RenaissanceRe Holdings Ltd. RNR continues to be in buyers’ good books on the again of its strategic initiatives, stable second-quarter outcomes and an encouraging solvency stage.

Over the previous 30 days, the inventory has witnessed its 2021 earnings estimates transfer 6.9% north.

RenaissanceRe’s second-quarter revenue per share of $5.64 beat the Zacks Consensus Estimate by 16.3% on larger gross premiums written throughout its Property in addition to Casualty and Specialty segments. Its funding portfolio, consisting of high-quality, liquid-fixed revenue plus authorities and company securities with a comparatively low allocation to equities is spectacular.

Right here we focus on the explanations for retaining this presently Zacks Rank #3 (Maintain) participant in your funding portfolio.

The corporate is witnessing a continued optimistic development in gross premiums written, which doubled over a span of 5 years, pushed by premium development at each its Casualty and Specialty, and Property segments. This upside is sort of apparent from the 24.6% CAGR witnessed within the 2014-2020 forecast interval, primarily led by robust segmental outcomes. Through the first quarter of 2021, gross premiums written additionally jumped 27.3% 12 months over 12 months.

The insurer additionally continues to make strategic divestitures by eliminating low-return high-risk companies to streamline its enterprise.

On the flip aspect, it is usually buying and increasing companies, which give scope for development. In March 2019, the corporate purchased Tokio Millennium Re for a price of $1.5 billion to extend its scale and enhance its portfolio. Within the first half of 2021, RenaissanceRe spent $552.eight million on acquisitions. We anticipate such strategic initiatives to deepen its concentrate on rising its core working enterprise.

Its Capital Companions enterprise has additionally been contributing to its efficiency since 2015. It managed to develop this enterprise line from 4 autos and $6 billion in capital to 6 autos with greater than $11 billion value of capital. Given the present state of affairs, the section is well-poised for long-term development.

The main property and casualty insurer has a stable solvency place. With no debt maturity till 2025, it is usually profitable in decreasing debt from the 2020-end stage. Whole debt of the corporate represents 13.6% of its capital, decrease than the business’s common of 19.5%. As of Jun 30, 2021, it had money and money equivalents value $1.78 billion, larger than its debt stage of $1.1 billion. Over the previous few years, it has been witnessing free money movement (besides in 2020).

RenaissanceRe has been deploying extra capital to enterprise for a substantial time frame. It has been elevating dividend since a number of years. In February 2021, the corporate’s board of administrators permitted a 2.9% hike within the quarterly dividend. It presently has a dividend yield of 0.9%, larger than the business common of 0.4%. Administration expects to reinforce its shareholder worth in 2021 and past.

12 months up to now, the corporate has bought shares value $618 million.

Nonetheless, dealing in property and casualty insurance coverage, it’s at all times uncovered to cat actions, the prevalence of which imparts volatility to its outcomes.

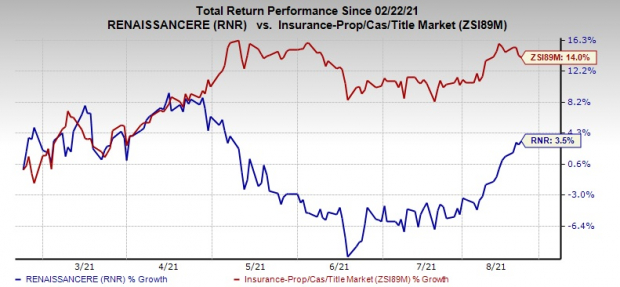

Up to now six months, shares of the corporate have gained 3.5%, underperforming its business’s development of 14%. You may see the entire listing of at this time’s Zacks #1 Rank (Sturdy Purchase) shares right here.

Picture Supply: Zacks Funding Analysis

Shares to Take into account

Some better-ranked firms in the identical house are Constancy Nationwide Monetary, Inc. FNF, Axis Capital Holdings Restricted AXS and Selective Insurance coverage Group, Inc. SIGI, every presently holding a Zacks Rank #2 (Purchase).

Constancy Nationwide Monetary, Axis Capital and Selective Insurance coverage managed to ship a trailing four-quarter shock of 37.3%, 34.5% and 42.1%, respectively, on common.

Bitcoin, Just like the Web Itself, Might Change Every part

Blockchain and cryptocurrency has sparked one of the thrilling dialogue subjects of a technology. Some name it the “Web of Cash” and predict it might change the way in which cash works perpetually. If true, it might do to banks what Netflix did to Blockbuster and Amazon did to Sears. Specialists agree we’re nonetheless within the early levels of this know-how, and because it grows, it’ll create a number of investing alternatives.

Zacks’ has simply revealed Three firms that may assist buyers capitalize on the explosive revenue potential of Bitcoin and the opposite cryptocurrencies with considerably much less volatility than shopping for them instantly.

See Three crypto-related shares now >>

Click on to get this free report

RenaissanceRe Holdings Ltd. (RNR): Free Inventory Evaluation Report

Axis Capital Holdings Restricted (AXS): Free Inventory Evaluation Report

Selective Insurance coverage Group, Inc. (SIGI): Free Inventory Evaluation Report

Constancy Nationwide Monetary, Inc. (FNF): Free Inventory Evaluation Report

To learn this text on Zacks.com click on right here.

Zacks Funding Analysis

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.