Eastman Chemical Firm’s EMN sha

Eastman Chemical Firm’s EMN shares have gained round 24% over the previous six months. The chemical maker is benefiting from its innovation-driven development mannequin, operational execution and cost-management actions.

We’re constructive on the corporate’s prospects and imagine that the time is best for you so as to add the inventory to portfolio because it seems to be promising and is poised to hold the momentum forward.

Let’s have a look into the components that make this Zacks Rank #2 (Purchase) inventory a beautiful selection for traders proper now.

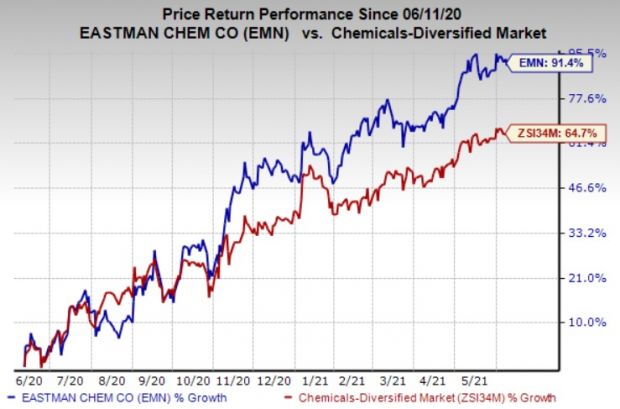

An Outperformer

Shares of Eastman Chemical have rallied 91.4% over the previous 12 months towards the 64.7% rise of its trade. It has additionally outperformed the S&P 500’s roughly 31.8% rise over the identical interval.

Picture Supply: Zacks Funding Analysis

Picture Supply: Zacks Funding Analysis

Estimates Going Up

Over the previous two months, the Zacks Consensus Estimate for Eastman Chemical for the present 12 months has elevated round 9.9%. The consensus estimate for second-quarter 2021 has additionally been revised 17.6% upward over the identical time-frame.

Optimistic Earnings Shock Historical past

Eastman Chemical has outpaced the Zacks Consensus Estimate in three of the trailing 4 quarters. On this time-frame, it has delivered an earnings shock of two.5%, on common.

Wholesome Progress Prospects

The Zacks Consensus Estimate for earnings for 2021 for Eastman Chemical is at the moment pegged at $8.66, reflecting an anticipated year-over-year development of 40.8%. Furthermore, earnings are anticipated to register a 167.1% development in second-quarter 2021.

Superior Return on Fairness (ROE)

Eastman Chemical’s ROE of 13.9%, as in contrast with the trade common of 11.2%, manifests the corporate’s effectivity in using shareholder’s funds.

Progress Drivers in Place

Eastman Chemical is witnessing larger demand throughout constructing & building, transportation and shopper durables markets. Continued energy in these markets is anticipated to drive its gross sales volumes in 2021. The corporate additionally stays targeted on rising new enterprise revenues from innovation.

The corporate additionally stays targeted on rising new enterprise revenues from innovation. Specifically, the corporate’s Superior Supplies phase has numerous merchandise which might be driving new enterprise revenues.

Furthermore, the corporate is taking an aggressive strategy to value administration within the wake of the pandemic. These initiatives embrace discount of discretionary spending. The corporate lowered prices by roughly $150 million in 2020. Additionally it is on monitor with its cost-cutting actions in 2021, that are anticipated to contribute to its earnings per share. The corporate expects to profit from decrease working prices from its operational transformation program within the second quarter of 2021.

Eastman Chemical additionally stays dedicated to sustaining a disciplined strategy to capital allocation, with an emphasis on financing its dividend and debt discount. The corporate returned $134 million to its shareholders by way of dividends and share repurchases through the first quarter of 2021. It expects to buyback shares price roughly $350 million in 2021. Eastman Chemical additionally anticipates free money circulation to strategy $1.1 billion for 2021.

Eastman Chemical Firm Worth and Consensus

Eastman Chemical Firm price-consensus-chart | Eastman Chemical Firm Quote

Shares to Take into account

Different top-ranked shares price contemplating within the primary supplies area embrace Dow Inc. DOW, Nucor Company NUE and Cabot Company CBT.

Dow has a projected earnings development price of roughly 303.6% for the present 12 months. The corporate’s shares have surged 58% in a 12 months. It at the moment sports activities a Zacks Rank #1 (Robust Purchase). You possibly can see the whole checklist of right this moment’s Zacks #1 Rank shares right here.

Nucor has a projected earnings development price of 259.9% for the present 12 months. The corporate’s shares have rallied round 144% in a 12 months. It at the moment sports activities a Zacks Rank #1.

Cabot has an anticipated earnings development price of round 126% for the present fiscal. The corporate’s shares have shot up 59% up to now 12 months. It at the moment carries a Zacks Rank #2.

Bitcoin, Just like the Web Itself, May Change All the pieces

Blockchain and cryptocurrency has sparked some of the thrilling dialogue subjects of a era. Some name it the “Web of Cash” and predict it may change the best way cash works ceaselessly. If true, it may do to banks what Netflix did to Blockbuster and Amazon did to Sears. Consultants agree we’re nonetheless within the early phases of this know-how, and because it grows, it’ll create a number of investing alternatives.

Zacks’ has simply revealed three corporations that may assist traders capitalize on the explosive revenue potential of Bitcoin and the opposite cryptocurrencies with considerably much less volatility than shopping for them instantly.

See three crypto-related shares now >>

Click on to get this free report

Nucor Company (NUE): Free Inventory Evaluation Report

Dow Inc. (DOW): Free Inventory Evaluation Report

Cabot Company (CBT): Free Inventory Evaluation Report

Eastman Chemical Firm (EMN): Free Inventory Evaluation Report

To learn this text on Zacks.com click on right here.

Zacks Funding Analysis

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.