at their goal markets paints a transparent image.

And so we see that TechTarget, Inc. TTGT supplies IT firms with ROI-focused advertising applications to generate leads, shorten gross sales cycles and develop revenues. So given its publicity to the new expertise phase and being a number one producer of vendor-sponsored webcasts and podcasts for the IT market, the inventory is ready up to reach the present atmosphere.

Analysts anticipate the corporate to develop income and earnings at sturdy double-digit charges each this yr and the subsequent. Estimates for each years are surging. The shares carry a Zacks Rank #1 (Sturdy Purchase) and a Progress Rating of B.

Intellinetics, Inc. INLX presents doc storage and administration options via a software program platform referred to as IntelliCloud(TM) that facilitates doc utilization throughout operations. With prospects spanning and personal and public sector organizations throughout healthcare, training and legislation enforcement verticals, one can see why the corporate would do effectively immediately.

The corporate is anticipated to see double-digit income will increase each this yr and within the subsequent. However following very sturdy triple-digit earnings development this yr, a correction is anticipated in 2022. The estimate revisions pattern is optimistic, doubtless the rationale behind the Zacks #2 (Purchase) Rank. The Progress Rating is A.

Shutterstock, Inc. SSTK, a worldwide market for digital imagery together with licensed images, vectors, illustrations and movies to companies, advertising businesses and media organizations world wide, can also be anticipated to see a roaring enterprise as COVID disrupted the world.

Consequently, income and earnings are anticipated to develop strongly each this yr and the subsequent with estimate revisions trending considerably increased in each years. The shares carry a Zacks Rank #2 and Progress Rating A.

Factors Worldwide, Ltd. PCOM is the proprietor and operator of Factors.com, the world’s main reward program administration website online. Factors.com is a web based loyalty program administration portal, the place customers can earn, purchase, present, share, swap and redeem miles and factors with a few of the loyalty applications and retail companions.

Collaborating applications embody American Airways AAdvantage program, Aeroplan, AsiaMiles, British Airways Govt Membership, Wyndham Rewards, Delta SkyMiles and InterContinental Motels Group’s Precedence Membership Rewards. Redemption companions embody Amazon.com and Starbucks.

Since PCOM is uncovered to the journey market, it’s considerably uncovered to the restoration in airline journey. On the similar time, the dangers are greater for this participant than the opposite three, since any resurgence within the virus or any new variants can damage demand.

Coming off the COVID-ravaged 2020, analysts at the moment anticipate the corporate to develop revenues at a double-digit price each this yr and within the subsequent with earnings rising triple digits in each years. The shares carry a Zacks Rank #1 and Progress Rating A.

And lest we neglect that this isn’t a sexy business total, listed here are particulars of some of the underdogs-

#3 (Maintain) ranked Spark Networks, Inc. LOV is a courting web site. So it’s straightforward to see why folks could possibly be staying off these for now. Each income and earnings are anticipated to say no considerably this yr and there aren’t dependable estimates for the next yr. Whereas the Worth Rating for this inventory is A its Progress Rating is C.

#5 (Sturdy Promote) rated Angi Inc. ANGI presents residence service professionals for residence restore, upkeep, and enchancment tasks, in addition to associated instruments and providers in the US and internationally. The corporate additionally owns and operates Angie’s Listing, which connects customers with service professionals for native providers via a web based listing of service professionals in numerous service classes and contains associated instruments and providers.

In July, it acquired Complete Residence Roofing to speed up its choices in roofing providers. The mixing of this acquisition, ongoing funding within the platform and $9.6 million in one-time prices associated to rationalizing its actual property footprint is resulting in backside line strain. In consequence and regardless of double-digit income development each this yr and the subsequent, the corporate’s losses are anticipated to extend considerably this yr with additional losses anticipated subsequent yr.

#4 (Promote) rated Brightcove Inc. BCOV supplies cloud-based providers for video. Its flagship product contains Video Cloud, a web based video platform that allows its prospects to publish and distribute video to Web-connected gadgets. Given the character of its choices, its comprehensible that it reported sturdy leads to the final quarter.

However since steering for the remainder of the yr disenchanted, analysts have considerably lowered their estimates for each the present and following years. Income continues to be anticipated to develop in each years, with earnings declining barely this yr and leaping again within the subsequent.

Conclusion

It’s pretty straightforward to decide on one of the best shares with one of the best ranks in probably the most enticing industries. However these could not at all times be low-cost. At occasions, once we are bargain-hunting, it is likely to be worthwhile to analysis shares in a few of the much less enticing industries.

3-Month Worth Efficiency

Picture Supply: Zacks Funding Analysis

Extra Inventory Information: This Is Larger than the iPhone!

It might change into the mom of all technological revolutions. Apple offered a mere 1 billion iPhones in 10 years however a brand new breakthrough is anticipated to generate greater than 77 billion gadgets by 2025, making a $1.Three trillion market.

Zacks has simply launched a Particular Report that spotlights this fast-emerging phenomenon and Four tickers for making the most of it. Should you do not buy now, you might kick your self in 2022.

Click on right here for the Four trades >>

Click on to get this free report

Brightcove Inc. (BCOV): Free Inventory Evaluation Report

Factors Worldwide, Ltd. (PCOM): Free Inventory Evaluation Report

Angi Inc. (ANGI): Free Inventory Evaluation Report

Shutterstock, Inc. (SSTK): Free Inventory Evaluation Report

Spark Networks, Inc. (LOV): Free Inventory Evaluation Report

TechTarget, Inc. (TTGT): Free Inventory Evaluation Report

Intellinetics, Inc. (INLX): Free Inventory Evaluation Report

To learn this text on Zacks.com click on right here.

Zacks Funding Analysis

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.

www.nasdaq.com