Australian Greenback, AUD/USD, US-China Tensions, Commerce Conflict Fears – Asia Pacific Market OpenAustralian Greenback struggle

Australian Greenback, AUD/USD, US-China Tensions, Commerce Conflict Fears – Asia Pacific Market Open

- Australian Greenback struggles at resistance after danger aversion sank shares

- US-China tensions could have fueled commerce battle fears as US Greenback rose

- Japanese Yen could rise if Asia Pacific shares fall, eyeing BoJ assembly

The sentiment-linked Australian Greenback aimed cautiously decrease Thursday amid a deterioration in market temper. By Wall Road shut, the Dow Jones and S&P 500 wrapped up -0.41% and -0.78% respectively. That is because the haven-oriented US Greenback and similarly-behaving Japanese Yen outperformed their main counterparts. Anti-fiat gold costs fell 1.20%, essentially the most in three weeks amid a stronger Dollar.

Recommended by Daniel Dubrovsky

What is the road ahead for the Australian Dollar?

Danger aversion gathered momentum early on through the Asia Pacific buying and selling session. That is as US President Donald Trump dialed up criticism towards China for a “disinformation and propaganda assault on the USA and Europe”. Trump has expressed his dissatisfaction with how China dealt with the coronavirus outbreak, hinting at utilizing tariffs in response.

That has introduced again fears of a US-China commerce battle which was underscored through the North American buying and selling session. In response to Trump, China stated that the nation will “safeguard sovereignty, safety and pursuits”. In keeping with AFP News Agency, China threatened ‘countermeasures’ in response to US coronavirus sanction threats. Shares declined following these developments.

Develop the self-discipline and objectivity that you must enhance your method to buying and selling constantly

Friday’s Asia Pacific Buying and selling Session

Asia Pacific equities may observe the pessimistic lead from Wall Road. Which will bode in poor health for the Australian Greenback whereas benefiting the Japanese Yen and US Greenback. There’s an emergency Financial institution of Japan (BOJ) assembly scheduled at 00:00 GMT. The central financial institution is just not anticipated to regulate its foremost coverage instruments. Markets appear to be eyeing measures to assist assist small companies. With that in thoughts, the Yen could look previous the BoJ and deal with the broader trajectory in market temper over the remaining 24 hours.

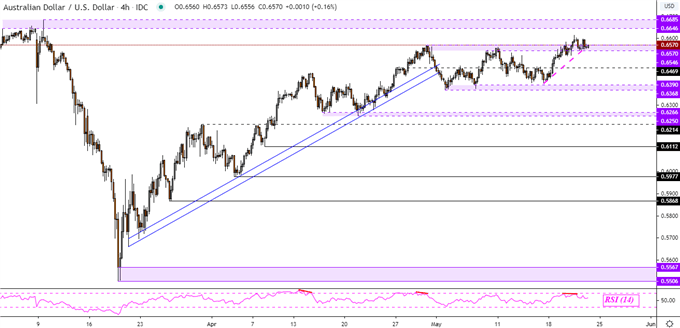

Australian Greenback Technical Evaluation

The AUD/USD is struggling to search out follow-through after costs tried to push above key resistance (0.6546 – 0.6570). This space was established after costs discovered a prime in late April. Since then, detrimental RSI divergence has emerged. It is a signal of fading upside momentum which may at occasions precede a flip decrease. Such an end result may place the deal with assist beneath at 0.6469.

| Change in | Longs | Shorts | OI |

| Daily | 20% | -5% | 3% |

| Weekly | 2% | 18% | 11% |

AUD/USD – Every day Chart

Chart Created in TradingView

— Written by Daniel Dubrovsky, Forex Analyst for DailyFX.com

To contact Daniel, use the feedback part beneath or @ddubrovskyFX on Twitter