Worldwide Flavors & Fragrances Inc. IFF has entered into an settlement to divest its Microbial Management enterprise unit to LANXESS for $1.Three billion. Money proceeds of the deal can be utilized in lowering debt.

LANXESS is a foremost specialty chemical substances firm that develops, manufactures and markets chemical intermediates, components, specialty chemical substances and plastics.

The newest deal permits Worldwide Flavors to deal with its core enterprise operations by strengthening the steadiness sheet, whereas maximizing shareholder return. In reality, the divesture boosts its monetary place by offering development acceleration and better margins. The deal is anticipated to shut within the second quarter of 2022.

Worldwide Flavors’ Microbial Management enterprise unit provides preservation and hygiene options for a broad vary of business and shopper functions that features paints & coatings, constructing supplies, animal biosecurity, private care, and residential care. It additionally supplies industrial water therapy options for manufacturing, cooling towers and pulp & paper. With two manufacturing services in america, this enterprise has an estimated income of $440 million for the present yr and an EBITDA of round $85 million.

Microbial Management joined with Worldwide Flavors by way of the merger cope with DuPont de Nemours, Inc.’s DD Vitamin & Biosciences (“N&B”) enterprise. Earlier this yr, Worldwide Flavors formally accomplished its merger with DuPont’s N&B enterprise. The brand new entity is anticipated to be a world chief in high-value elements and options for meals and beverage, residence and private care, and well being & wellness markets with estimated professional forma revenues of greater than $11 billion and EBITDA of $2.5 billion.

In Could, Worldwide Flavors entered into an settlement to divest its fruit preparation enterprise to Frulact, in sync with the corporate’s portfolio-optimization technique to maximise shareholder worth by way of non-core enterprise divestitures. The divestiture is anticipated to shut in third-quarter 2021.

The corporate expects current-year gross sales to be $11.Four billion, indicating year-over-year development of seven%. Focus to drive higher efficiencies all through the enterprise by way of prices and productiveness initiatives, margin enchancment, acquisition-related synergies and favorable taxes continues to drive profitability. The corporate is prioritizing tasks that generate excessive returns inside a short while, whereas delaying longer-term funding which might be pointless right now.

Worldwide Flavors is nicely poised to learn from the rising demand for a wide range of shopper merchandise containing flavors and fragrances. Given the corporate’s world presence, diversified enterprise platform, broad product portfolio, world and regional buyer base, will probably be in a position to capitalize on the enlargement within the flavors and fragrances markets, and ship long-term development.

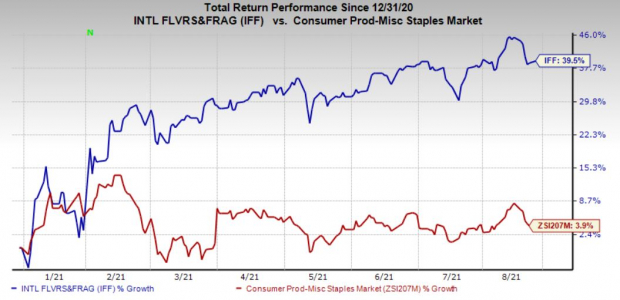

Worth Efficiency

Over the previous yr, Worldwide Flavors’ shares have gained 39.5%, outperforming the business’s development of three.9%.

Picture Supply: Zacks Funding Analysis

Zacks Rank & Key Picks

Worldwide Flavors presently carries a Zacks Rank #3 (Maintain).

A couple of better-ranked shares within the Client Staples sector are Inter Parfums, Inc. IPAR and Pilgrim’s Delight Company PPC. Whereas Inter Parfums flaunts a Zacks Rank #1 (Sturdy Purchase), Pilgrim’s Delight carries a Zacks Rank #2 (Purchase), at current. You possibly can see the entire checklist of in the present day’s Zacks #1 Rank shares right here.

Inter Parfums has an anticipated earnings development price of 61.2% for 2021. The inventory has gained 23.6% up to now yr.

Pilgrim’s Delight has a projected earnings development price of 114.7% for the present yr. Its shares have rallied 38.6% in a yr’s time.

Tech IPOs With Huge Revenue Potential

Previously few years, many common platforms and like Uber and Airbnb lastly made their method to the general public markets. However the greatest paydays got here from lesser-known names.

For instance, electrical carmaker X Peng shot up +299.4% in simply 2 months. Consider it this fashion…

In the event you had put $5,000 into XPEV at its IPO in September 2020, you possibly can have cashed out with $19,970 in November.

With file quantities of money flooding into IPOs and a record-setting inventory market, this yr’s lineup might be much more profitable.

See Zacks Hottest Tech IPOs Now >>

Click on to get this free report

DuPont de Nemours, Inc. (DD): Free Inventory Evaluation Report

Worldwide Flavors & Fragrances Inc. (IFF): Free Inventory Evaluation Report

Pilgrims Delight Company (PPC): Free Inventory Evaluation Report

Inter Parfums, Inc. (IPAR): Free Inventory Evaluation Report

To learn this text on Zacks.com click on right here.

Zacks Funding Analysis

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.