(This story is a part of the Weekend Temporary version of the Night Temporary e-newsletter. To enroll in CNBC's Night Temporary, click on here.)Ent

(This story is a part of the Weekend Temporary version of the Night Temporary e-newsletter. To enroll in CNBC’s Night Temporary, click on here.)

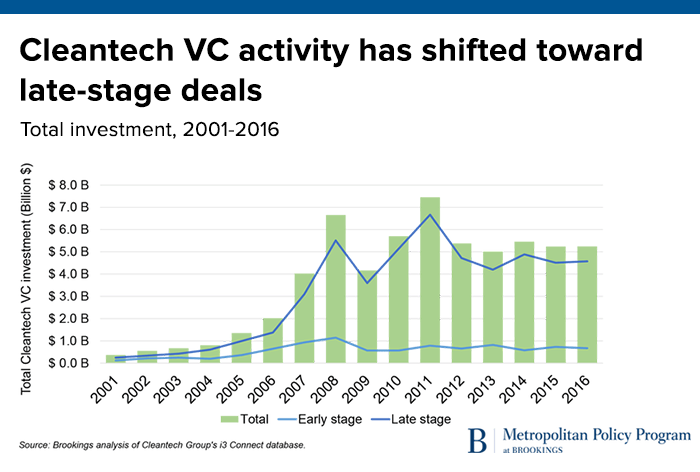

Enterprise capital funding for clear vitality expertise firms has declined after years of lackluster efficiency drove traders to different sectors. However a brand new fund is making a giant guess that it is attainable to again clear tech firms on the earliest — and sometimes riskiest — phases, all with out sacrificing returns.

In October, Clean Energy Ventures introduced that it raised $110 million for its first fund, which can goal “the present capital hole for seed and early-stage funding in promising superior vitality improvements,” a press release said.

The agency’s technique rests on the assumption that with out reinventing the wheel, and with out compromising returns, it will possibly determine and fund scalable, capital-efficient start-ups that can considerably scale back greenhouse gasoline emissions.

With this inflow of capital the fund’s three ideas, who between them have backed greater than 30 early-stage clear tech firms over their mixed 40-plus years of investing, wish to again firms in areas like vitality storage, grid connectivity and clear transportation.

“There is a valley of loss of life proper now. There’s a number of good expertise that is being constructed … however to get to a Collection A or Collection B it is a lengthy haul,” Clear Vitality…