Royal Gold, Inc. RGLD has issue

Royal Gold, Inc. RGLD has issued an replace for fourth-quarter fiscal 2021 (ended Jun 30, 2021) operations. Throughout the quarter, RGLD Gold AG — the fully-owned subsidiary of Royal Gold — bought 63,500 gold equal ounces (GEOs) comprising 50,500 gold ounces, 319,000 silver ounces and 1,500 tons of copper associated to its streaming agreements. Stream gross sales in the course of the fiscal fourth quarter had been in step with the earlier guided vary of 60,000 to 65,000 GEOs.

The typical realized value of gold was $1,801 per ounce within the quarter, down 1.5% sequentially. Common realized value of silver stood at $26.45 per ounce, flat in contrast with the prior quarter. Common realized copper costs had been $9,584 per ton, up from the earlier quarter’s $8,575 per ton. The corporate ended the fiscal fourth quarter with 38,000 gold equal ounces in stock, together with 27,000 ounces of gold, 485,000 silver ounces and 800 tons of copper.

Throughout the fiscal fourth quarter, price of gross sales got here in at round $388 per gold equal ounce in contrast with the fiscal third-quarter determine of $410 per gold equal ounce. The price of gross sales relies on the quarterly common silver-gold ratio of roughly 68 to 1, and copper-gold ratio of round 0.19 tons per ounce.

The Zacks Consensus Estimate for fiscal fourth-quarter earnings is pegged at 90 cents, suggesting a rise of 69.8% from the prior-year reported determine. The Zacks Consensus Estimate for quarterly revenues is pinned at $158.9 million, indicating year-over-year development of 32.4%.

Royal Gold is targeted on allocating its strong money stream to dividends, debt discount and investments in new companies. As of Mar 31, 2021, the corporate had $850 million accessible and $150 million excellent beneath the revolving credit score facility.

Royal Gold is a valuable metals stream and royalty firm engaged within the acquisition and administration of valuable steel streams, royalties and related production-based pursuits. As of Jun 30, 2021, the corporate owned pursuits on 187 properties on 5 continents, together with pursuits on 41 producing mines and 17 improvement stage tasks.

The corporate will profit from larger steel costs this yr. Silver and copper are gaining on pick-up in industrial exercise. Copper costs look sturdy on strong demand in China. Gold continues to be probably the most vital income driver for Royal Gold and accounted for 68% of complete revenues in the course of the fiscal third quarter. After declining beneath $1,700 an oz earlier this yr, gold costs have picked up currently and are at present buying and selling above $1,800 per ounce on issues over the brand new Delta COVID-19 variant. Nevertheless, this volatility in gold costs is a priority.

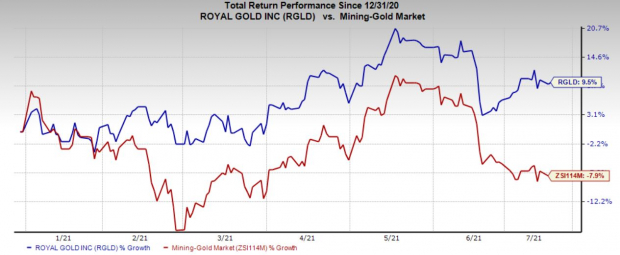

Value Efficiency

Royal Gold’s shares have gained 9.5% to this point this yr, as towards the business’s lack of 7.9%.

Picture Supply: Zacks Funding Analysis

Zacks Rank & Different Shares to Contemplate

Royal Gold at present carries a Zacks Rank #2 (Purchase). You may see the entire checklist of right this moment’s Zacks #1 Rank (Robust Purchase) shares right here.

Different top-ranked shares within the primary supplies house embrace Industrial Metals Firm CMC, Nucor Company NUE and Cabot Company CBT, every flaunts a Zacks Rank #1, at current.

Industrial Metals has a projected earnings development charge of 21.9% for fiscal 2021. The corporate’s shares have rallied round 51.9% in a yr’s time.

Nucor has a projected earnings development charge of 259.9% for the present yr. The corporate’s shares have soared round 130% over the previous yr.

Cabot has an anticipated earnings development charge of round 126% for the present fiscal yr. The corporate’s shares have surged 60% previously yr.

Infrastructure Inventory Growth to Sweep America

A large push to rebuild the crumbling U.S. infrastructure will quickly be underway. It’s bipartisan, pressing, and inevitable. Trillions might be spent. Fortunes might be made.

The one query is “Will you get into the proper shares early when their development potential is best?”

Zacks has launched a Particular Report that will help you just do that, and right this moment it’s free. Uncover 7 particular firms that look to achieve probably the most from building and restore to roads, bridges, and buildings, plus cargo hauling and vitality transformation on an nearly unimaginable scale.

Obtain FREE: The best way to Revenue from Trillions on Spending for Infrastructure >>

Click on to get this free report

Nucor Company (NUE): Free Inventory Evaluation Report

Industrial Metals Firm (CMC): Free Inventory Evaluation Report

Cabot Company (CBT): Free Inventory Evaluation Report

Royal Gold, Inc. (RGLD): Free Inventory Evaluation Report

To learn this text on Zacks.com click on right here.

Zacks Funding Analysis

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.