Welbilt, Inc. WBT recently provided an update on its pending deal with Ali Holding S.r.l., Ali Group North America Corporation and Ascend Merger Corp. The last three companies are collectively referred to as the ‘Ali Group’ below.

Before discussing on the update, it is worth noting here that the deal between the companies calls for the acquisition and merger of shares of Welbilt by the Ali Group, a prominent name in the foodservice equipment industry. The merger agreement was signed in July this year.

In the last two trading days, Welbilt’s shares dipped 0.04%. It closed the trading session at $23.55 on Friday.

Inside the Headlines

Welbilt announced that its merger with the Ali Group was unanimously approved by its shareholders. Of the total, 99.72% of the votes supported the pending merger. The parties also submitted regulatory filings in the European Union, the United States and the United Kingdom jurisdictions.

The parties involved in the deal also decided to divest Manitowoc Ice brand of Welbilt in 2022. This decision was taken to address concerns raised by the U.S. Department of Justice.

A brief discussion on the deal inked in July is provided below:

Per the agreement, each share of Welbilt will be acquired by the Ali Group for $24.00. The aggregate value equals $4.8 billion enterprise value and $3.5 billion equity value. This transaction got approvals from the board of directors of both parties.

This deal is expected to enhance the value of Welbilt’s shareholders as well as help unlock solid growth opportunities for its employees. The combined business of Welbilt and the Ali Group is anticipated to be a leader in the global foodservice equipment industry.

Subject to the fulfillment of closing conditions, the transaction is anticipated to be complete in 2022.

Zacks Rank, Price Performance and Estimates

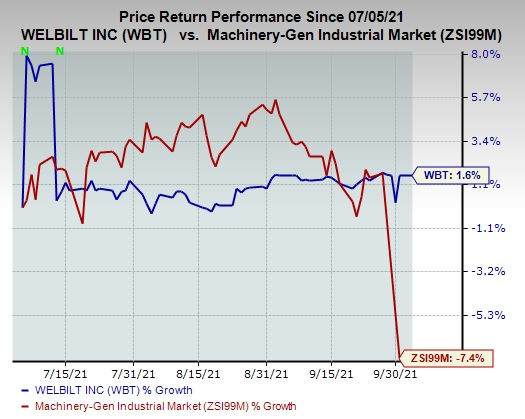

With a market capitalization of $3.4 billion, Welbeit currently carries a Zacks Rank #2 (Buy). The company is benefiting from improved demand for products, pricing and productivity. In the past three months, the stock has increased 1.6% against the industry’s decline of 7.4%.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for earnings is pegged at 63 cents for 2021 and 85 cents for 2022, indicating growth of 16.7% and 6.3% each from the respective 60-day-ago figures. Earnings estimates for the third quarter are pegged at 16 cents, implying a 6.7% rise from the 60-day-ago figure.

Welbilt, Inc. Price and Consensus

Welbilt, Inc. price-consensus-chart | Welbilt, Inc. Quote

Other Stocks to Consider

Three other top-ranked stocks in the industry are Nordson Corp. NDSN, Kadant Inc. KAI and EnPro Industries, Inc. NPO, all presently sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, earnings estimates for these companies improved for the current year. Further, earnings surprise for the last reported quarter was 14.15% for Nordson, 33.11% for Kadant and 25.81% for EnPro.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Click to get this free report

Nordson Corporation (NDSN): Free Stock Analysis Report

Kadant Inc (KAI): Free Stock Analysis Report

EnPro Industries (NPO): Free Stock Analysis Report

Welbilt, Inc. (WBT): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

www.nasdaq.com