The Chemours Firm’s CC shares h

The Chemours Firm’s CC shares have shot up roughly 26% over the previous six months. It’s benefiting from larger demand for Opteon in cellular purposes, robust execution and cost-cutting measures.

We’re optimistic on the corporate’s prospects and consider that the time is best for you so as to add the inventory to the portfolio because it seems to be promising and is poised to hold the momentum forward.

Chemours at present carries a Zacks Rank #2 (Purchase) and a VGM Rating of A. Our analysis reveals that shares with a VGM Rating of A or B, mixed with a Zacks Rank #1 (Robust Purchase) or 2, provide the perfect funding alternatives for traders.

Let’s have a look at what makes this chemical maker a gorgeous funding possibility for the time being.

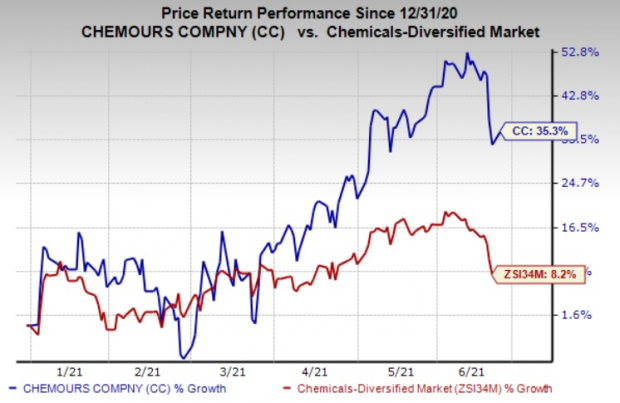

Worth Efficiency

Shares of Chemours have rallied 35.3% yr thus far in opposition to the 8.2% rise of its trade. It has additionally outperformed the S&P 500’s 10.9% rise over the identical interval.

Picture Supply: Zacks Funding Analysis

Picture Supply: Zacks Funding Analysis

Estimates Northbound

Over the previous two months, the Zacks Consensus Estimate for Chemours for the present yr has elevated round 16.9%. The consensus estimate for 2022 has additionally been revised 10% upward over the identical timeframe. The favorable estimate revisions instill investor confidence within the inventory.

Constructive Earnings Shock Historical past

Chemours has outpaced the Zacks Consensus Estimate in every of the trailing 4 quarters. On this timeframe, it has delivered an earnings shock of 55.2%, on common.

Enticing Valuation

Valuation seems to be enticing as Chemours’ shares are at present buying and selling at a stage that’s decrease than the trade common, suggesting that the inventory nonetheless has upside potential.

Going by the EV/EBITDA (Enterprise Worth/ Earnings earlier than Curiosity, Tax, Depreciation and Amortization) a number of, which is commonly used to worth chemical shares, Chemours is at present buying and selling at trailing 12-month EV/EBITDA a number of of 10.45, cheaper in contrast with the trade common of 11.53.

Superior Return on Fairness (ROE)

ROE is a measure of an organization’s effectivity in using shareholder’s funds. ROE for the trailing 12-months for Chemours is 43.3%, above the trade’s stage of 11.3%.

Development Drivers in Place

Chemours is benefiting from rising adoption of the Opteon platform and rising purposes of fluoropolymers, particularly in automotive, electronics and power end-markets. The corporate stays is dedicated towards driving Opteon adoption. The corporate is seeing larger demand for Opteon in cellular purposes. It’s ramping up manufacturing on the new low-cost Opteon Corpus Christi facility.

The corporate additionally stands to achieve from its efforts to scale back prices. It’s endeavor actions to chop prices by lowering overhead, discretionary spend and capital expenditures. The corporate, in 2020, benefited from its $160-million cost-management program aimed towards enhancing monetary flexibility.

The corporate’s cost-reduction program together with its productiveness and operational enchancment actions throughout its companies are additionally anticipated to assist margins in 2021.

The Chemours Firm Worth and Consensus

The Chemours Firm price-consensus-chart | The Chemours Firm Quote

Shares to Contemplate

Different top-ranked shares price contemplating within the primary supplies house embrace Nucor Company NUE, Cabot Company CBT and Impala Platinum Holdings Restricted IMPUY.

Nucor has a projected earnings development fee of 344.9% for the present yr. The corporate’s shares have surged round 127% in a yr. It at present sports activities a Zacks Rank #1. You possibly can see the entire listing of in the present day’s Zacks #1 Rank shares right here.

Cabot has an anticipated earnings development fee of round 126% for the present fiscal. The corporate’s shares have rallied 56% prior to now yr. It at present carries a Zacks Rank #2.

Impala Platinum has an anticipated earnings development fee of 225.2% for the present fiscal. The corporate’s shares have surged round 129% prior to now yr. It at present carries a Zacks Rank #2.

5 Shares Set to Double

Every was hand-picked by a Zacks skilled because the #1 favourite inventory to achieve +100% or extra in 2020. Every comes from a distinct sector and has distinctive qualities and catalysts that would gas distinctive development.

A lot of the shares on this report are flying underneath Wall Road radar, which offers an awesome alternative to get in on the bottom flooring.

In the present day, See These 5 Potential Dwelling Runs >>

Click on to get this free report

Nucor Company (NUE): Free Inventory Evaluation Report

Cabot Company (CBT): Free Inventory Evaluation Report

Impala Platinum Holdings Ltd. (IMPUY): Free Inventory Evaluation Report

The Chemours Firm (CC): Free Inventory Evaluation Report

To learn this text on Zacks.com click on right here.

Zacks Funding Analysis

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.