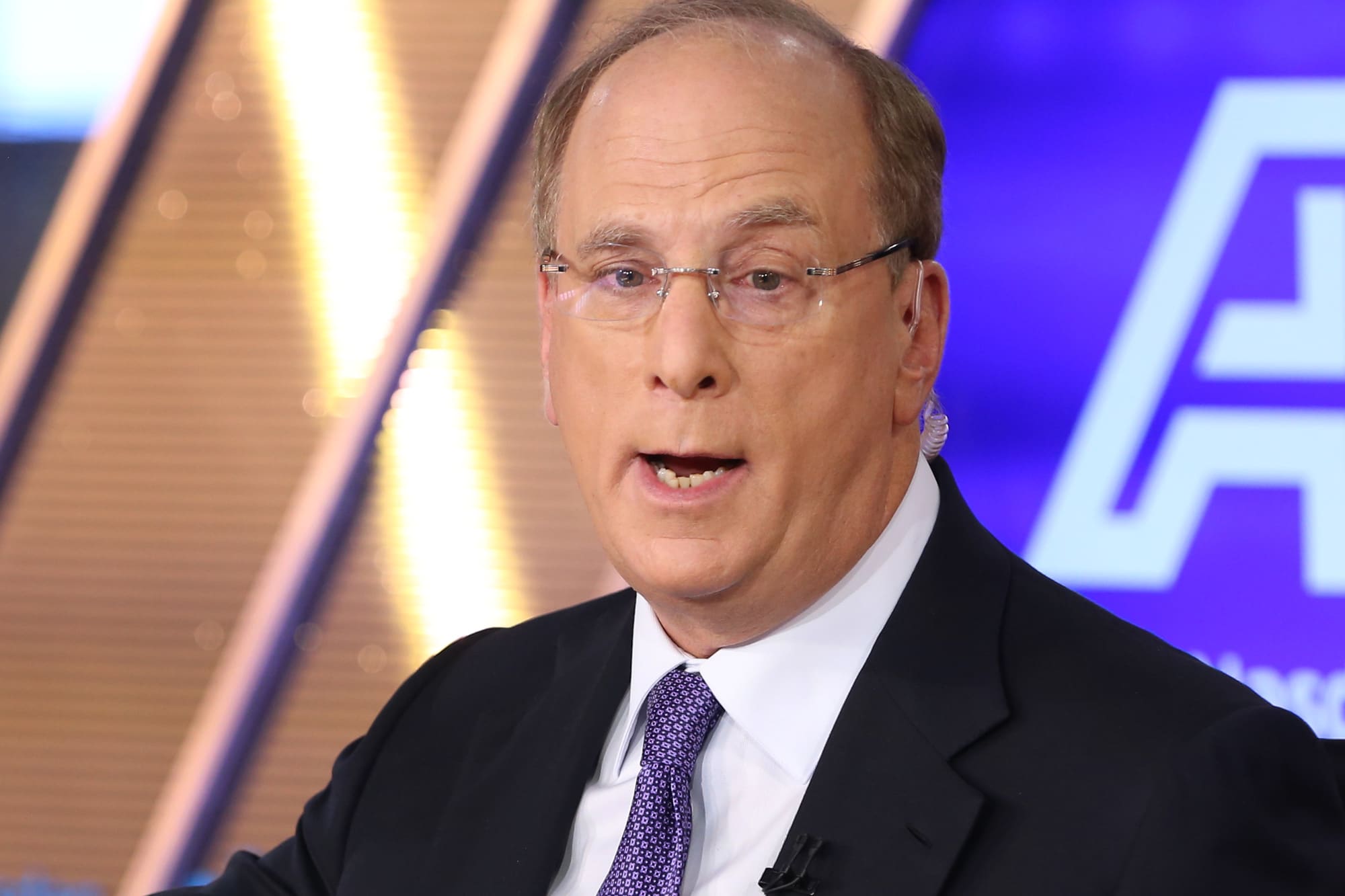

BlackRock CEO Larry Fink advised CNBC on Thursday that the world's largest cash supervisor has extra discussions with its institutional shoppers on

BlackRock CEO Larry Fink advised CNBC on Thursday that the world’s largest cash supervisor has extra discussions with its institutional shoppers on points round local weather change and inflation than it does on cryptocurrencies.

“Our broad-based consumer relationships, we have had little or no interconnectivity on the dialog on crypto apart from a fascination,” Fink mentioned in a “Squawk Field” interview.

The BlackRock co-founder and chairman believes crypto can “develop into an awesome asset class,” acknowledging his agency made some strikes into bitcoin.

“We’re finding out it,” Fink mentioned. “We make cash on it, however I am not right here to inform you that we’re seeing broad-based curiosity by establishments worldwide.”

“Perhaps they’re speaking to anyone else, so I do not wish to counsel that we have now good data,” he added, shortly after BlackRock reported better-than-expected earnings and a file $9 trillion in belongings underneath administration.

The value of bitcoin has soared since final yr, buying and selling above $62,000 per coin Thursday morning. As just lately as October, the world’s largest cryptocurrency by market worth traded beneath $11,000.

Institutional adoption of bitcoin has been cited as one issue propelling the rise. Firms comparable to Tesla have used money on the stability sheet to purchase bitcoin, and Wall Road corporations Morgan Stanley and Goldman Sachs have individually introduced intentions to supply their wealth administration shoppers publicity to bitcoin.

For BlackRock’s institutional shoppers particularly, Fink mentioned different matters rank increased on the checklist of concern than digital belongings.

“The quantity of dialog we’re having on local weather danger and the way they need to navigate portfolios is a serious element of the dialog,” mentioned Fink, who has develop into a number one voice on Wall Road round local weather change and sustainable investing. “The conversations about our [budget] deficits and … on inflation danger is much extra dominant with our shoppers worldwide than the entire dialog about crypto.”

Chris Ailman, chief funding officer of CalSTRS, advised CNBC later Thursday that local weather change “dominated” his current dialog with Fink.

“I had an opportunity to speak to Larry straight only a week in the past,” Ailman mentioned on “Squawk on the Road.” “We did not speak loads about crypto, however it’s on the analysis block for many establishments. A couple of of the endowments within the USA have dabbled in it, however proper now it is all hypothesis.”

Whereas saying he believes crypto is “right here to say,” Ailman contended that it is too early to inform whether or not it represents a wholly new asset class.

“Folks have not actually determined as a result of we do not have lengthy of a buying and selling historical past. All we have now is a speculative ramp up and down after which again up once more,” he mentioned. “Long run, it in all probability has an fascinating place within the forex markets. It might be an asset class. I believe it is extra prone to be another forex.”

CalSTRS, which stands for California State Academics’ Retirement System, is the world’s largest educator-only pension fund.

The feedback Thursday from Fink and Ailman got here sooner or later after the biggest cryptocurrency change within the U.S., Coinbase, went public on the Nasdaq. Coinbase’s direct itemizing was heralded as the most recent milestone within the rising acceptance of cryptocurrencies as an asset class. Coinbase completed Wednesday’s session with a market cap of almost $86 billion.

Fink additionally advised CNBC he is “extremely bullish” on the inventory market proper now. “I imagine due to financial stimulus, fiscal stimulus, the money on the sidelines, earnings, the markets are OK. Markets are going to proceed to be stronger,” he mentioned.