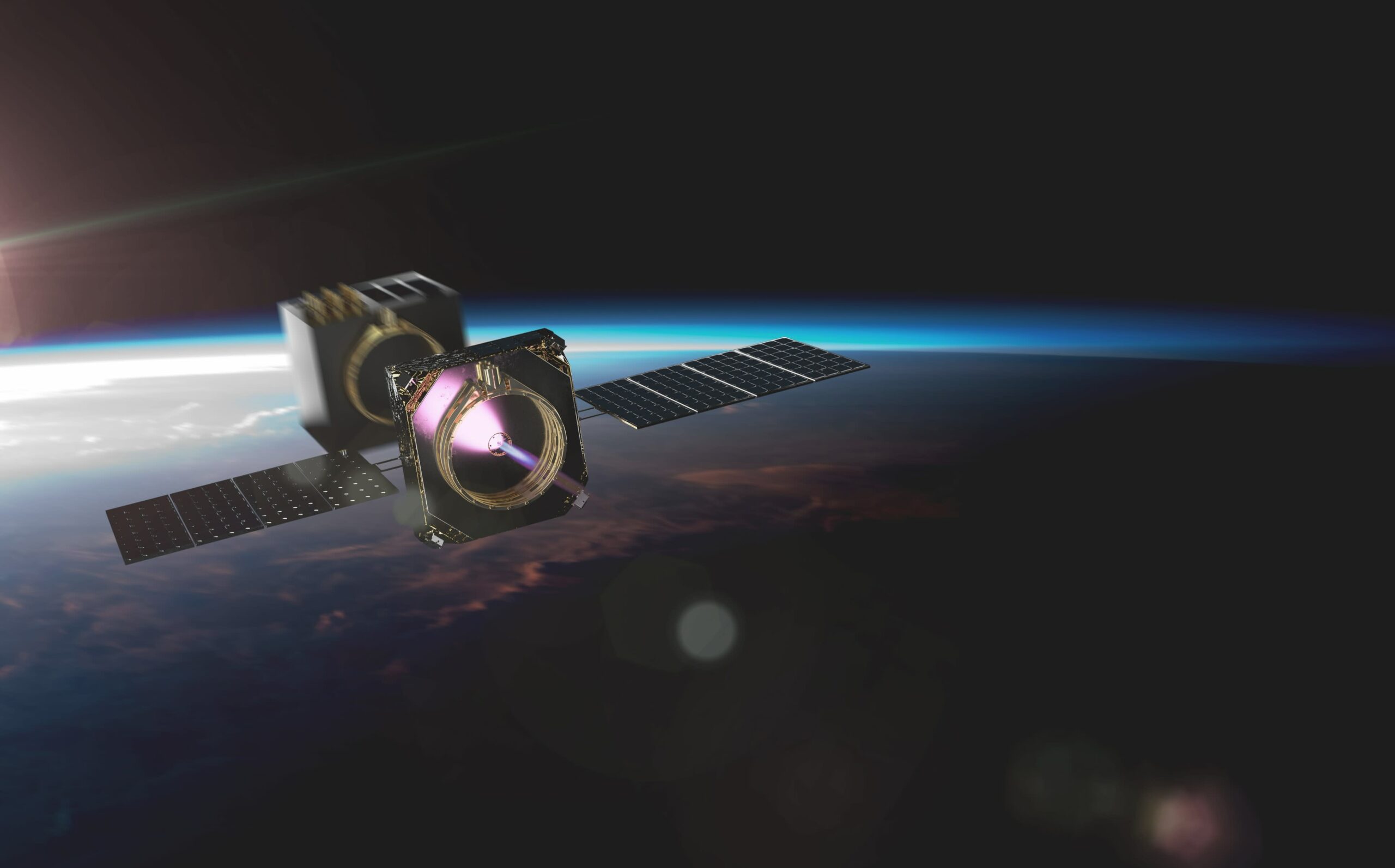

An artist's rendering of a Momentus Vigoride switch automobile deploying satellites in orbit.MomentusHouse firm Momentus debuted on the Nasdaq on F

An artist’s rendering of a Momentus Vigoride switch automobile deploying satellites in orbit.

Momentus

House firm Momentus debuted on the Nasdaq on Friday, finishing an almost year-long and turbulent merger course of that resulted in a brand new CEO and the departure of its founders.

“When it comes to worth for buyers, I believe we’re effectively positioned to satisfy some large market traits,” Momentus CEO John Rood, who started main the corporate on Aug. 1, instructed CNBC. “There’s a want for what we offer.”

Momentus inventory dropped as a lot as 9% in buying and selling from its earlier shut of $10.97 a share.

The corporate this week accomplished its merger with Steady Highway Capital, a particular goal acquisition firm, or SPAC. A SPAC raises cash from buyers by way of an preliminary public providing after which makes use of the money to amass a personal firm and take it public.

Momentus’ highway to the general public market has been embattled on a number of fronts, with missions now delayed to mid-2022 on the earliest. Nationwide safety issues about its Russian co-founders, former CEO Mikhail Kokorich and Lev Khasis, led to each promoting their stakes – in alternate for “roughly $40 million,” Rood mentioned – and leaving the corporate.

Momentus’ valuation was then lower in half, from $1.1 billion to $567 million. After which, final month, the agency and Steady Highway settled fees from the Securities and Trade Fee that the businesses misled buyers and falsified the outcomes from a 2019 prototype spacecraft take a look at, paying about $eight million in civil penalties.

The corporate was anticipating to have $310 million on its books to develop after the SPAC merger, however its revised settlement with Steady Highway diminished that money to about $150 million “to fund our operations,” Rood mentioned.

“We expect that offers us ample runway to go do our extra improvement work, to employees up, and among the different issues that we have to do,” Rood mentioned.

Rood described Momentus as an “early stage expertise firm,” as it’s now testing a brand new variation of its water-based plasma engines, referred to as the Microwave Electrothermal Thruster. The corporate instructed CNBC that its longest single firing of one in every of these engines throughout floor testing was 9.7 hours in a vacuum chamber, “considerably longer than what we anticipate requiring for any single firing on-orbit.”

The thruster is crucial to Momentus’ marketing strategy, which contain delivering satellites from rockets to particular orbits utilizing a spacecraft referred to as Vigoride. The spacecraft consists of a body, an engine, photo voltaic panels, avionics and a set of satellite tv for pc deployers and is particularly designed for satellites that hitch a journey on massive rockets, an more and more common trade observe referred to as ridesharing.

The corporate had deliberate to launch its first Vigoride mission earlier this 12 months, however the ongoing nationwide safety evaluation led to the spacecraft’s elimination from SpaceX rideshare launches. The delay has additionally led to Momentus dropping clients, with its backlog of contracts dropping to $66 million from $90 million.

Kokorich

Former CEO Kokorich has reportedly left the nation, and has not settled the SEC’s fees towards him.

“We haven’t any enterprise dealings with Mikhail Kokorich or the opposite founders of the corporate. In truth, our nationwide safety settlement with the Protection Division prohibits that,” Rood mentioned.

Requested whether or not Momentus or any of its group are speaking with Kokorich since he left, Rood mentioned the conversations should not in knowledgeable or technological capability.

“If they’re [talking to Kokorich], it is of a social nature and we’re required to log it,” Rood mentioned.

Trying forward

An artist’s rendering of a Momentus Vigoride switch automobile deploying a satellite tv for pc in orbit.

Momentus

Whereas Momentus has overhauled its monetary forecasts, the corporate nonetheless has an formidable goal of greater than $2 billion in income by 2027. The corporate booked no income final 12 months, expects the identical this 12 months, and simply $5 million in 2022.

The corporate expects to be worthwhile on an EBITDA foundation by 2024, a objective that may require Momentus fly 26 missions that 12 months. Rood mentioned Momentus – whereas it really works to resolve the Pentagon’s issues and purchase a launch license – has constructed two Vigoride spacecraft and can work on extra because it finishes testing.

“We’re within the technique of assembling and testing and qualifying extra Vigoride automobiles,” Rood mentioned.

Momentus’ early missions will operate as each exams of Vigoride and carrying paying clients’ satellites, he famous. The corporate is discounting its pricing for these clients.

“We are attempting to make it extra enticing for purchasers early on,” Rood mentioned.

A further key to Momentus’ success is the provision and value of launches, with the previous having steadily elevated and the latter decreased in recent times – largely because of the rideshare launches Elon Musk’s SpaceX is providing on its Falcon 9 rockets.

“We now have an settlement with SpaceX and we’re on the stage … the place we are able to get the inexperienced mild from the federal authorities for our launch licenses, then we’ll be capable of guide a manifest on a SpaceX rocket and go along with them,” Rood mentioned.

Its partnership with SpaceX is “very useful and one thing that we prize,” Rood added. However Momentus can’t be depending on only one technique of attending to house, so Vigoride is designed to be “launch automobile agnostic,” Rood mentioned, and “there are different suppliers that we’re speaking to.”

Turn into a wiser investor with CNBC Professional.

Get inventory picks, analyst calls, unique interviews and entry to CNBC TV.

Signal as much as begin a free trial as we speak.