New Hampshire is ordering Merrill Lynch to pay $26.25 million in fines and restitution to the state and to an investor, the previous Governor of Ne

New Hampshire is ordering Merrill Lynch to pay $26.25 million in fines and restitution to the state and to an investor, the previous Governor of New Hampshire, who claimed he suffered losses by the hands of a former Boston-based dealer, to settle allegations together with unauthorized and extreme buying and selling.

It’s the largest financial sanction within the state’s historical past and the second largest FINRA settlement in at the very least a decade.

Merrill Lynch, which is a subsidiary of Financial institution of America, was additionally cited for failure to oversee and ordered to take care of compliance undertakings particularly put in place to deal with the compliance failures uncovered by New Hampshire’s investigation.

Individually, the state securities regulator has completely barred former Merrill Lynch dealer, Charles Kenahan, from the securities enterprise in New Hampshire.

The state’s investigation discovered that Kenahan “traded with out authorization, mismarked commerce confirmations, excessively traded shares and Preliminary Public Choices, over charged commissions, and inappropriately traded inverse and leveraged merchandise,” in accordance with the press launch on Monday.

The misconduct, in accordance with the state regulator, “result in excessive commissions for Merrill Lynch and Kenahan and heavy losses for the investor.”

“This case is about an abuse of belief dedicated by Merrill Lynch and Kenahan,” Jeff Spill, the deputy director and head of enforcement for New Hampshire’s Bureau of Securities Regulation, mentioned. “Finally, Kenahan’s suggestions benefited Kenahan and Merrill Lynch and never the investor,” Spill mentioned.

“We’ve got enhanced our insurance policies and monitoring techniques during the last a number of years to extra carefully monitor sure forms of consumer account exercise,” a spokesman for Merrill Lynch mentioned in an e mail to CNBC.

CNBC first reported in July that New Hampshire state authorities have been investigating the Boston-based Merrill Lynch and at the very least one former prime dealer over buyer complaints of alleged misconduct that resulted in staggering losses. At the moment, the state regulator had approached Merrill Lynch with its findings and settlement talks have been underway.

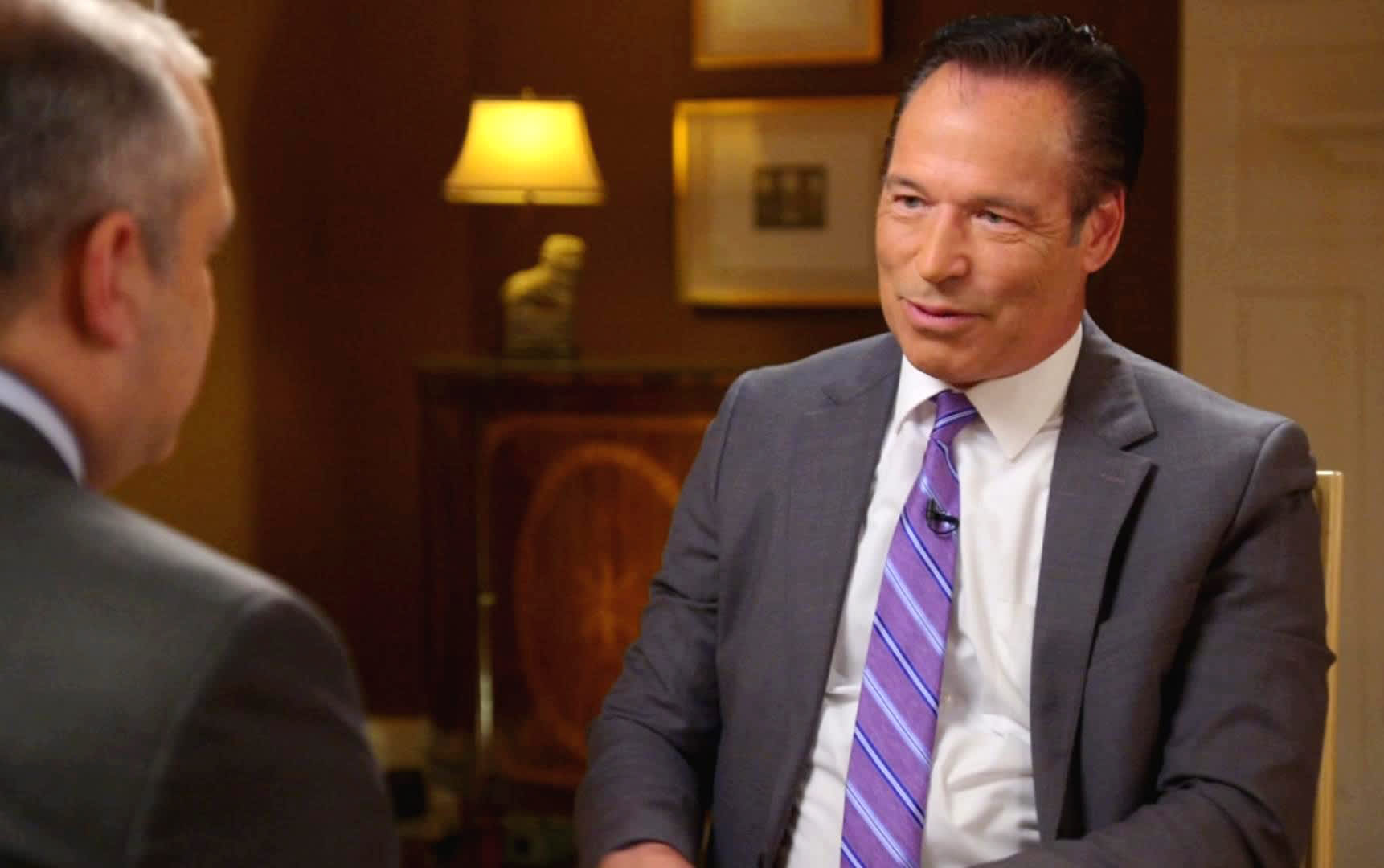

Craig Benson, the previous Governor of New Hampshire, in a sit-down interview with CNBC’s Scott Cohn in December 2019.

CNBC

Beneath the settlement phrases, the state will obtain $2 million, whereas “Investor #1” will obtain $24.25 million.

“Investor #1” is Craig Benson, the previous governor of New Hampshire, in accordance with sources aware of the settlement who couldn’t be named as a result of nature of the non-disclosure settlement.

Benson’s legal professional declined to remark saying “the events of the settlement settlement can’t touch upon the settlement.”

Craig Benson, the previous Governor of New Hampshire, in a sit-down interview with CNBC’s Scott Cohn in December 2019.

CNBC

In CNBC’s unique investigation, Benson mentioned he had alerted the state securities regulator after he filed a FINRA arbitration declare in opposition to Merrill Lynch and two of the agency’s former brokers, Kenahan and Dermod Cavanaugh. The allegations included extreme buying and selling, unauthorized buying and selling, overcharging commissions, failure to oversee and breach of fiduciary obligation.

Benson alleged in his declare that the widespread misconduct resulted in losses of greater than $50 million and market-adjusted damages of over $100 million.

“I definitely did not signal a doc and say it is OK to steal from me,” Benson instructed CNBC. “This can be a combat I by no means selected,” he mentioned.

Second Largest FINRA Settlement

The settlement with New Hampshire securities regulators will even resolve Benson’s pending FINRA arbitration case which was filed in February 2019.

FINRA’s BrokerCheck system knowledge signifies that the $24.25 million settlement is the second largest involving a person claimant out of over 29,000 within the final decade, in accordance with Craig McCann, the founder and principal of Securities Litigation and Consulting Group.

The most important settlement was additionally made by Merrill Lynch, when the agency paid out $40 million to Robert Levine, who co-founded Cabletron Techniques with Benson within the early 1980s. Previous to the settlement, Levine had filed a FINRA arbitration grievance in opposition to Merrill Lynch and Kenahan alleging he had sustained damages of greater than $100 million resulting from, amongst different issues, his accounts being relentlessly churned.

Bob Levine (L) and Craig Benson (R) co-founders of Cabletron Techniques

Supply: Cabletron Techniques

In 2019, after the case went to a ultimate listening to in entrance of an arbitration panel, however earlier than that panel introduced its determination, Merrill Lynch determined to settle with Levine.

Kenahan was fired by Merrill Lynch in July 2019, following Levine’s ultimate FINRA arbitration listening to, citing “clients’ allegations of unauthorized buying and selling, unsuitable funding suggestions and extreme buying and selling,” his BrokerCheck report exhibits.

Kenahan’s legal professional declined to remark. Nevertheless, Kenahan’s BrokerCheck report does embody his feedback on the matter. That part states that “the transactions giving rise to the shoppers’ allegations have been executed on the clients’ route. The allegations resulted in arbitrations and settlements. I used to be not a celebration to the arbitrations; I had no say within the agency’s determination to settle the claims; and I used to be not requested to make any cost as a part of the settlements.”

Extra Reporting: Louise Connelly

Please e mail tricks to [email protected].