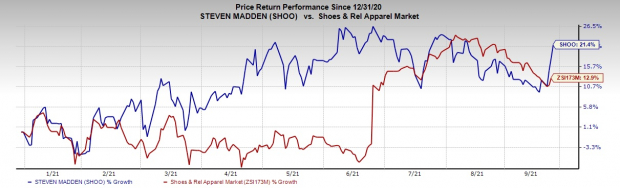

Steven Madden, Ltd. SHOO is climbing up the charts, thanks to immense strength in its e-commerce wing and strategic ploys. The company’s commerce business is reflecting a sturdy momentum since the outbreak of the coronavirus pandemic. Management also remains encouraged about its prudent buyouts. Its cost-containment efforts are also fruitful and aiding margins. Buoyed by such strengths, shares of this currently Zacks Rank #1 (Strong Buy) player have increased 21.4% in the year-to-date period while its industry has rallied 12.9%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Delving Deeper

Solid gains from increased investment in digital marketing and robust online capabilities, such as try before you buy, are steadily yielding results. Its constant efforts to optimize features and functionality of its website are also contributing. The company also significantly accelerated its digital commerce initiatives with respect to distribution. It added high level talent to the organization, ramped up digital marketing spend, improved data science capabilities, launched try-before-you-buy payment facility, rolled out buy online, pick-up in store across its entire U.S. full-price retail outlets, and introduced advanced delivery and return options.

The e-commerce momentum continued in the second quarter of 2021 with revenues surging 105% including a 119%-increase in Steve Madden’s e-commerce business. Digital sales represented about 54% of the company’s total Retail segment sales in the quarter.

Image Source: Zacks Investment Research

Speaking of its smart buyouts, Steven Madden is optimistic about the takeover of BB Dakota, a California-based women’s apparel company through which the former is steadily expanding its apparel category. Its European joint venture (JV) is also noteworthy. This transaction distributes the company’s branded footwear and accessories across majority countries in Europe.

Steven Madden formed this JV roughly five years ago, and the same registered solid double-digit percentage revenue growth each year with a 21% revenue increase in 2020. For 2021, management anticipated revenues from the European JV of about $55 million, more than 3/4 of which will be generated from digital channels. Also, the business is expected to generate a mid-teen operating profit margin before allocation of corporate overhead.

Management remains focused on creating trendy products, deepening relations with customers via marketing, enhancing digital-commerce solutions and expanding in the international markets. Growth in the company’s brands and a robust business model position it well to cash in on the market-expansion opportunities and boost stakeholder value.

More Strengths

Strong e-commerce momentum along with other aforementioned strategies will continue helping the company stay afloat on a tough operating landscape. Results are also benefiting from trend-right product assortments as well as an accelerated business recovery. Higher consumer demand and spending on fashion products are further adding up to the company’s performance. Brick-and-mortar business continues to be impressive on a steady recovery from the pandemic.

For 2021, management projected revenue growth of 43-47% from the total revenues of $1,201.8 million reported in 2020. Adjusted earnings per share are likely to fall in the bracket of $2-$2.10. In 2020, the company reported adjusted earnings of 64 cents. Sturdy growth trends witnessed during the second quarter are likely to remain throughout 2021.

In addition, the Zacks Consensus Estimate for 2021 sales and earnings is currently pegged at $1.76 billion and $2.10 per share, respectively. These estimates suggest corresponding growth of about 46% and 228% from the respective year-ago reported figures. An expected long-term earnings growth rate of 15% further exhibits strength. Considering all the aforesaid factors, Steven Madden is a solid investment bet now.

Eye These Solid Picks Too

Ralph Lauren RL has a long-term earnings growth rate of 15% and a Zacks Rank #1, currently.

GIII Apparel GIII currently has a Zacks Rank of 1 and a long-term earnings growth rate of 11.6%.

Wolverine WWW has a long-term earnings growth rate of 10% and a Zacks Rank #2 (Buy), presently.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 77 billion devices by 2025, creating a $1.3 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 4 tickers for taking advantage of it. If you don’t buy now, you may kick yourself in 2022.

Click here for the 4 trades >>

Click to get this free report

Ralph Lauren Corporation (RL): Free Stock Analysis Report

Wolverine World Wide, Inc. (WWW): Free Stock Analysis Report

GIII Apparel Group, LTD. (GIII): Free Stock Analysis Report

Steven Madden, Ltd. (SHOO): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

www.nasdaq.com