Olin Company’s OLN shares have shot up round 37% over the previous six months. It’s benefiting from the Lake Metropolis U.S. Military contract, productiveness actions and funding within the Data Expertise (IT) challenge. We’re constructive on the corporate’s prospects and imagine that the time is best for you so as to add the inventory to portfolio because it appears promising and is poised to hold the momentum forward.

Olin has a Zacks Rank #1 (Sturdy Purchase) and a VGM Rating of A. Our analysis reveals that shares with a VGM Rating of A or B, mixed with a Zacks Rank #1 or 2 (Purchase), provide one of the best funding alternatives for traders.

Let’s have a look into the elements that make this chemical maker a compelling selection for traders proper now.

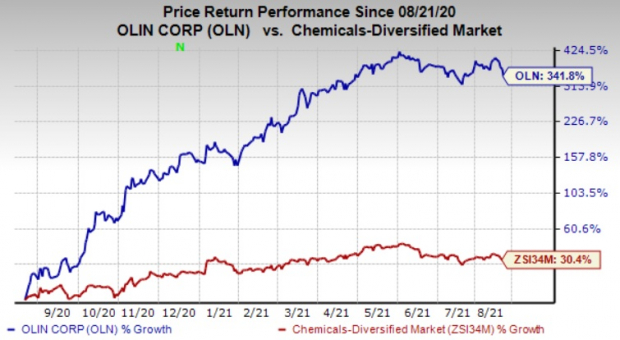

An Outperformer

Shares of Olin have surged 341.8% over the previous yr in opposition to the 30.4% rise of its business. It has additionally outperformed the S&P 500’s roughly 30.4% rise over the identical interval.

Picture Supply: Zacks Funding Analysis

Estimates Going Up

Over the previous two months, the Zacks Consensus Estimate for Olin for 2021 has elevated round 21.2%. The consensus estimate for third-quarter 2021 has additionally been revised 44% upward over the identical timeframe. The favorable estimate revisions instill investor confidence within the inventory.

Strong Development Prospects

The Zacks Consensus Estimate for earnings for 2021 for Olin is at present pegged at $6.62, reflecting an anticipated year-over-year progress of 590.4%. Furthermore, earnings are anticipated to register a 1,115% progress in third-quarter 2021.

Valuation Appears to be like Engaging

Olin’s shares are at present buying and selling at a stage that’s decrease than the business common, suggesting that the inventory nonetheless has upside potential.

Going by the EV/EBITDA (Enterprise Worth/ Earnings earlier than Curiosity, Tax, Depreciation and Amortization) a number of, which is usually used to worth chemical shares, Olin is at present buying and selling at trailing 12-month EV/EBITDA a number of of 4.79, cheaper in contrast with the business common of 10.31.

Upbeat Prospects

Olin delivered strong leads to the second quarter with each adjusted earnings and revenues topping the respective Zacks Consensus Estimate. The corporate noticed sturdy gross sales throughout all its segments within the second quarter. It benefited from larger pricing and volumes within the quarter.

The corporate, in its second-quarter name, stated that it anticipates Chlor Alkali Merchandise and Vinyls, Epoxy, and Winchester segments’ third-quarter outcomes to extend sequentially. Furthermore, it expects third-quarter 2021 adjusted EBITDA to enhance sequentially from second-quarter 2021 ranges.

The Winchester section is well-placed to profit from the Lake Metropolis U.S. Military ammunition contract. The multi-year contract is predicted to considerably enhance annual profitability of the unit. Notably, gross sales from the section greater than doubled yr over yr within the second quarter, pushed by larger industrial and navy gross sales in addition to larger industrial ammunition pricing. The corporate expects the Lake Metropolis contract to extend Winchester’s annual revenues by $450-$550 million.

The corporate additionally stays dedicated to enhance its price construction and effectivity and in addition drive productiveness by way of a lot of tasks. It at present has greater than 1,200 energetic productiveness tasks which can be anticipated to contribute to financial savings in 2021. It expects productiveness measures to ship $100 million of internet financial savings in 2021.

Olin can also be anticipated to realize from price and different advantages from its funding within the IT challenge. The challenge, which entails implementation of crucial IT infrastructure, is predicted to maximise price effectiveness, effectivity and management over its international chemical operations by standardizing enterprise processes.

Olin Company Worth and Consensus

Olin Company price-consensus-chart | Olin Company Quote

Shares to Think about

Different top-ranked shares price contemplating within the primary supplies house embrace Nucor Company NUE, ArcelorMittal MT and AdvanSix Inc. ASIX, every sporting a Zacks Rank #1. You’ll be able to see the whole record of in the present day’s Zacks #1 Rank shares right here.

Nucor has a projected earnings progress fee of 489.2% for the present yr. The corporate’s shares have surged round 163% in a yr.

ArcelorMittal has an anticipated earnings progress fee of 1,731.2% for the present yr. The corporate’s shares have shot up round 189% prior to now yr.

AdvanSix has an anticipated earnings progress fee of round 160.4% for the present yr. The corporate’s shares have rallied roughly 155% prior to now yr.

Bitcoin, Just like the Web Itself, May Change The whole lot

Blockchain and cryptocurrency has sparked one of the thrilling dialogue subjects of a era. Some name it the “Web of Cash” and predict it may change the best way cash works ceaselessly. If true, it may do to banks what Netflix did to Blockbuster and Amazon did to Sears. Specialists agree we’re nonetheless within the early phases of this know-how, and because it grows, it’s going to create a number of investing alternatives.

Zacks’ has simply revealed three firms that may assist traders capitalize on the explosive revenue potential of Bitcoin and the opposite cryptocurrencies with considerably much less volatility than shopping for them instantly.

See three crypto-related shares now >>

Click on to get this free report

ArcelorMittal (MT): Free Inventory Evaluation Report

Nucor Company (NUE): Free Inventory Evaluation Report

Olin Company (OLN): Free Inventory Evaluation Report

AdvanSix Inc. (ASIX): Free Inventory Evaluation Report

To learn this text on Zacks.com click on right here.

Zacks Funding Analysis

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.