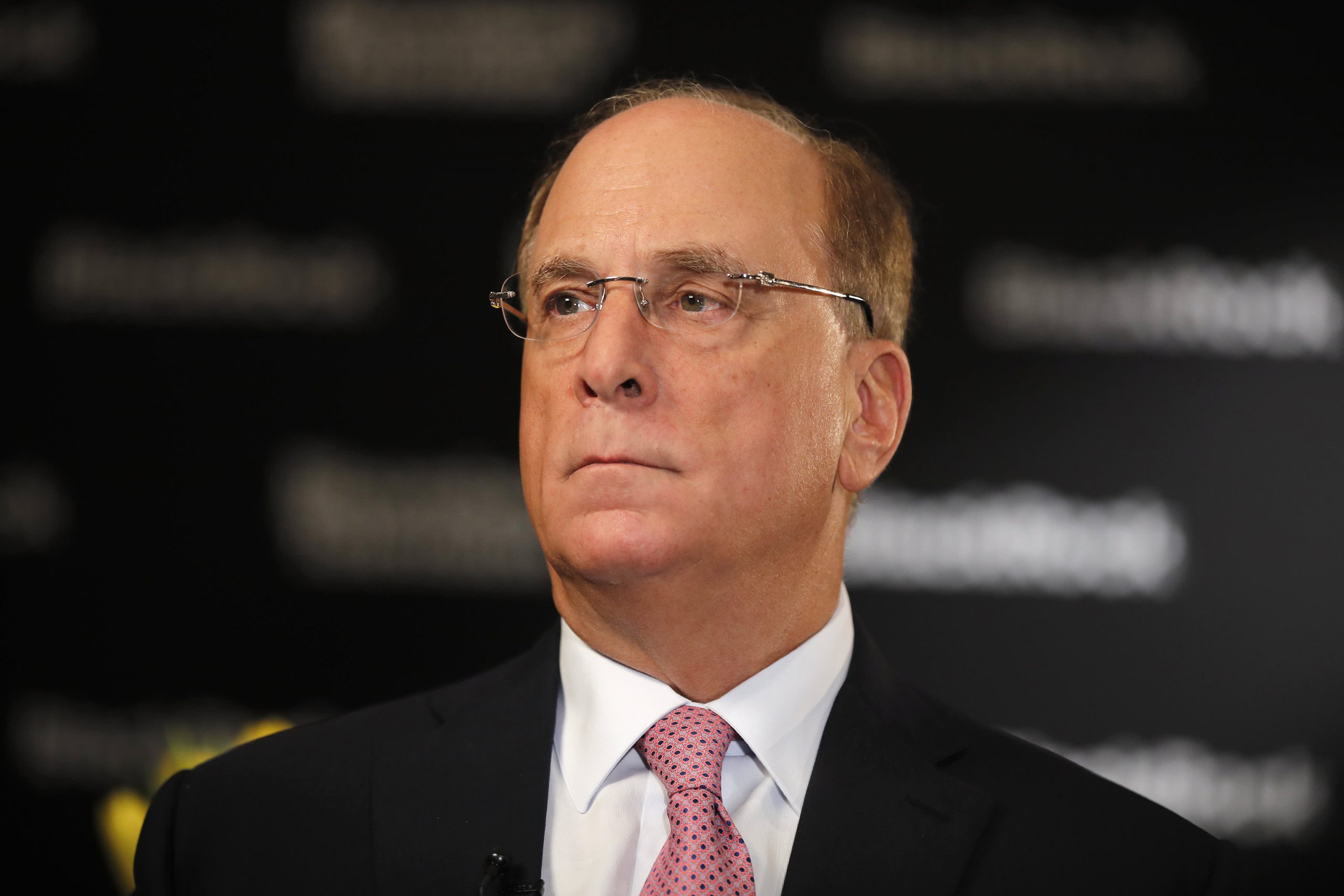

BlackRock's Larry Fink instructed CNBC on Thursday he believes the inventory market has room to run, however the head of the world's largest asset

BlackRock’s Larry Fink instructed CNBC on Thursday he believes the inventory market has room to run, however the head of the world’s largest asset supervisor cautioned that the rally is probably not as strong because it was within the second half of 2020.

“I believe we will proceed to see the market to be robust into 2021, in all probability not as robust as we noticed within the fourth quarter or the third quarter final 12 months,” the BlackRock chairman and CEO stated on “Squawk Field.”

The S&P 500 rose greater than 20% from July 1 to Dec. 31 as a part of an enormous restoration in equities from the coronavirus pandemic-induced sell-off in February and March.

One issue that ought to present a tail wind for the market is the document amount of money buyers have on the sidelines, Fink stated.

“We’re persistently seeing buyers worldwide under-invested, not over-invested, in long-term belongings, and the perfect supply of long-term belongings are equities and plenty of asset classes within the personal space,” he stated.

The presence of low rates of interest — and the chance that accommodative financial coverage will probably be in place for some time — will proceed to drive buyers into the market, Fink contended.

Fink anticipates the second half of 2021 will probably be stronger for the market than the primary half because of the broad rollout of Covid vaccines, permitting for the resumption of extra financial exercise. That’s “going to be a robust part for ahead development,” he stated.

Shares of BlackRock had been below strain in premarket buying and selling Thursday after the New York-based agency reported better-than-expected earnings and income within the fourth quarter.

BlackRock’s belongings below administration surged to a document $8.68 trillion on the conclusion of the quarter. That is up from $7.43 trillion in the identical interval final 12 months.