As ride-hailing corporations Uber and Lyft rose to recognition and e-scooters popped up throughout main U.S. cities earlier this decade, business a

As ride-hailing corporations Uber and Lyft rose to recognition and e-scooters popped up throughout main U.S. cities earlier this decade, business analysts predicted the start of the top of automobile possession.

That meant “conventional” automakers akin to Basic Motors must evolve or die.

In an effort to spur its lagging inventory value and fight such exaggerated claims, GM made a collection of investments starting in 2016 that executives believed would place it as a “mobility” firm as a substitute of the growing older dinosaur Wall Road noticed. It began a shared mobility model known as Maven, launched a car subscription service, bought an autonomous car firm and even designed and developed e-bikes. It additionally took a 7.8% stake in Lyft.

A number of the offers briefly juiced the automaker’s share value. However the positive factors by no means lasted, and Wall Road has barely appeared to note as GM tosses a lot of these high-profile mobility initiatives apart.

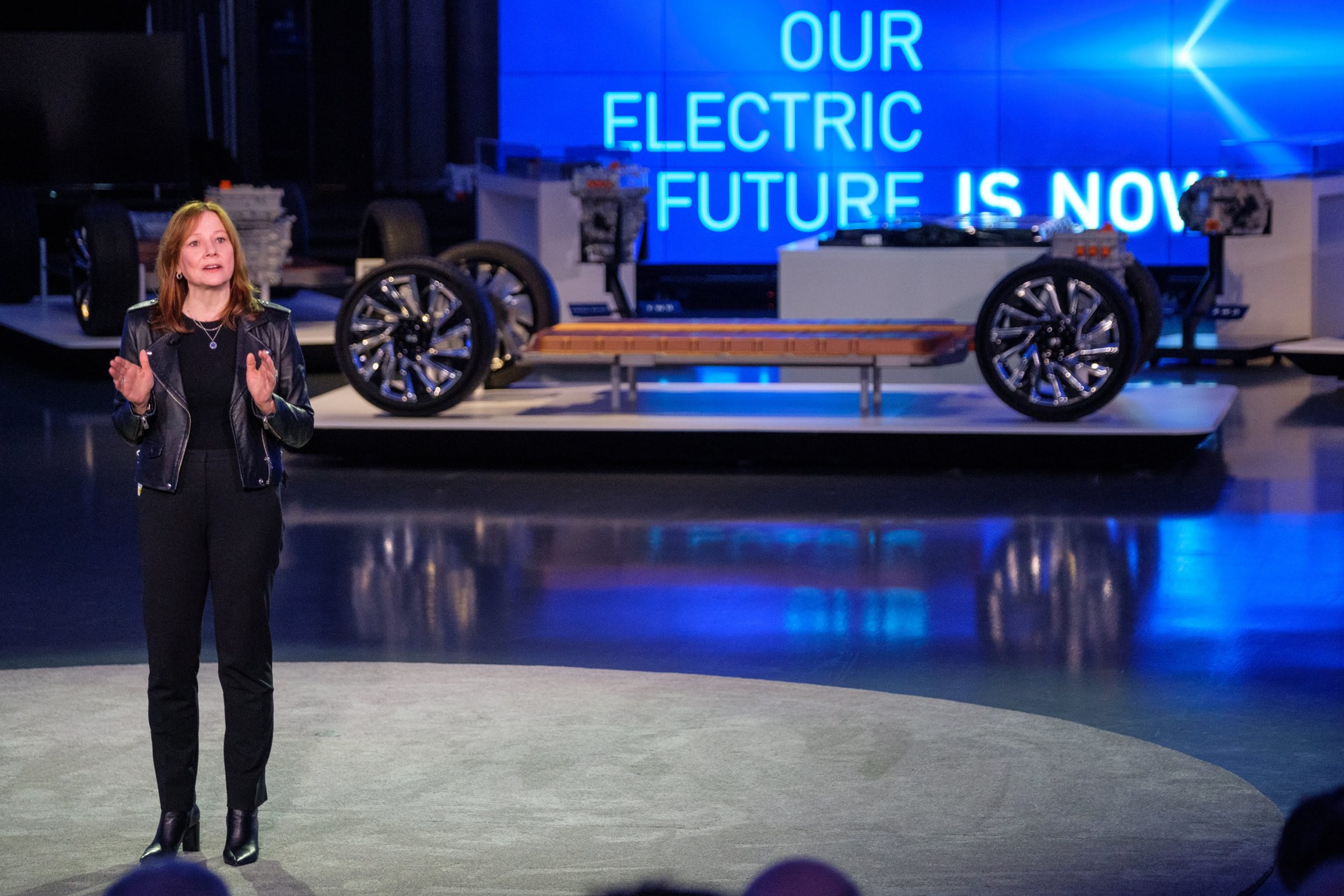

As an alternative, traders have been centered on the automaker’s leaner, extra environment friendly core enterprise operations – one thing executives akin to GM CEO Mary Barra and GM President Mark Reuss have touted for years within the firm’s shift to electrical and autonomous automobiles. It seems they only wanted a worldwide well being pandemic to show it. The place different automakers have struggled, GM has profitably navigated via the coronavirus pandemic thus far, and its traders have been rewarded.

“For a few years when individuals mentioned what’s it going to take to get the inventory transferring? Ultimately, I needed to say – it sounds perverse – however we’d really have to see a recession,” Morningstar’s David Whiston instructed CNBC. “Then GM can lastly show to the market that ‘Hey, all these years we now have been saying we’re not like ‘previous GM’ and we actually are totally different … now we now have an opportunity to show it.’ I believe they’ve proved it.”

Inventory rebounds

GM’s inventory hit an all-time low on March 18 after it briefly closed all U.S. factories as a result of coronavirus. The shares have since rallied because the automaker simply beat Wall Road’s earnings expectations within the second and third quarters. Bulletins round growing and accelerating its EV efforts, together with the GMC Hummer EV, have boosted the share value as properly.

“They’ve good fundamentals, upside in numbers but additionally what’s serving to is the EV narrative is accelerating,” Credit score Suisse analyst Dan Levy instructed CNBC. “General, a optimistic information cycle on their endeavors on this space, I believe, helps. It is a mixture of each of people who assist.”

Levy, who has an outperform ranking on GM, mentioned the automaker’s efficiency throughout the second quarter throughout the depths of the pandemic was strong proof of how its restructuring efforts would assist in a downturn – a serious argument of bears of Wall Road.

Shares of GM are up 157% since their low in March, together with an 18% bounce in November thus far. The inventory hit a brand new 52-week excessive Wednesday of $44.13 a share simply earlier than the automaker introduced it was upping its funding in electrical and autonomous automobiles by 35% to $27 billion via 2025.

Not everyone seems to be shopping for into GM although. CFRA Analysis has a “promote” ranking on the Detroit automaker largely based mostly on the price of switching its car fleet to all-electric and its means to compete in opposition to Tesla, which accounts for roughly three of each 4 EVs offered within the U.S.

“They’ve accomplished job slicing prices and now their top-line has actually improved from the depths of the place we had been 6 months in the past, in order that’s a optimistic, however we argue that the inventory’s additionally had an unbelievable rebound,” mentioned Garrett Nelson, senior fairness analyst at CFRA Analysis. “A whole lot of that, in our view, is already discounted within the present share value.

“Now, traders actually must weigh the truth of this pivot to electrical automobiles. It’ll be very troublesome we expect.”

Mobility efforts

GM is not absolutely conceding its mobility efforts however other than Cruise, they’ve taken a backseat to EVs and extra conventional (and worthwhile) enterprise akin to re-entering auto insurance coverage, which the automaker introduced earlier this week.

The coronavirus pandemic was the final nail within the coffin for its Maven mobility model, which the corporate has mentioned it “realized” quite a bit from however was by no means worthwhile. It was GM’s first important foray into the car-sharing and mobility house in 2016. After quickly increasing operations, together with the addition of peer-to-peer sharing of automobiles and as a fleet to Uber and Lyft, this system’s prominence pale.

The ARĪV Meld compact eBike from Basic Motors

GM

A less-known endeavor by GM to supply compact and foldable electrified bicycles known as Ariv additionally was eradicated throughout the coronavirus pandemic in April. Introduced in late-2018 as a “final mile” resolution for commuters — a priority cities and corporations have appeared to deal with in numerous methods for years.

Previous to the pandemic, the automaker introduced it might stop operations of its Guide by Cadillac car subscription program. The service primarily allowed for short-term leases of Cadillac’s total lineup with white-glove supply and pickup providers for a set value.

A brand new model of Guide by Cadillac was anticipated to launch earlier this 12 months, however GM says that was delayed as a result of coronavirus pandemic. An organization spokeswoman mentioned inner discussions about this system “are ongoing” however she declined to reveal when its launch could also be rescheduled.

The lone survivor of GM’s mobility efforts, Cruise, continues to work on the event and deployment of automotive automobiles, largely based mostly in California. After indefinitely delaying the launch of a robotaxi fleet final 12 months for San Francisco, the corporate not too long ago introduced a brand new partnership with Walmart in Arizona and was accredited to start testing unmanned autonomous automobiles in California.