In case you're hoping to attain a great deal on a brand new automotive throughout July Fourth gross sales occasions, it is going to be a blended b

In case you’re hoping to attain a great deal on a brand new automotive throughout July Fourth gross sales occasions, it is going to be a blended bag.

Whereas producers and dealerships are providing particular offers on some fashions to prop up gross sales amid the pandemic, stock is down resulting from coronavirus-related disruptions in manufacturing.

“We have seen incentives proceed to maneuver up throughout the trade in latest weeks, even if stock is falling,” mentioned Kelsey Mays, senior client affairs editor of Vehicles.com.

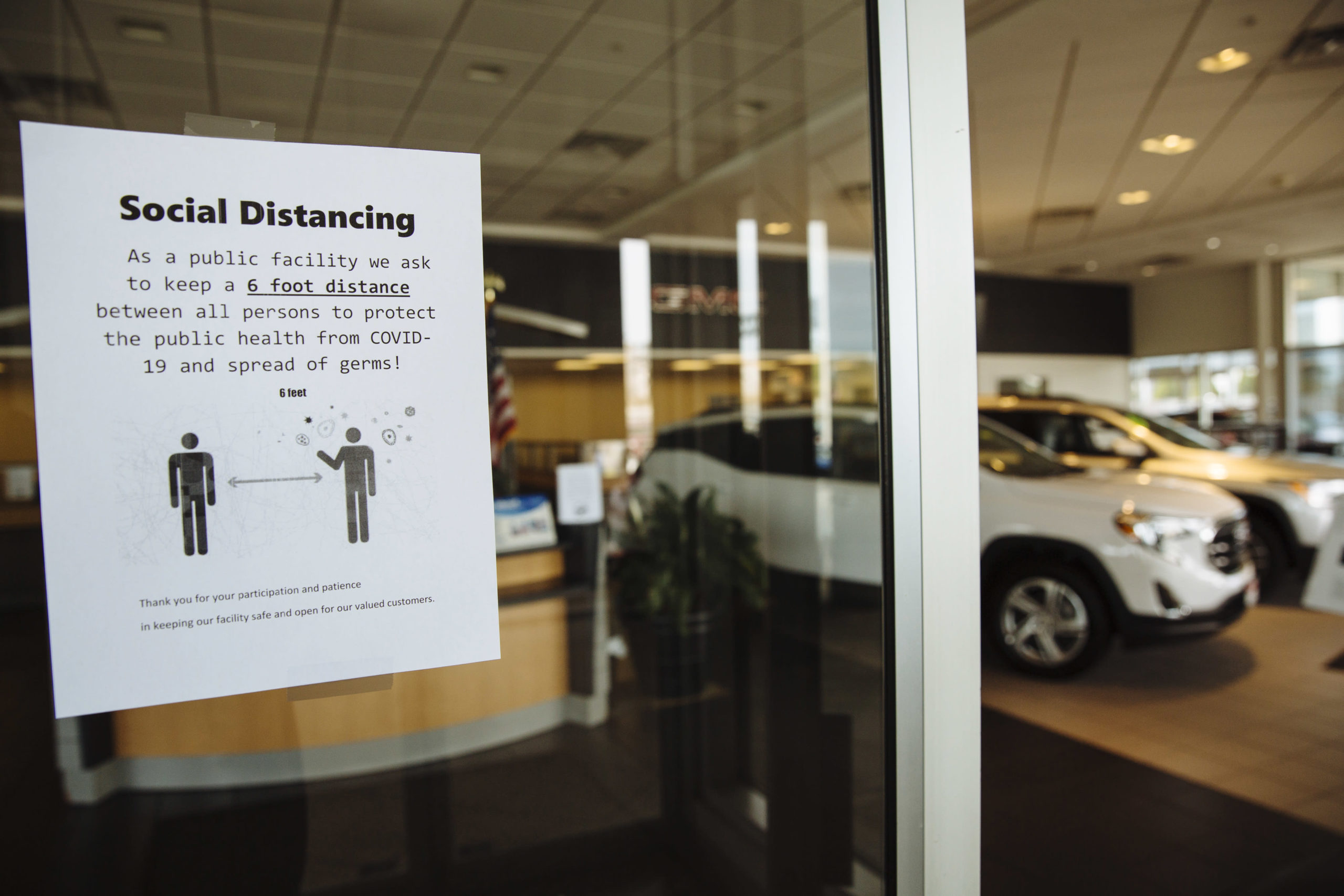

An indication advising prospects to observe social distancing is displayed on the door of a Normal Motors Co. Buick and GMC automotive dealership in Woodbridge, New Jersey, on Could 20.

Angus Mordant | Bloomberg | Getty Photographs

New-car stock at the start of June was down by a 3rd, in comparison with the identical time final 12 months, in keeping with analysis from Edmunds.com. On the similar time, June auto gross sales climbed about 3.3% from Could, though they’re down by 30% in comparison with a 12 months earlier, in keeping with estimates from Cox Automotive.

“Folks will nonetheless see offers … however we will all be very particular about what we would like — the colour, the choices — and that is tougher to search out for lots of vehicles,” mentioned Jessica Caldwell, government director of insights at Edmunds.

“New automotive gross sales haven’t been nice all through the pandemic, however fairly first rate, and a few sellers are operating out of stock,” Caldwell mentioned.

Amongst customers planning to purchase over the Fourth of July weekend, 69% plan to buy a brand new automotive, in keeping with a Vehicles.com survey completed in June. One other 23% mentioned they’d purchase a used automotive (together with licensed pre-owned) and eight% have been undecided.

Consumers also needs to be ready for a unique shopping for expertise.

In a enterprise identified for its private interplay, the pandemic compelled many dealerships to maneuver a lot of the method on-line in March and April amid shutdowns and stay-at-home orders.

“We have seen 50% of sellers and 70% of stock on Vehicles.com offered as digital gross sales with a house supply and digital appointment,” Mays mentioned. “In lots of instances, the paperwork may be signed on-line, however it is determined by the placement.”

Even when the dealership is open, they do not need swarms of individuals there.

Jessica Caldwell

Government director of insights at Edmunds

And whereas many dealerships have re-opened their showrooms as native rules have permitted, it is price calling forward if you wish to go there as a result of you could have to schedule an appointment.

“Even when the dealership is open, they do not need swarms of individuals,” Caldwell mentioned.

As for offers, it would depend upon the producer and mannequin. Nissan, as an example, is providing $6,000 off sure variations of its Murano, a crossover SUV with a beginning value of $31,530. The 2020 Ram 1500, a full-size truck with an asking value of $32,145, comes with as much as $6,300 off on sure fashions. Within the sedan class, the low cost on the Ford Fusion (beginning value of $23,170) is $2,500.

You additionally might be able to rating a great financing deal. Whereas the common annual proportion fee on new-car loans is 4.2%, customers with nice credit score may get a 0% fee. In June, these offers constituted 19.4% of all new financed offers, in keeping with Edmunds.

A few of these loans stretch for as a lot as seven years, which may put consumers in a tough state of affairs down the highway in the event that they find yourself desirous to promote or commerce within the automotive and owe greater than it is price — i.e., having so-called unfavorable fairness.

“At 0% financing, a six- or seven-year mortgage may make sense for a accountable purchaser,” Caldwell mentioned. “However for a lot of Individuals, counting on longer mortgage phrases to justify their greater car purchases may put them at higher danger for unfavorable fairness sooner or later.”

The share of recent gross sales with a trade-in involving unfavorable fairness was 44% in April, up from under 35% a 12 months earlier, Edmunds analysis reveals. The common quantity of unfavorable fairness was $5,571.

Extra from Spend money on You:

The right way to ace your video interview and get the job provide

Want cash? Discover money in these surprising locations

Enjoyable cash classes on your youngsters this summer season

Auto lenders additionally seem like tightening credit score. Caldwell mentioned that the share of individuals paying 10% or extra on their loans — usually those that are much less credit-worthy — is dropping.

“That claims to me they’re both getting denied the acquisition, or there are much less of us in that class which can be making an attempt to purchase a automotive,” Caldwell mentioned.

Additionally, be sure to evaluate dealerships. Whereas all of them usually provide the producer’s low cost, one might offer you a greater deal on a trade-in, a decrease rate of interest in your mortgage or another perk.

Even as soon as you discover the most effective deal, Mays mentioned, there’s one other quantity that you need to give attention to: the “out-the-door” value.

“That quantity contains all taxes and charges and you need to negotiate that quantity,” he mentioned.

SIGN UP: Cash 101 is an 8-week studying course to monetary freedom, delivered weekly to your inbox.

CHECK OUT: 23-year-old CEO: How I made a dorm room aspect hustle right into a enterprise bringing in $1 million through Develop with Acorns+CNBC.

Disclosure: NBCUniversal and Comcast Ventures are traders in Acorns.