The continued semiconductor chip scarcity is now anticipated to price the worldwide automotive business $110 billion in income in 2021, in keeping

The continued semiconductor chip scarcity is now anticipated to price the worldwide automotive business $110 billion in income in 2021, in keeping with consulting agency AlixPartners.

The forecast is up by 81.5% from an preliminary forecast of $60.6 billion, which the New York-based agency launched in late January when the elements downside began inflicting automakers to chop manufacturing at crops.

Mark Wakefield, world co-leader of the automotive and industrial follow at AlixPartners, stated quite a few elements have contributed to the rise, together with a fireplace at a plant close to Tokyo for chip provider Renesas and weather-related kinks within the automotive provide chain.

“The pandemic-induced chip disaster has been exacerbated by occasions which can be usually simply bumps within the highway for the auto business, corresponding to a fireplace in a key chip-making fabrication plant, extreme climate in Texas and a drought in Taiwan,” he stated in a press launch. “However all this stuff are actually main points for the business — which, in flip, has pushed residence the necessity to construct supply-chain resiliency for the long run.”

AlixPartners is forecasting that manufacturing of three.9 million autos can be misplaced this yr on account of the scarcity. That is up from January’s forecast that estimated the scarcity would lower manufacturing of two.2 million autos.

Within the U.S., the scarcity has precipitated the Biden administration to order a 100-day assessment of U.S. provide chains. About $50 billion of President Joe Biden’s $2 trillion infrastructure proposal is also earmarked for the American semiconductor business.

Automakers corresponding to Ford Motor and Basic Motors count on the chip scarcity to chop billions of their earnings this yr. Ford stated the scenario will decrease its earnings by about $2.5 billion in 2021. GM expects the chip scarcity will lower its earnings by $1.5 billion to $2 billion.

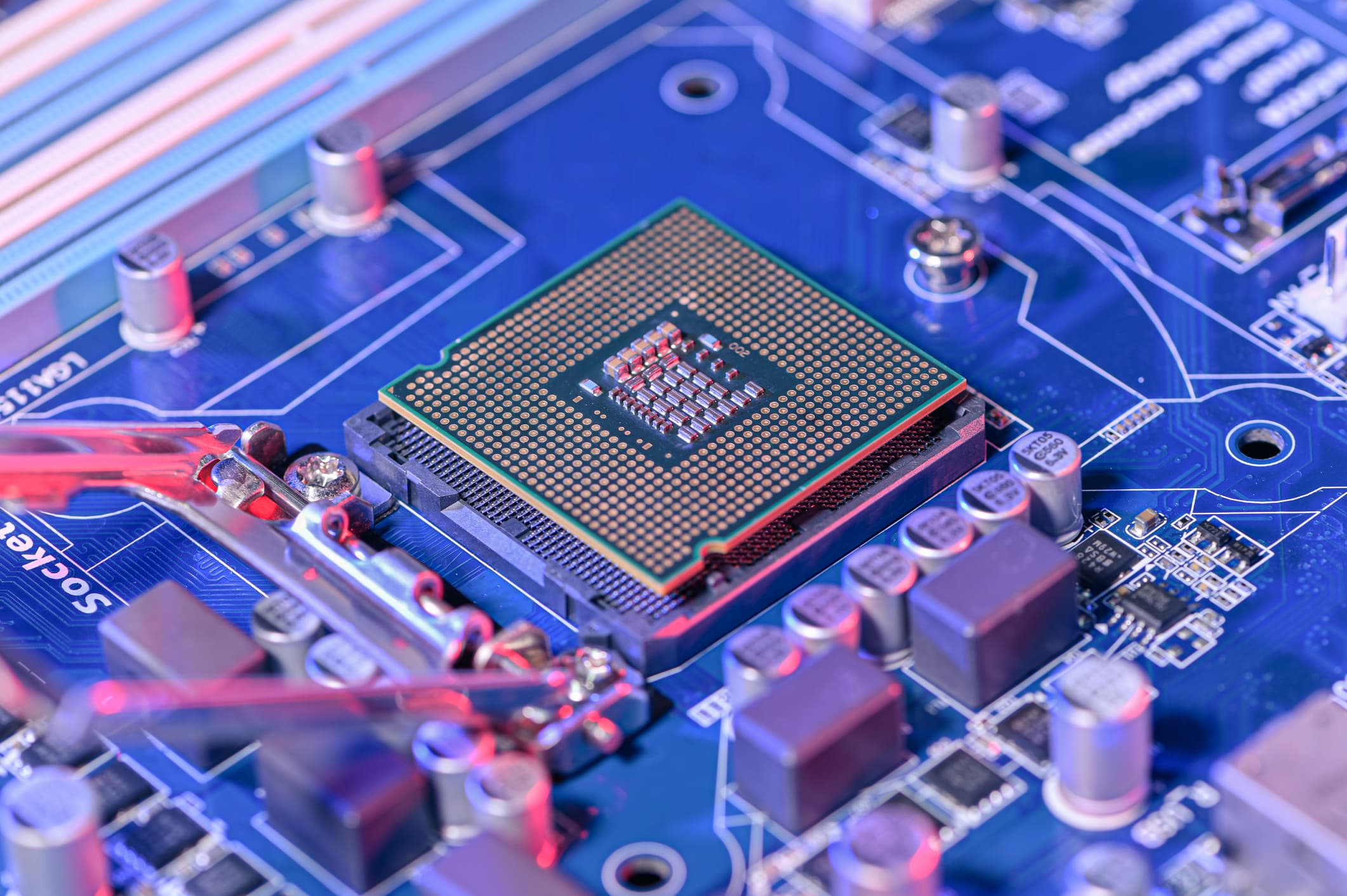

Semiconductor chips are extraordinarily vital parts of latest autos for areas like infotainment methods and extra primary elements corresponding to energy steering and brakes. Relying on the car and its choices, specialists say a car might have lots of of semiconductors, if no more. Greater-priced autos with superior security and infotainment methods have excess of a base mannequin, together with various kinds of chips.

“There are as much as 1,400 chips in a typical car at this time, and that quantity is barely going to will increase because the business continues its march towards electrical autos, ever-more linked autos and, finally, autonomous autos,” Dan Hearsch, a managing director in AlixPartners’ automotive and industrial follow, stated in an announcement. “So, this actually is a important situation for the business.”

AlixPartners expects the most important influence to manufacturing within the second quarter after which progressively get higher through the second half of the yr and into 2022, Hearsch advised CNBC.

“By Q3, there’s sufficient to get all people again up and working for probably the most half,” he stated. “After which in This fall, we must always get buzzing once more after which subsequent yr get again to regular, hopefully.”

That does not imply provide constraints can be utterly solved subsequent yr, however Hearsch stated automakers ought to have sufficient semiconductors to provide as many autos as they need.

The worldwide automotive business is a particularly complicated system of shops, automakers and suppliers. The final group consists of bigger suppliers corresponding to Robert Bosch or Continental AG that supply chips for his or her merchandise from smaller, more-focused chip producers corresponding to Renesas or NXP Semiconductors.

A lot of the issue begins on the backside of the availability chain involving wafers. The wafers are used with the small semiconductor to create a chip that is then put into modules for issues like steering, brakes and infotainment methods.

The origin of the scarcity dates to early final yr when Covid precipitated rolling shutdowns of car meeting crops. Because the amenities closed, the wafer and chip suppliers diverted the elements to different sectors corresponding to shopper electronics, which weren’t anticipated to be as damage by stay-at-home orders.

Hearsch stated the highest precedence for corporations proper now’s “mitigating one of the best they’ll the short-term results of this disruption,” which can embrace all the pieces from renegotiating contracts to managing the expectations of lenders and traders.

Stellantis CEO Carlos Tavares stated the automaker, which was shaped in January by way of a merger between Fiat Chrysler and French automaker PSA Groupe, is not ruling out methods to be repaid by suppliers for the elements downside.

“It is too quickly to say. We do not know but the overall of the monetary influence … It is going to be huge,” he stated Wednesday through the through the Monetary Occasions Way forward for the Automobile Digital Summit. “But it surely’s clear that it is a aggressive recreation … we is not going to exclude that chance.”