The Williams Companies, Inc.’s WMB board recently approved a new share repurchase program worth $1.5 billion, which was implemented with immediate effect. The move underscores the company’s sound financial position and its commitment to reward its shareholders.

Management noted that the announcement throws light on the company’s dedication to enhancing shareholder value. Its strong balance sheet along with excess free cash flow enables it to take advantage of this investment opportunity.

Williams’ solid cash flow generation capacity supports its shareholder-friendly activities. Even during the coronavirus-ravaged 2020, the company generated distributable cash flow of $3.35 billion, indicating a 2% rise from the figure generated in 2019.

The Oklahoma-based premier energy infrastructure provider in North America also has a decent dividend payment history. In 2020, it paid out dividends worth $1.94 billion, up 5.4% year over year. Retaining its pro-shareholder stance, Williams paid out dividends worth $996 million in the first half of 2021.

Hence, with its earnings strength and a decent liquidity position, Williams will likely sustain the current level of capital deployments and continue to bolster its shareholder returns.

A much-improved commodity price scenario and the economic recovery have contributed to the balance sheet strength of the energy companies like Williams. Benefiting from the robust fundamentals, their cash from operations are now covering capital spending. This provides a sustainable financial framework for these firms to increase cash returns to shareholders.

Established in 1908, the company’s core operations include finding, producing, gathering, processing and transporting natural gas and natural gas liquids. Possessing a widespread pipeline system, which is extended to more than 33,000 miles, Williams is one of the largest domestic transporters of natural gas by volume.

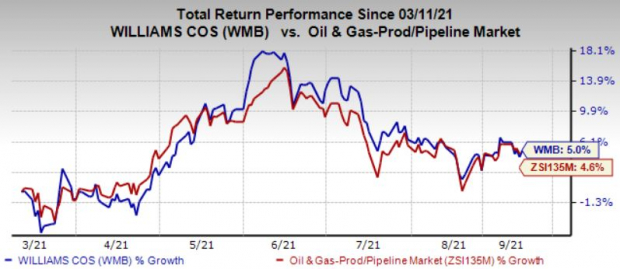

Shares of Williams have gained 5% over the past six months compared with the 4.6% increase of its industry.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Williams currently has a Zacks Rank #4 (Sell).

Some better-ranked players in the energy space are Devon Energy Corporation DVN, Matador Resources Company MTDR and Continental Resources, Inc. CLR, each presently flaunting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency has sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix did to Blockbuster and Amazon did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks’ has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 3 crypto-related stocks now >>

Click to get this free report

Williams Companies, Inc. The (WMB): Free Stock Analysis Report

Devon Energy Corporation (DVN): Free Stock Analysis Report

Continental Resources, Inc. (CLR): Free Stock Analysis Report

Matador Resources Company (MTDR): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

www.nasdaq.com