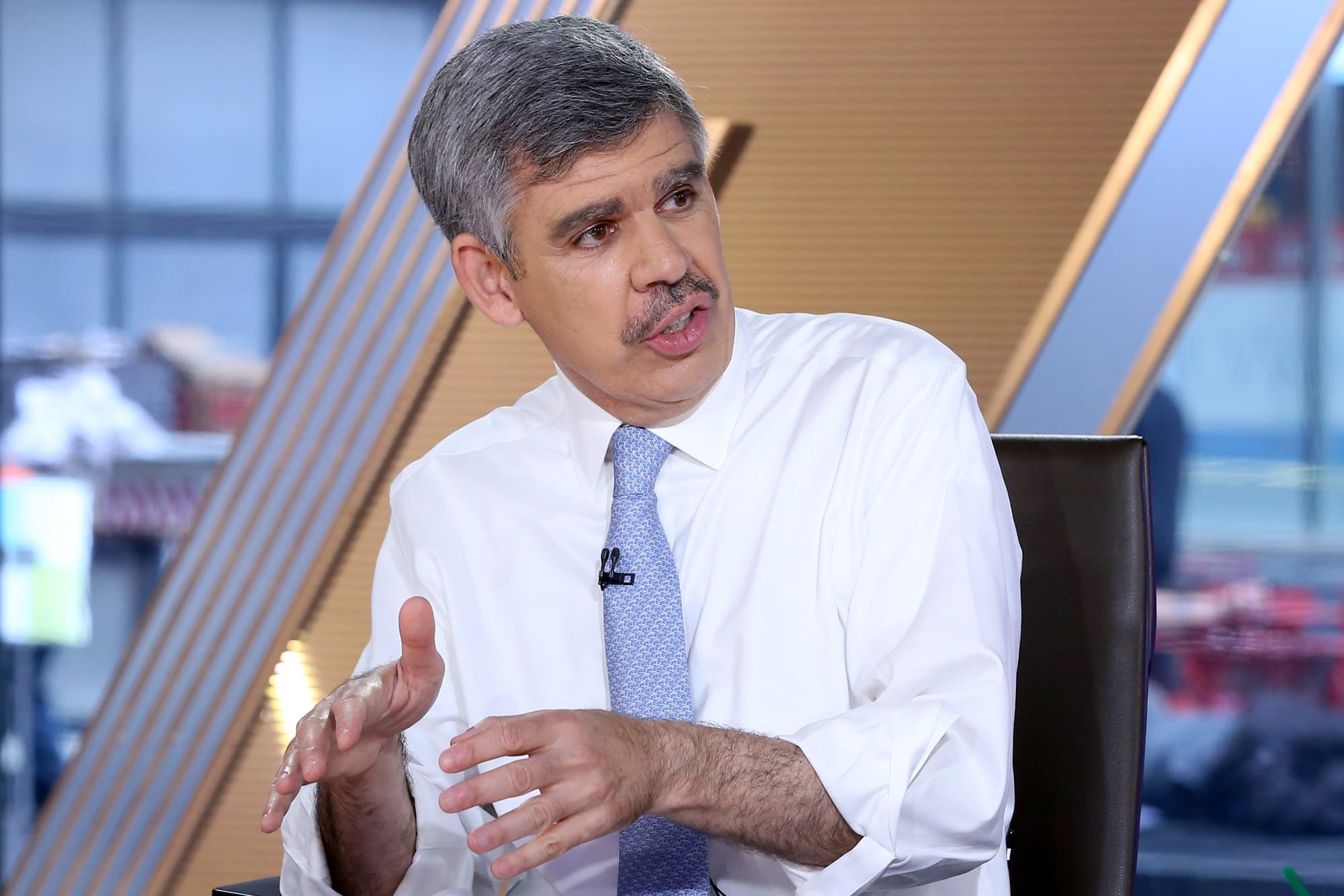

Mohamed El-Erian, who in early March appropriately referred to as a coronavirus-driven bear market, instructed CNBC on Monday he is reluctant to pu

Mohamed El-Erian, who in early March appropriately referred to as a coronavirus-driven bear market, instructed CNBC on Monday he is reluctant to purchase the most recent inventory rally.

“For me personally, it is an uncomfortable wager to proceed to wager on an enormous restoration,” the chief financial advisor at Allianz mentioned on “Squawk Field.” “I do not like doing this. However I respect and admire those that can.”

Dow futures have been pointing to a rally at Monday’s open, constructing on Friday’s 3.1% surge. The Nasdaq rose 2%, hitting an all-time intraday excessive however closing shy of February’s report. From their March 23 lows, the Dow Jones Industrial Common and Nasdaq have been every up 48%. Nevertheless, the Dow was nonetheless greater than 8% away from its report in February.

Wall Avenue continues to consider in an financial restoration as states enter numerous phases of reopening. New York Metropolis shifts into part one of many state’s coronavirus reopening plan Monday, permitting extra companies to renew operations, together with development, manufacturing and curbside-pickup retail.

El-Erian mentioned the choice on whether or not to purchase into this market energy depends upon numerous elements dealing with every investor and their tolerance for threat. “I’ve received to emphasize, it is a very private selection. How else are you uncovered? Are you structurally uncovered to the market? Must you even be tactically uncovered to the market?”

Cash additionally retains pouring into shares on the again of the Federal Reserve’s huge financial stimulus, together with open-ended asset shopping for and near-zero rates of interest. The Fed begins its two-day June assembly on Tuesday.

“The narrative has been win-win” within the inventory market, El-Erian mentioned. “You win when you look by means of all of the dangerous knowledge and wager on an enormous restoration. And you continue to win as a result of the Fed will help you on a regular basis. That narrative is so deeply embedded now that it takes a serious shock to vary it.”