Robinhood is giving banking one other shot.

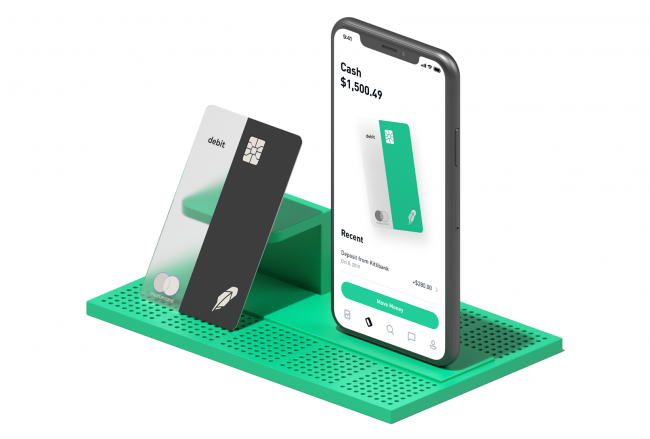

Ten months after the failed announcement of a checking and financial savings account, the free stock-trading start-up introduced a money administration account with a 2.05% rate of interest. The APY is greater than twenty occasions increased than the nationwide common for financial savings accounts, in accordance with Bankrate.com.

In December, Robinhood stated it will provide zero-fee checking and financial savings accounts with a 3% rate of interest alongside its brokerage accounts. The transfer was seen as a shot throughout the bow of conventional banks. However the product noticed swift pushback from regulators who questioned the SIPC insurance coverage it was promising, which is supposed for brokerage accounts — not for financial savings merchandise. A day later, Robinhood said they’d re-brand and re-name the product after the “confusion.”

“Over the previous yr, we pressed the reset button and began constructing this from scratch,” CEO Baiju Bhatt instructed CNBC in a cellphone interview. “We have spent lots of time and power rising our enterprise, and employed an all-star forged of individuals with monetary providers and danger compliance backgrounds.”

Prior to now yr, Robinhood has hired Amazon veteran Jason Warnick as its first-ever chief monetary officer and Gretchen Howard, a former associate at Alphabet’s development fairness arm, Capital G, as chief working officer. On Monday, the corporate announced that former SEC…