The inventory of Petco Well being and Wellness Firm WOOF has been on an increase after reporting robust second-quarter 2021 earnings of 25 cents per share, which beat the Zacks Consensus Estimate by 38.89%.

The corporate that gives a whole ecosystem of look after pets, each on-line and offline, reported revenues of $1.four billion, up 19% yr over yr. Earnings appeared wholesome, underscored by 50% progress in recurring income clients, which creates stickiness, and creates long-term predictability within the firm’s earnings.

Recurring revenues have been up 60%, generated by automatically-scheduled supply of pet meals, subscription PupBox for brand new pet house owners, insurance coverage and Important Care membership. The quarter marked the 11th consecutive interval of comp gross sales progress, pushed by recurring income choices, quickly increasing vet enterprise and digital progress

High-line efficiency led to 19% adjusted EBITDA and 127% adjusted EPS progress. Throughout the quarter, Petco added round 1 million clients who’re primarily millennial and Gen-Z clients.

Together with rising its revenues, the corporate is specializing in deleveraging its stability sheet. Web debt was decreased to 1.5 billion from $3.1 billion a yr earlier. Free money circulation of $103 million was generated within the first six months of 2021, up 142% yr over yr.

A steerage elevate following the second-quarter earnings displays its robust enterprise momentum. The corporate now expects income progress within the vary of 14-16% to $5.6-$5.7 billion and EPS within the band of 81-85 cents. Earlier, revenues have been anticipated to leap 11-13% and EPS to develop within the 73-76 cents vary.

With its give attention to omni-channel gross sales, Petco is uniquely positioned to steer the pet care market, which is witnessing elevated pet possession, larger spend per pet, and the continued humanization and premiumization of the pets.

Capital expenditures related to the constructing of vet hospitals, digital innovation and provide chain will drive long-term progress.

The corporate with its broad product and repair bouquet together with its on-line and offline presence is completely poised to faucet an increasing per care market. The market measurement for pet care merchandise surpassed $232 billion in 2020 and is poised to see a 6.1% CAGR between 2021 and 2027.

Different firms which are betting on the pet wellness trade embrace PetIQ, Inc.PETQ, IDEXX Laboratories, Inc. IDXX and Phibro Animal Well being Company PAHC.

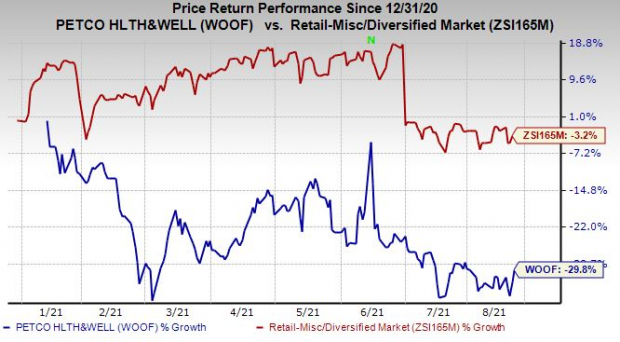

Petco presently carries a Zacks Rank #3 (Maintain) and has declined 29.8% yr up to now in contrast with its trade’s dip of three.2%. Its development in a profitable market will perk up its inventory worth going forward.

You possibly can see the entire record of at this time’s Zacks #1 Rank (Sturdy Purchase) shares right here.

Picture Supply: Zacks Funding Analysis

Bitcoin, Just like the Web Itself, Might Change Every thing

Blockchain and cryptocurrency has sparked one of the thrilling dialogue subjects of a era. Some name it the “Web of Cash” and predict it may change the best way cash works perpetually. If true, it may do to banks what Netflix did to Blockbuster and Amazon did to Sears. Consultants agree we’re nonetheless within the early phases of this expertise, and because it grows, it should create a number of investing alternatives.

Zacks’ has simply revealed Three firms that may assist buyers capitalize on the explosive revenue potential of Bitcoin and the opposite cryptocurrencies with considerably much less volatility than shopping for them straight.

See Three crypto-related shares now >>

Click on to get this free report

IDEXX Laboratories, Inc. (IDXX): Free Inventory Evaluation Report

Petco Well being and Wellness Firm, Inc. (WOOF): Free Inventory Evaluation Report

Phibro Animal Well being Company (PAHC): Free Inventory Evaluation Report

PetIQ, Inc. (PETQ): Free Inventory Evaluation Report

To learn this text on Zacks.com click on right here.

Zacks Funding Analysis

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.