AMN Healthcare Services Inc AMN is well poised for growth in the coming quarters, backed by its broad array of services. A solid performance in the second quarter of 2021 and its key buyouts also raise optimism about the stock. However, consolidation of healthcare delivery units and healthcare industry regulations are major downsides.

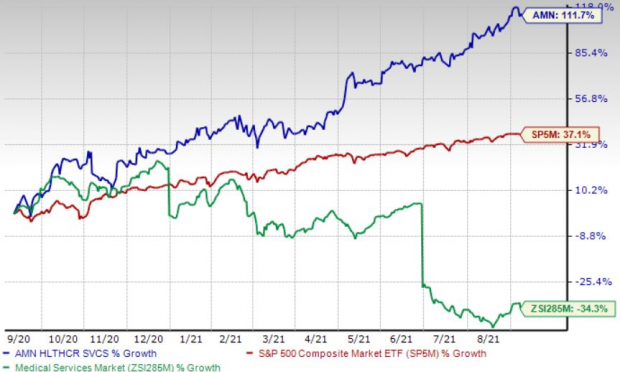

Over the past year, the Zacks Rank #3 (Hold) stock has gained 111.7% versus 34.3% fall of the industry and 37.1% rise of the S&P 500.

The renowned player in the healthcare total talent services space has a market capitalization of $5.36 billion. The company projects 10.5% growth for the next five years and expects to witness continued improvements in its business. AMN Healthcare surpassed the Zacks Consensus Estimate in all the trailing four quarters, delivering an earnings surprise of 16.94%, on average.

Image Source: Zacks Investment Research

Let’s delve deeper.

Acquisitions: AMN Healthcare has lately been strengthening its inorganic portfolio through a string of acquisitions, raising our optimism. In May 2021, the company forayed into the post-acute care market with the acquisition of the telehealth company Synzi, which offers virtual care and remote patient-monitoring platforms in the home health and outpatient markets. These solutions will help AMN Healthcare to conduct virtual visits and use secure messaging, texts, and emails for clinician-to-patient and clinician-to-clinician communications.

The buyouts of Stratus Video (now known as AMN Language Services) and b4health are other top performance drivers for AMN Healthcare.

Broad Array of Services: We are upbeat about its business’ gradual evolution beyond traditional healthcare staffing. The company has become a strategic total talent solutions partner for its clients. AMN Healthcare has expanded its portfolio to serve a diverse and growing set of healthcare talent-related needs. The company’s suite of healthcare workforce solutions includes Managed Services Programs (MSP), vendor management systems (VMS), and medical language interpretation services, among others.

The company has also displayed strength in digital health capabilities with its AMN Passport and AMN Cares. The first one is the company’s mobile app for healthcare experts, while AMN Cares is a telehealth platform. The company also expanded its scalable VMS solution, enabling a wide array of health care facilities to quickly staff and manage their entire range of contingent talent.

Strong Q2 Results: AMN Healthcare’s better-than-expected results in second-quarter 2021 buoy our optimism. The company recorded robust performance across each of its core segments, along with a surge in its top and bottom lines in the quarter. Per management, increased healthcare utilization and a tight labor market have created record-high demand in many areas of the company’s business, which is encouraging. Strength in the healthcare MSP also looks encouraging. Expansion of both margins bodes well for the stock. Upbeat revenue guidance for the third quarter of 2021 is encouraging.

Downsides

Consolidation of Healthcare Delivery Units: Healthcare delivery organizations are consolidating, which is providing them with greater leverage in negotiating pricing for services. Consolidations may also result in AMN Healthcare losing its ability to work with certain clients because the party acquiring or consolidating with its client may have a previously established service provider they choose to maintain.

Healthcare Industry Regulations: The healthcare industry is subject to extensive and complex federal and state laws and regulations. AMN Healthcare provides talent solutions and technologies on a contractual basis to its clients, who pay the company directly. Accordingly, Medicare, Medicaid and insurance reimbursement policy changes generally do not directly impact the company. Nevertheless, reimbursement changes in government programs, particularly Medicare and Medicaid, can and do indirectly affect the demand and prices paid for the company’s services.

Estimate Trend

AMN Healthcare has been witnessing an upward estimate revision trend for 2021. Over the past 90 days, the Zacks Consensus Estimate for its earnings per share has moved 17.1% north to $5.76.

The Zacks Consensus Estimate for third-quarter 2021 revenues is pegged at $781.6 million, suggesting a 41.7% rise from the year-ago reported number.

Key Picks

Some better-ranked stocks from the broader medical space are Henry Schein, Inc. HSIC, IDEXX Laboratories, Inc. IDXX, and Intuitive Surgical, Inc. ISRG.

Henry Schein’s long-term earnings growth rate is estimated at 13.9%. The company presently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

IDEXX’s long-term earnings growth rate is estimated at 19.9%. It currently has a Zacks Rank #2.

Intuitive Surgical’s long-term earnings growth rate is estimated at 9.7%. It currently flaunts a Zacks Rank #1.

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency has sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix did to Blockbuster and Amazon did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks’ has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 3 crypto-related stocks now >>

Click to get this free report

Intuitive Surgical, Inc. (ISRG): Free Stock Analysis Report

Henry Schein, Inc. (HSIC): Free Stock Analysis Report

IDEXX Laboratories, Inc. (IDXX): Free Stock Analysis Report

AMN Healthcare Services Inc (AMN): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

www.nasdaq.com