The Federal Reserve simply reduce rates of interest for the third time this yr and said it will likely pause from here. That state of affairs is of

The Federal Reserve simply reduce rates of interest for the third time this yr and said it will likely pause from here. That state of affairs is often excellent for shares.

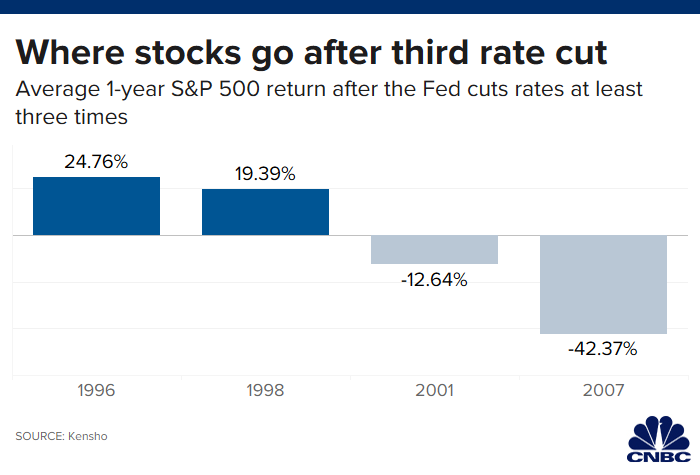

CNBC used Kensho, a hedge fund analytics device, to trace what occurred to the market after the Fed reduce rates of interest no less than thrice. Previously 25 years, this has occurred on 4 events, and information present that when the third reduce was the final reduce, shares acquired a wholesome increase within the following yr. When the third reduce was adopted by extra cuts as a result of the financial system was slipping right into a recession, shares tumbled.

The central financial institution’s determination Wednesday to decrease the in a single day lending price to a goal vary of 1.50% to 1.75% marks the third price reduce since July, when the Fed lowered charges for the primary time for the reason that monetary disaster. Powell has attributed the collection of cuts to “the implications of worldwide developments for the financial outlook in addition to muted inflation pressures.”

The FOMC eliminated a key clause that had appeared in post-meeting statements since June saying it was dedicated to “act as applicable to maintain the growth.” This was changed by a extra muted dedication to “monitor the implications of incoming info for the financial outlook because it assesses the suitable path of the goal vary for the federal funds price,” the assertion stated.

Powell later added in a…