Goldman Sachs has joined the flight of institutional traders from Fisher Investments.The large funding financial institution is pulling $234 millio

Goldman Sachs has joined the flight of institutional traders from Fisher Investments.

The large funding financial institution is pulling $234 million from Camas, Washington-based Fisher, in response to a supply near the matter.

Nevertheless, the top tally could possibly be even higher, a supply instructed CNBC.

Goldman Sachs and Fisher Investments each declined to remark.

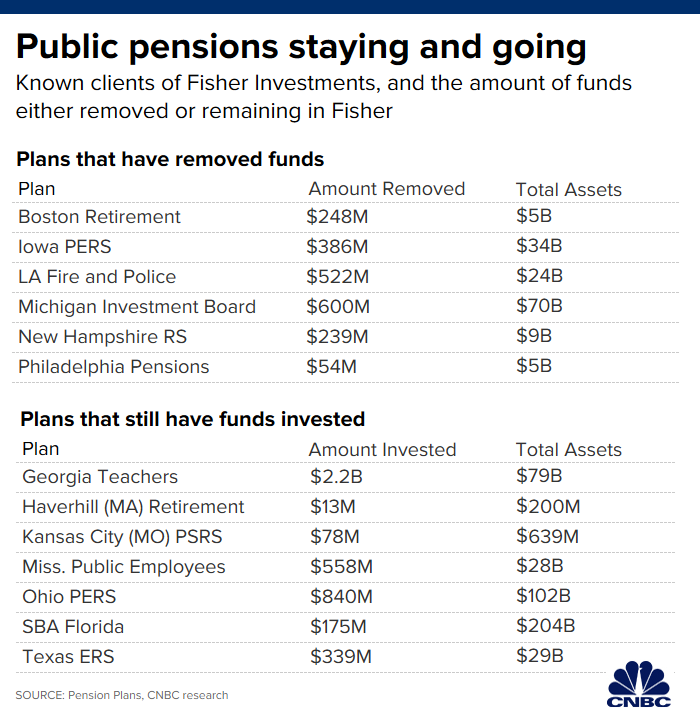

In all, institutional traders, together with Goldman, are withdrawing greater than $2.7 billion from Fisher Investments in gentle of Ken Fisher’s lewd feedback made at a convention on Oct. 8.

In the meantime on Thursday, the Los Angeles fireplace and police pension plan voted to fireplace Fisher, the place it held $522 million.

The Los Angeles pension has $24 billion in whole property.

The board of commissioners stated that they had invited Fisher himself to talk on the assembly, which was webcast live, however he didn’t attend.

“The one clarification is that Mr. Fisher was unable to attend and had enterprise within the workplace,” Ray Ciranna, basic supervisor of the Los Angeles Fireplace and Police Pension System, wrote in an electronic mail to CNBC.

In whole, Fisher Investments has misplaced greater than $2.7 billion in latest weeks as eight institutional purchasers — six of which have been authorities pensions — parted methods with the agency. Fisher had $94 billion in property below administration as of Dec. 31, 2018, in response to their SEC submitting.

That determine reached $112 billion as of…