As part of its acquisition-driven growth strategy, Terreno Realty Corporation TRNO recently shelled out $26.3 million for the purchase of an industrial property in Kearny, NJ.

Adjacent to the Exit 15E of the New Jersey Turnpike, this 5.4-acre improved land parcel at 97 Third Street is 51% leased to two tenants. The estimated stabilized cap rate of the property is 3.1%.

The industrial real estate market has been witnessing solid fundamentals, as demand has been shooting up amid an e-commerce boom, growth in industries and companies making efforts to improve supply-chain efficiencies. In addition to the fast adoption of e-commerce, the logistics real estate is anticipated to benefit from a likely increase in the inventory levels post the global health crisis, offering scope to industrial landlords, including Terreno Realty, Duke Realty DRE, Prologis PLD and Rexford Industrial Realty, Inc. REXR, among others, to enjoy a favorable market environment.

Terreno Realty is also banking on such scopes and is focused on expanding its portfolio on acquisitions. It targets functional assets at in-fill locations, which enjoy high-population densities and are located near high-volume distribution points.

Recently, the company announced shelling out $17.9 million for the buyout of an industrial property in Carlstadt, NJ. This buyout comes after the company’s recent purchase of an industrial property in Hayward, CA, for $8.3 million.

Backed by such efforts, the company is well poised to enhance its portfolio in the six major coastal U.S. markets — Los Angeles, Northern New Jersey/New York City, San Francisco Bay Area, Seattle, Miami and Washington, DC — which display solid demographic trends and witness healthy demand for industrial real estates.

However, with the asset category being attractive in these challenging times, there is a development boom in a number of markets. This high supply is likely to intensify competition and curb pricing power.

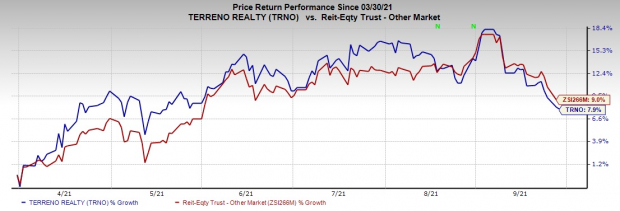

In the past three months, the company’s shares have gained 7.9% compared with its industry’s rally of 9%. However, the recent estimate revision trend of 2021 funds from operations (FFO) per share indicates a favorable outlook for the company, having been revised 2.4% upward over the past month.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Terreno Realty currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks’ Top Picks to Cash in on Artificial Intelligence

In 2021, this world-changing technology is projected to generate $327.5 billion in revenue. Now Shark Tank star and billionaire investor Mark Cuban says AI will create “the world’s first trillionaires.” Zacks’ urgent special report reveals 3 AI picks investors need to know about today.

See 3 Artificial Intelligence Stocks With Extreme Upside Potential>>

Click to get this free report

Prologis, Inc. (PLD): Free Stock Analysis Report

Duke Realty Corporation (DRE): Free Stock Analysis Report

Terreno Realty Corporation (TRNO): Free Stock Analysis Report

Rexford Industrial Realty, Inc. (REXR): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

www.nasdaq.com