After operating the numbers it’s clear as day that dollar-cost averaging into bitcoin over time is a really worthwhile technique!

Greenback-cost averaging (DCA) is outlined as buying at decided intervals no matter worth, and has confirmed to be one of the efficient and most secure methods to build up bitcoin. It permits the person to mitigate bitcoin’s wild volatility, and have peace of thoughts of their saving technique.

DCA can be not solely good on your web price, nevertheless it’s additionally good for Bitcoin. As Hass McCook explains in “How The DCA Military Will Drive A $1 Million Bitcoin Value,” Bitcoin advantages in some ways if there are sufficient individuals doing auto-DCA, thus casually consuming away on the complete bitcoin provide.

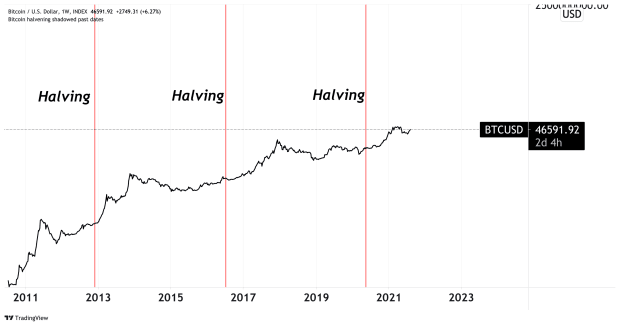

In case you DCA on a protracted sufficient time horizon, you may revenue rather a lot — particularly after every halving, which ends up in the brand new provide of bitcoin created each day getting lower in half each 4 years. Traditionally, bitcoin’s worth has at all times seen a meteoric rise and a brand new all-time excessive all through annually following each halving to date.

Picture through @BTCization

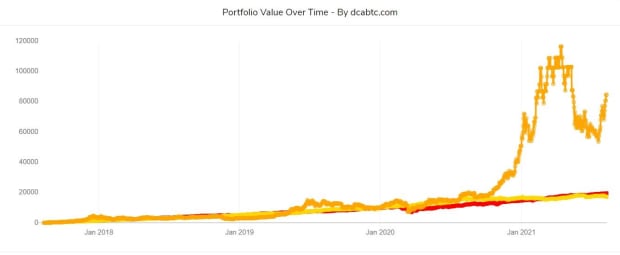

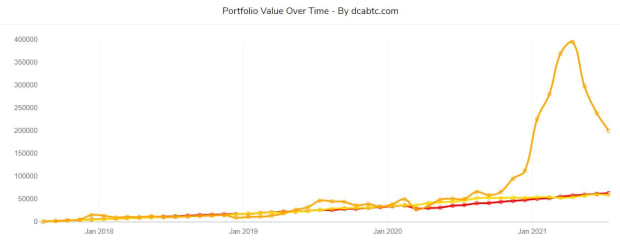

Picture through @BTCization

The bull run in 2017 made bitcoin go mainstream, with many leaping in on the hype. Let’s run the numbers and see the place you’ll be if you happen to began DCAing into bitcoin again then.

Day by day Buys

In case you had been to have began each day DCAing $10 into bitcoin each single day since August 12, 2017, you’ll have invested a complete of $14,610 {dollars} on the time of writing. That cash saved in bitcoin can be price a complete quantity of $84,506, roughly 1.82 BTC. That’s a complete return of 478.41%.

Now what if we had been to have taken that very same cash however as a substitute invested it in what many declare to be a competitor to Bitcoin: gold?

In case you would have invested that very same cash into gold as a substitute of bitcoin, as we speak you’ll have a complete of $17,177. A complete improve of solely 17.57%. This makes for a really pathetic comparability and it has to make you suppose, if you happen to held gold over bitcoin throughout this time then you definately misplaced out on 460.84%. Gold unexpectedly does not appear to be too good a retailer of worth, huh?

Picture Supply

Picture Supply

Weekly Buys

In case you had been to have DCAed $100 per week from August 12, 2017, you’ll have invested a complete of $20,900. In the present day that cash can be price a grand complete of $115,718, roughly 2.49 BTC. That’s a complete improve of 453.68%.

Bitcoin completely crushes its competitors, gold. In case you would have invested that $20,900 into gold over that very same, then as we speak you’ll solely have $25,075 — a complete improve of 19.98%.

Picture Supply

Picture Supply

Month-to-month Buys

In case you had been to have carried out a $1,000 per thirty days DCA into Bitcoin, you’ll have invested a complete quantity of $48,000. That cash as we speak can be price $200,066, or roughly 4.31 BTC. That is a complete improve of 316.81%.

Similar to the each day and weekly buys, gold has completely been steamrolled by bitcoin. Your funding of $48,000 into gold would now be price $59,191. A rise of solely 23.32%.

Picture Supply

Picture Supply

This 2021 bull run just isn’t over but, as nearly everybody who’s educated within the trade is anticipating a second leg as much as occur within the remaining half of this 12 months. Many are making enormous worth predictions corresponding to $100,000, $250,000, and even over $500,000.

Let’s say the value rises to $250,000 later this 12 months. That 1.82 BTC from each day shopping for will probably be price $455,000. That 2.49 BTC from weekly shopping for will probably be price $622,500. And that 4.31 BTC from month-to-month shopping for will probably be price $1,077,500.

In case you had been to have began DCAing even sooner than 4 years in the past, then you definately would have gathered extra bitcoin and develop into even wealthier. Bitcoin was the best-performing asset of the final decade, and is taken into account by many to be on monitor to turning into the very best performing asset of this decade as effectively. When selecting to retailer wealth, it’s necessary to decide on correctly. Maintain bitcoin, or lose worth holding different property.

“Historical past exhibits it isn’t doable to insulate your self from the results of others holding cash that’s tougher than yours.” – Saifedean Ammous

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.