Amid favorable in-migration traits of jobs and family formations within the Solar Belt sub-markets, Mid-America Condominium Communities MAA, also referred to as MAA, is prone to witness progress in demand and hire. Nevertheless, elevated provide, notably in city submarkets, would possibly impede this progress momentum within the upcoming interval.

Markedly, the residential REIT’s portfolio is effectively diversified when it comes to markets, submarkets, product varieties and value factors which is able to doubtless assist the corporate take care of any financial downturn. Furthermore, a high-quality resident profile has resulted in strong hire assortment efficiency, even amid the pandemic.

Additional, the Solar Belt space has been much less affected amid the coronavirus mayhem. Slightly, the pandemic has accelerated employment shifts and inhabitants influx into the corporate’s markets, as renters search extra business-friendly, lower-taxed and low-density cities. These favorable longer-term secular dynamic traits are rising the desirability of its markets. Amid this, MAA is effectively poised to seize restoration in demand and leasing as in comparison with the costly coastal market.

Moreover, the corporate’s strong stability sheet, with low leverage and ample availability below its revolving credit score facility, allows it to navigate by way of any destructive externalities. Backed by an in-place at-the-market fairness share providing program, MAA is effectively poised to supply attractively-priced capital from the fairness markets. It additionally generates 95.3% unencumbered web working earnings (NOI), which provides scope for tapping further secured debt capital if required. As well as, it enjoys funding grade rankings of BBB+/BBB+ and a secure outlook from Commonplace and Poor’s, and a constructive outlook from Fitch Scores, respectively, which renders the corporate’s favorable entry to debt.

Moreover, MAA continues to implement its three inside funding applications — inside redevelopment, property repositioning tasks and Good Residence installations. The applications will assist the corporate seize upside potential in hire progress, generate accretive returns and enhance earnings from its current asset base in late 2021 and 2022.

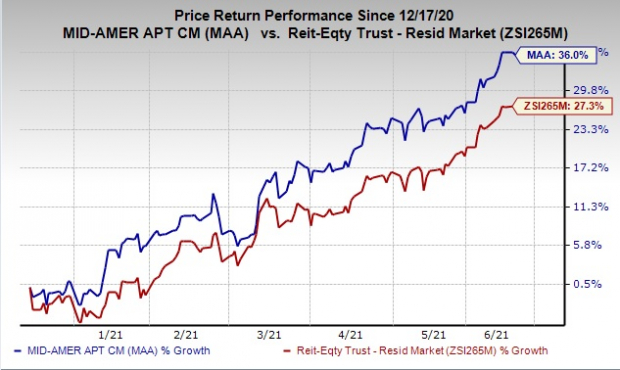

Shares of this Zacks Rank #3 (Maintain) firm have rallied 36% over the previous six months outperforming the trade’s progress of 27.3%. Additionally, the Zacks Consensus Estimate for 2021 funds from operations (FFO) per share moved up marginally over the previous month.

Picture Supply: Zacks Funding Analysis

Picture Supply: Zacks Funding Analysis

Nevertheless, new provide of residential properties has been excessive for the previous few years. This excessive provide adversely impacts landlords’ functionality to demand extra rents and leads to lesser absorption, notably at house communities situated in city sub-markets. That is prone to put strain on rental charges and erode income progress within the close to time period.

Moreover, an in depth growth pipeline will increase the corporate’s operational dangers by exposing it to building value overruns, entitlement delays and lease-up dangers. Moreover, rising actual property taxes would possibly inflate bills and damage the underside line within the days to come back.

Key Trade Picks

Just a few better-ranked REIT shares are talked about under:

BRT Residences Corp.’s BRT Zacks Consensus Estimate for 2021 funds from operations (FFO) per share moved up 6.1% over the previous month. The corporate presently sports activities a Zacks Rank of two (Purchase). You may see the entire checklist of immediately’s Zacks #1 Rank shares right here.

Bluerock Residential Progress REIT, Inc.’s BRG Zacks Consensus Estimate for the current-year FFO per share moved 3.1% north in a month’s time. The corporate carries a Zacks Rank of two at current.

RPT Realty’s RPT FFO per share estimate for the continuing yr has been revised upward by 3.7% over the previous month. The corporate carries a Zacks Rank of two, presently.

Be aware: Something associated to earnings introduced on this write-up symbolize funds from operations (FFO) — a broadly used metric to gauge the efficiency of REITs.

Zacks’ High Picks to Money in on Synthetic Intelligence

In 2021, this world-changing expertise is projected to generate $327.5 billion in income. Now Shark Tank star and billionaire investor Mark Cuban says AI will create “the world’s first trillionaires.” Zacks’ pressing particular report reveals Three AI picks traders must learn about immediately.

See Three Synthetic Intelligence Shares With Excessive Upside Potential>>

Click on to get this free report

MidAmerica Condominium Communities, Inc. (MAA): Free Inventory Evaluation Report

Bluerock Residential Progress REIT, Inc. (BRG): Free Inventory Evaluation Report

BRT Residences Corp. (BRT): Free Inventory Evaluation Report

RPT Realty (RPT): Free Inventory Evaluation Report

To learn this text on Zacks.com click on right here.

Zacks Funding Analysis

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.