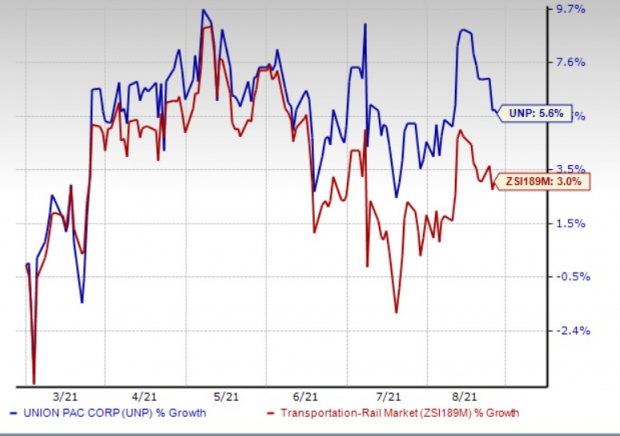

Shares of Union Pacific Company UNP have gained 5.6% up to now this yr in contrast with the three% appreciation of its business.

Picture Supply: Zacks Funding Analysis

Let’s look into the elements which are working in favor of this at present Zacks Rank #2 (Purchase) inventory. You may see the whole record of right now’s Zacks #1 Rank (Robust Purchase) shares right here.

Northward Earnings Estimates: The Zacks Consensus Estimate for current-quarter earnings has been revised 3.6% upward over the previous 60 days. For 2021, the consensus mark for earnings has moved 4.5% north in the identical time-frame. The favorable estimate revisions mirror the arrogance of brokers within the inventory.

Given the wealth of knowledge at brokers’ disposal, it’s in one of the best curiosity of traders to be guided by their professional recommendation and the course of their estimate revisions. It is because the trail of estimate revisions serves as an necessary pointer in terms of ascertaining the inventory worth.

Spectacular Income Progress: The Zacks Consensus Estimate for current-quarter revenues is pegged at $5.53 billion, indicating a 12.5% rise from the year-ago quarter’s reported determine. Equally, the consensus mark for current-year revenues stands at $21.64 billion, implying a 10.8% enhance from the prior-year reported determine.

Different Tailwinds: Union Pacific is being aided by the betterment of the freight state of affairs in america. Evidently, freight revenues, which accounted for bulk of the highest line, rose 29% within the June quarter. With financial actions gaining tempo, total volumes are bettering. In second-quarter 2021, total volumes rose 22% yr over yr.

We’re additionally impressed with the corporate’s efforts to reward its shareholders even in these difficult occasions. In first-half 2021, the corporate returned $5.Four billion to its shareholders by means of dividends ($1.Three billion) and buybacks ($4.1 billion). In Might, it hiked its quarterly dividend by 10% to $1.07 per share. It expects a dividend payout of roughly 45% (of earnings) in 2021. Union Pacific anticipates repurchasing shares price roughly $7 billion in 2021. Robust free money movement technology by the railroad operator (up 8.6% to $1,798 million in first-half 2021) is supporting shareholder-friendly actions.

Different Shares to Contemplate

Buyers within the broader Zacks Transportation sector can even think about shares like Knight-Swift Transportation Holdings KNX,Landstar System, Inc. LSTR and Herc Holdings Inc. HRI.Whereas Knight-Swift and Landstar carry a Zacks Rank of two at current, Herc Holdings sports activities a Zacks Rank #1 (Robust Purchase), at present. You may see the whole record of right now’s Zacks #1 Rank shares right here.

Lengthy-term anticipated earnings per share (three to 5 years) progress fee for Knight-Swift, Landstar and Herc Holdings is pegged at 12.8%, 12% and 49.2%, respectively.

5 Shares Set to Double

Every was handpicked by a Zacks professional because the #1 favourite inventory to realize +100% or extra in 2021. Earlier suggestions have soared +143.0%, +175.9%, +498.3% and +673.0%.

A lot of the shares on this report are flying underneath Wall Road radar, which supplies an awesome alternative to get in on the bottom flooring.

As we speak, See These 5 Potential Dwelling Runs >>

Click on to get this free report

Union Pacific Company (UNP): Free Inventory Evaluation Report

KnightSwift Transportation Holdings Inc. (KNX): Free Inventory Evaluation Report

Landstar System, Inc. (LSTR): Free Inventory Evaluation Report

Herc Holdings Inc. (HRI): Free Inventory Evaluation Report

To learn this text on Zacks.com click on right here.

Zacks Funding Analysis

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.

www.nasdaq.com