Wealthfront has named former Federal Deposit Insurance coverage Company head Sheila Bair and ex-Comptroller of Foreign money Thomas Curry to an adv

Wealthfront has named former Federal Deposit Insurance coverage Company head Sheila Bair and ex-Comptroller of Foreign money Thomas Curry to an advisory group created to assist the fintech agency push additional into monetary companies, CNBC has discovered.

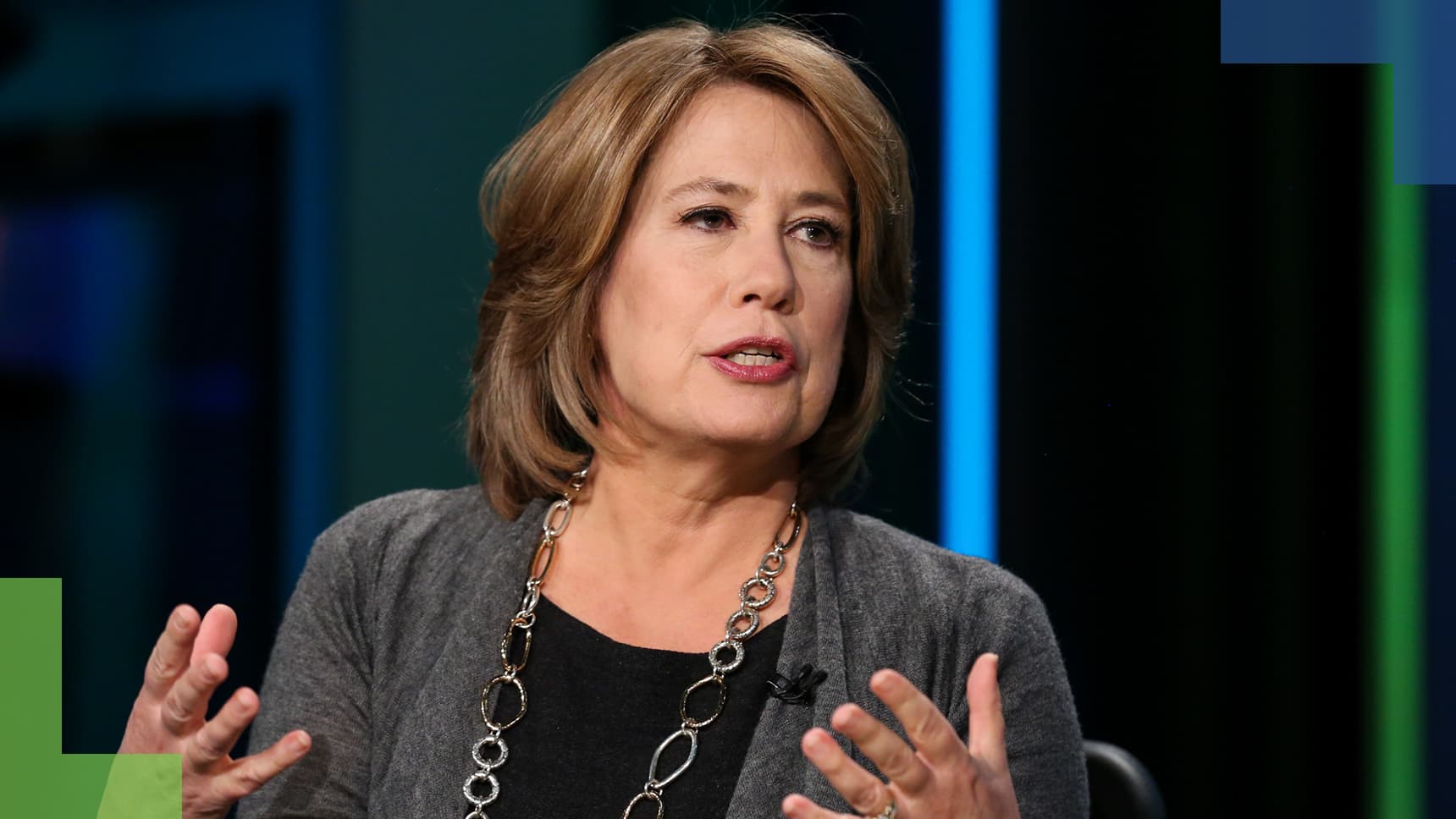

Bair is greatest identified for steering the FDIC by means of the 2008 monetary disaster, pushing again towards taxpayer bailouts of huge banks and warning of the dangers of subprime mortgages. Curry is a former FDIC board member who served as OCC head from 2012 to 2017.

“Sheila’s and Tom’s mixed expertise within the banking trade might be invaluable to Wealthfront as we proceed our efforts to rebuild a brand new, higher option to financial institution that makes cash with the consumer, not from them,” Wealthfront CEO Andy Rachleff mentioned in a press release.

Wealthfront was co-founded in 2008 by Rachleff as one of many earliest robo-advisors, or automated wealth managers, a transfer that contributed to payment strain throughout the trade. Quickly, funding giants together with Vanguard and Constancy and brokerages together with Morgan Stanley and JPMorgan Chase supplied their very own variations of the expertise.

Final 12 months, Wealthfront added high-interest money accounts and later bolstered the service with debit playing cards and direct deposit for paychecks, a part of a imaginative and prescient for shopper finance the corporate calls “Self-Driving Cash.” The agency manages about $22 billion total, based on a spokeswoman.

“I really like the way in which the crew thinks outdoors the field to ship extra long-term worth to the consumer, and the chance forward of them in banking is big,” Bair mentioned in a press release. “Expertise has big potential to decrease prices and enhance companies for the banking public. I could not be extra excited to assist Wealthfront create lengthy overdue change.”