Investors would possibly wish to wager on Micron (MU), as earnings estimates for this firm have bee

Investors would possibly wish to wager on Micron (MU), as earnings estimates for this firm have been displaying stable enchancment currently. The inventory has already gained stable short-term worth momentum, and this development would possibly proceed with its nonetheless bettering earnings outlook.

The upward development in estimate revisions for this chipmaker displays rising optimism of analysts on its earnings prospects, which ought to get mirrored in its inventory worth. In spite of everything, empirical analysis reveals a powerful correlation between developments in earnings estimate revisions and near-term inventory worth actions. This perception is on the core of our inventory score instrument — the Zacks Rank.

The five-grade Zacks Rank system, which ranges from a Zacks Rank #1 (Robust Purchase) to a Zacks Rank #5 (Robust Promote), has a powerful externally-audited monitor report of outperformance, with Zacks #1 Ranked shares producing a mean annual return of +25% since 2008.

For Micron, there was sturdy settlement among the many overlaying analysts in elevating earnings estimates, which has helped push consensus estimates significantly greater for the subsequent quarter and full 12 months.

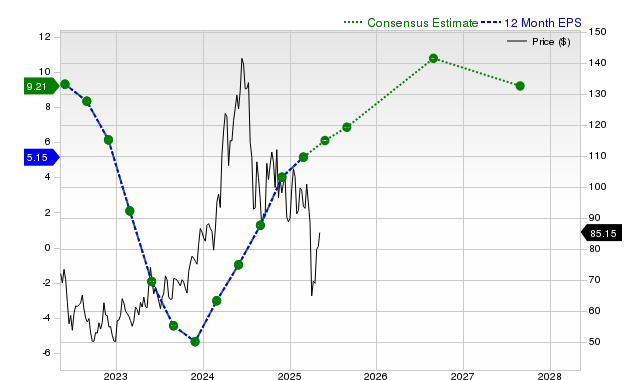

The chart under reveals the evolution of ahead 12-month Zacks Consensus EPS estimate:

12 Month EPS

Present-Quarter Estimate Revisions

The corporate is predicted to earn $0.64 per share for the present quarter, which represents a year-over-year change of +33.33%.

During the last 30 days, six estimates have moved greater for Micron in comparison with no damaging revisions. Because of this, the Zacks Consensus Estimate has elevated 9.1%.

Present-Yr Estimate Revisions

For the complete 12 months, the corporate is predicted to earn $3.38 per share, representing a year-over-year change of +19.43%.

When it comes to estimate revisions, the development for the present 12 months additionally seems fairly encouraging for Micron. Over the previous month, six estimates have moved greater in comparison with no damaging revisions, serving to the consensus estimate enhance 13.87%.

Favorable Zacks Rank

Because of promising estimate revisions, Micron at the moment carries a Zacks Rank #1 (Robust Purchase). The Zacks Rank is a tried-and-tested score instrument that helps buyers successfully harness the ability of earnings estimate revisions and make the fitting funding determination. You may see the whole listing of right now’s Zacks #1 Rank (Robust Purchase) shares right here.

Our analysis reveals that shares with Zacks Rank #1 (Robust Purchase) and a pair of (Purchase) considerably outperform the S&P 500.

Backside Line

Micron shares have added 28.1% over the previous 4 weeks, suggesting that buyers are betting on its spectacular estimate revisions. So, it’s possible you’ll contemplate including it to your portfolio instantly to profit from its earnings progress prospects.

Need the newest suggestions from Zacks Funding Analysis? At present, you may obtain 7 Finest Shares for the Subsequent 30 Days. Click on to get this free report

Micron Expertise, Inc. (MU): Free Inventory Evaluation Report

To learn this text on Zacks.com click on right here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.