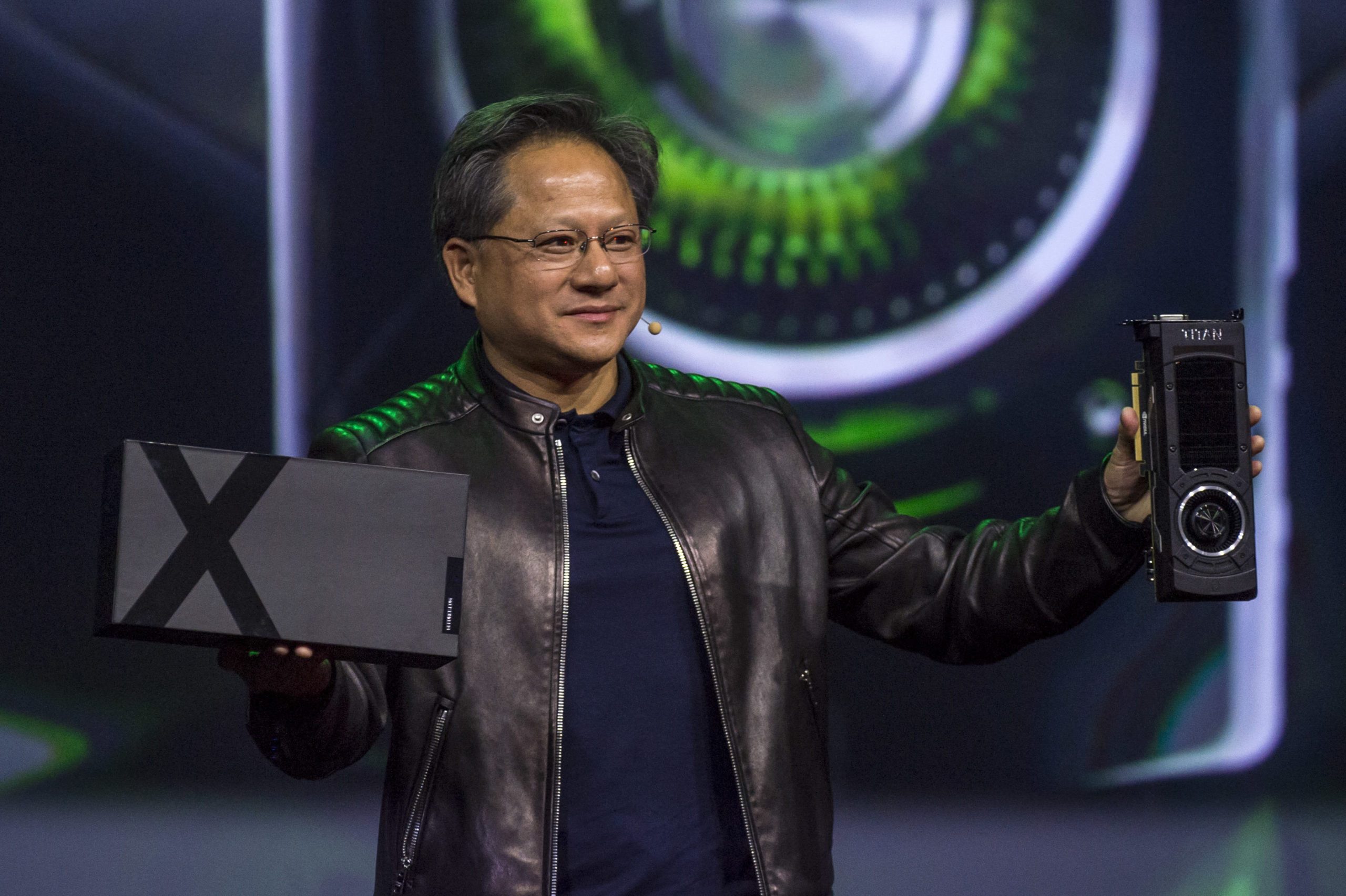

Jen-Hsun Huang, chief govt officer of Nvidia Corp., holds up a Titan C CPU and GeForce GTX Titan X graphics card .David Paul Morris | Bloomberg | G

Jen-Hsun Huang, chief govt officer of Nvidia Corp., holds up a Titan C CPU and GeForce GTX Titan X graphics card .

David Paul Morris | Bloomberg | Getty Photographs

Shares have delivered very spectacular positive factors just lately. Certainly, indexes are circling document ranges, boosted by robust second quarter incomes stories and reopening optimism. That is regardless of financial decline and rising jobless claims because the fallout from the coronavirus pandemic continues.

For traders, the hot button is to give attention to shares which are set to ship robust progress in increasing markets. Right here we have a look at six shares that just do that- and what’s extra, all these shares have obtained bullish calls from the Road’s prime analysts over the past week.

TipRanks analyst forecasting service makes an attempt to pinpoint Wall Road’s best-performing analysts- so traders can observe the suggestions of analysts that are likely to get it proper. These are the analysts with the very best success fee and common return measured on a one-year foundation — factoring within the variety of rankings made by every analyst.

Listed here are the best-performing analysts’ six favourite shares proper now:

Amazon

5-star Needham analyst Laura Martin has simply reiterated her Amazon purchase ranking with a bullish inventory worth forecast of $3,700. She made the transfer after taking a deep dive into the corporate’s Amazon Prime and Prime Video companies.

“We calculate that Amazon Prime is value almost $200B, or 12% of AMZN whole EV. Stand alone, we calculate that Prime Video is value almost $40B, or about 2% of AMZN’s whole EV, primarily based on NFLX present per sub valuations” the analyst instructed traders on August 17.

Martin highlights greater than a dozen impartial knowledge suppliers’ Could, June and July knowledge factors that display accelerating shopper adoption of streaming services- like Amazon’s Prime Video.

Certainly, coronavirus shelter-at-home orders, shuttered cinemas, no dwell sports activities, and detrimental subjects dominating the information cycle have all boosted streaming demand, says the analyst.

And in contrast to Netflix, Prime Video advantages from its tie-in with different Prime services- bringing new subscribers and decreasing churn. The analyst cites a Diffusion group survey which discovered that 80% of subscribers pay for Prime primarily at no cost delivery, whereas the remaining 20% pay primarily for its media belongings.

In keeping with TipRanks, Martin is ranked at a powerful #94 out of just about 6,900 analysts, with a 20.1% common return per ranking.

Regeneron

Regeneron is at present growing a promising antibody cocktail in opposition to coronavirus. REGN-COV2 might assist deal with individuals already experiencing coronavirus symptoms- and forestall an infection in individuals uncovered to the virus.

“We’re excited concerning the potential for one drugs to serve each as a therapy for these contaminated in addition to safety for individuals uncovered to the virus. REGN-COV2 may very well be a important line of protection in opposition to the COVID-19 pandemic,” Invoice Anderson, CEO of Roche acknowledged on August 19.

Following a name with Regeneron administration, prime Oppenheimer analyst Hartaj Singh reiterated his purchase REGN purchase ranking with a $725 worth goal. “We keep bullish and examine REGN as a core holding” the analyst wrote.

He notes that REGN is working the REGN-COV2 trials in a full spectrum of sufferers (preventative, hospitalized, and many others.), testing numerous doses, and dealing with different corporations to scale manufacturing and dealing on future accounting therapy, pricing, and distribution.

Regeneron’s pipeline can also be progressing effectively, says Singh, with Dupixent in persistent obstructive pulmonary illness (COPD) and oncology among the many standouts. “REGN is on the cusp of robust 20/21 gross sales progress,” Singh instructed traders on August 17.

Nvidia

Financial institution of American analyst Vivek Arya has simply reiterated his ‘Prime Decide’ standing on chip inventory Nvidia following stellar incomes outcomes. He additionally ramped up his inventory worth forecast from $520 to a Road-high $600 (24% upside potential).

“Stable beat/elevate, with ~30% YoY gross sales, ~50% YoY pf-EPS natural progress and importantly, 38% FCF margins which are best-in-class in not simply large-cap semis but additionally seemingly in all-tech” cheered the analyst on August 19.

In the meantime, NVDA’s developer base crossed 2 million, with the second million coming in simply the final two years, 5x sooner than the primary.

Wanting ahead, Arya sees continued secular momentum with new product cycles (subsequent gen 7nm Ampere launch) and restoration in cyclical autos offsetting a probably ‘lumpy’ knowledge middle enterprise.

“Greater image, we consider NVDA has an unassailable {hardware} / software program / developer lead in among the largest and quickest rising markets in semis/tech (AI, Gaming, Autonomous), all derived from a standard structure” the analyst tells traders.

He believes this could probably drive gross sales at 20% and EPS at a 25% tempo to go in the direction of $22/ share by CY24E. In keeping with Arya, this now paints a state of affairs for the world’s first $0.5 trillion market cap chip vendor.

Because of his robust inventory choosing abilities, Arya is ranked at #117 out of 6,895 analysts tracked by TipRanks.

2U

2U Inc makes a speciality of digital schooling, together with supplying schools and universities with a cloud-based software-as-a-service platform, coursework design and infrastructure assist.

And the inventory has simply obtained the thumbs up from prime Needham analyst Ryan MacDonald. This five-star analyst reiterated his TWOU purchase ranking with a $50 worth goal on August 17. Regardless of shares already surging 64% year-to-date, his inventory worth forecast signifies additional upside potential of 27%.

“We stay bullish on 2U’s progress prospects as the corporate continues to search out artistic methods to drive an accelerated adoption of on-line schooling” the analyst instructed traders.

TWOU’s most up-to-date partnership gives a credit-bearing “Semester of Code” program for Arcadia College. Not solely does Arcadia boast 2,400 undergrad college students, however the college’s research overseas program hosts almost 3,000 college students from 300 college companions yearly.

“We view this new partnership as a artistic and accretive strategy to additional penetrate the sizable undergrad alternative” MacDonald writes.

Buyers are at present underappreciating the continued shift to on-line schooling, and 2U’s progress in the direction of limiting money burn says the analyst. With a 20% EBITDA margin achievable long term, he believes “the discounted valuation creates a beautiful entry level.”

Lowe’s

“One for the document books” cheered five-star Wells Fargo analyst Zachary Fadem after Lowe’s blowout second quarter. The analyst reiterated his purchase ranking on the home-improvement retailer on August 19, whereas boosting his worth goal from $180 to $185.

For a corporation of LOW’s dimension, a 35% comp and 312bps of EBIT margin enlargement is uncommon and historic, wrote the analyst, highlighting the extraordinarily spectacular 135% on-line progress for Lowes.com.

In keeping with Fadem, LOW’s better-than-expected Q2 outcomes “function additional proof that execution has clearly improved (after years of mismanagement), the class stays very robust (20%+ by Aug), and near-term advantages seemingly show each cyclical and structural.”

And whereas tailwinds and authorities stimulus inevitably ease, he nonetheless sees loads of long-term levers (Professional loyalty, Instrument rental, Omni-channel, and many others.) to drive sustainable comp progress and margin enchancment that ought to in the end exceed LOW’s ~12% mid-term goal.

Regardless of all these tailwinds and related basic enhancements, LOW shares stay undervalued vs. rival Residence Depot and a -10% low cost vs. the S&P 500. “In our view, this is not the LOW of previous, and it is about time valuation caught up” Fadem concludes.

With a 30.6% common return, this is among the Prime 30 analysts on TipRanks.

Analog Gadgets

Analog Gadgets is a number one provider of high-performance analog (HPA), blended sign, and digital sign processing (DSP) ICs. And the inventory has simply obtained a seal of approval from Oppenheimer’s Rick Schafer. This is among the finest tech analysts on TipRanks, coming in at #30 out of 6,895 tracked analysts.

After ADI reported upside to earnings, Schafer instructed traders “ADI is our prime large-cap 5G RAN play.” He reiterated his purchase ranking on August 19 with a $140 inventory worth forecast (18% upside potential).

Crucially, Analog is at present within the strategy of buying Maxim Built-in, in an all-stock transaction for ~$19 billion. ADI sees $275 million in MXIM price synergies and an extra $100 million from LLTC synergies.

In keeping with Schafer, ADI and MXIM have extremely diversified, differentiated, and sticky high-performance analog (HPA) companies with a give attention to the high-margin industrial, automotive, and communications markets.

Wanting forward, he likes ADI’s 5G-led structural progress/margin profile and see the strategic MXIM deal affording the corporate scale to higher compete in opposition to rival Texas Devices.

“We consider ADI has one of the vital engaging core enterprise fashions in analog semiconductors, which appears to be like even higher when including MXIM to the combination… We stay long-term patrons” the analyst wrote on August 19.