Jordan Katzman, co-founder of SmileDirectClub Inc., left, and Alex Fenkell, co-founder of SmileDirectClub Inc., watch merchants through the firm's

Jordan Katzman, co-founder of SmileDirectClub Inc., left, and Alex Fenkell, co-founder of SmileDirectClub Inc., watch merchants through the firm’s preliminary public providing (IPO) on the Nasdaq MarketSite in New York, U.S., on Thursday, Sept. 12, 2019.

Michael Nagle | Bloomberg | Getty Photos

On-line dentistry firm SmileDirectClub’s income climbed whereas its losses swelled within the firm’s first earnings report as a public firm.

Here is what the corporate reported, in contrast with Wall Avenue estimates:

- Loss per share: 89 cents

- Income: $180.2 million vs. $165.four million as forecast by Refinitiv consensus estimates

Given inconsistencies with excellent share counts for a not too long ago public firm’s first quarterly report, CNBC doesn’t evaluate earnings per share figures with EPS consensus estimates.

SmileDirectClub reported a third-quarter internet lack of $387.6 million, or a lack of 89 cents per share. That features a $299.three million loss from SmileDirectClub’s non-controlling curiosity in SDC monetary. The corporate posted a internet lack of $14.95 million within the year-ago quarter.

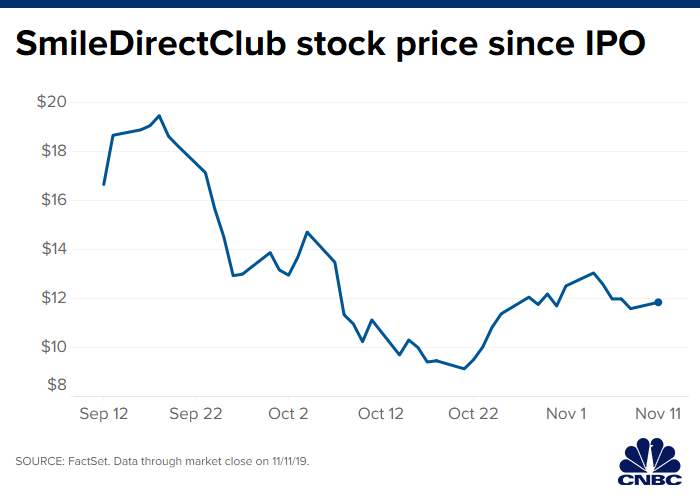

Shares of SmileDirectClub rose by about 2% in after-hours buying and selling Thursday.

“Publish-IPO, our crew is laser targeted on execution,” SmileDirectClub Chief Monetary Officer Kyle Wailes stated in a press release. “Our outcomes for the quarter, all of which exceeded administration’s expectations, are a…