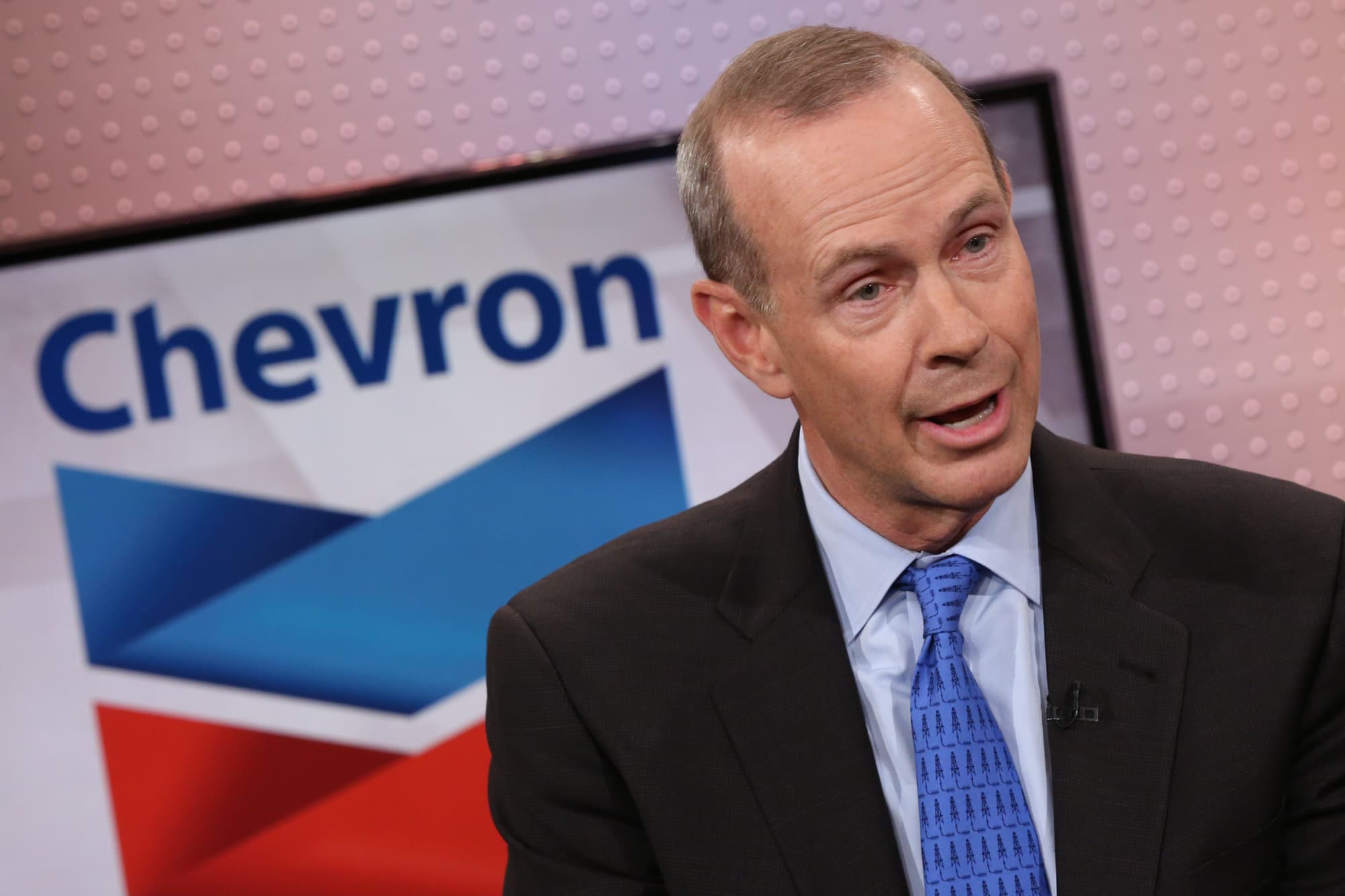

Michael Wirth, CEO of Chevron.Adam Jeffery | CNBCChevron and Exxon on Friday reported earnings for the second straight quarter as bettering demand

Michael Wirth, CEO of Chevron.

Adam Jeffery | CNBC

Chevron and Exxon on Friday reported earnings for the second straight quarter as bettering demand for petroleum merchandise and a leap in oil and fuel costs boosted operations.

Chevron additionally reinstated its share repurchase program, signaling confidence in its futures earnings.

The oil big earned $1.71 per share throughout the second quarter on an adjusted foundation, with income coming in at $37.6 billion. Analysts have been anticipating the corporate to earn $1.59 per share on $35.94 billion in income, in keeping with estimates from Refinitiv.

“Our free money circulate was the very best in two years attributable to stable operational and monetary efficiency and decrease capital spending,” Chevron Chairman and CEO Mike Wirth mentioned in a press release. “We are going to resume share repurchases within the third quarter at an anticipated charge of $2- $three billion per yr.”

Through the first quarter of 2021, the corporate earned 90 cents per share on an adjusted foundation, with income coming in at $32.03 billion.

Exxon additionally beat top- and bottom-line estimates throughout the interval.

The corporate earned $1.10 per share in contrast with Wall Road’s expectation of 99 cents, in keeping with estimates from Refinitiv. Income got here in at $67.74 billion, additionally forward of the anticipated $66.81 billion.

Final quarter, Exxon turned a revenue, snapping a four-quarter streak of losses. The corporate earned 65 cents per share excluding gadgets on $59.15 billion in income.

“Optimistic momentum continued throughout the second quarter throughout all of our companies as the worldwide financial restoration elevated demand for our merchandise,” Chairman and CEO Darren Woods mentioned.

“We’re realizing important advantages from an improved value construction, stable working efficiency and low-cost-of-supply investments that, collectively, are producing engaging returns and powerful money circulate to fund our capital program, pay the dividend and scale back debt.”

The 2 firms’ outcomes are a far cry from the identical interval a yr earlier because the pandemic sapped demand for petroleum merchandise. Through the second quarter of 2020 Chevron misplaced $1.59 per share on an adjusted foundation on income of $13.49 billion. Exxon misplaced 70 cents per share on an adjusted foundation on $32.61 billion in income.

Nonetheless, the oil giants pointed to warning round capital spending plans.

Chevron mentioned it continues to train self-discipline with its capital spending, which is down 32% this yr from final yr. Exxon mentioned it has spent $6.9 billion on capital and exploration expenditures this yr, which was “in line with deliberate decrease exercise within the first half of 2020.”

The corporate mentioned it anticipates increased spending round key initiatives, however famous that total 2021 spending is predicted to be on the decrease finish of its beforehand introduced targets.

Through the depths of the pandemic in 2020, power firms slashed spending as West Texas Intermediate crude futures briefly tumbled into adverse territory for the primary time on report.

Chevron’s web oil-equivalent manufacturing rose 5% yr over yr to three.13 million barrels per day throughout the second quarter of 2021. The corporate’s U.S. upstream operations earned $1.four billion, in contrast with a lack of $2.1 billion in the identical interval a yr in the past. Chevron mentioned its common gross sales worth per barrel of crude oil and pure fuel liquids was $54, up from $19 a yr earlier.

Shares of Chevron and Exxon superior about 1% throughout premarket buying and selling on Friday.

Exxon’s oil-equivalent manufacturing dipped 2% yr over yr to three.6 million barrels per day attributable to elevated upkeep exercise.

Turn out to be a better investor with CNBC Professional.

Get inventory picks, analyst calls, unique interviews and entry to CNBC TV.

Signal as much as begin a free trial at present