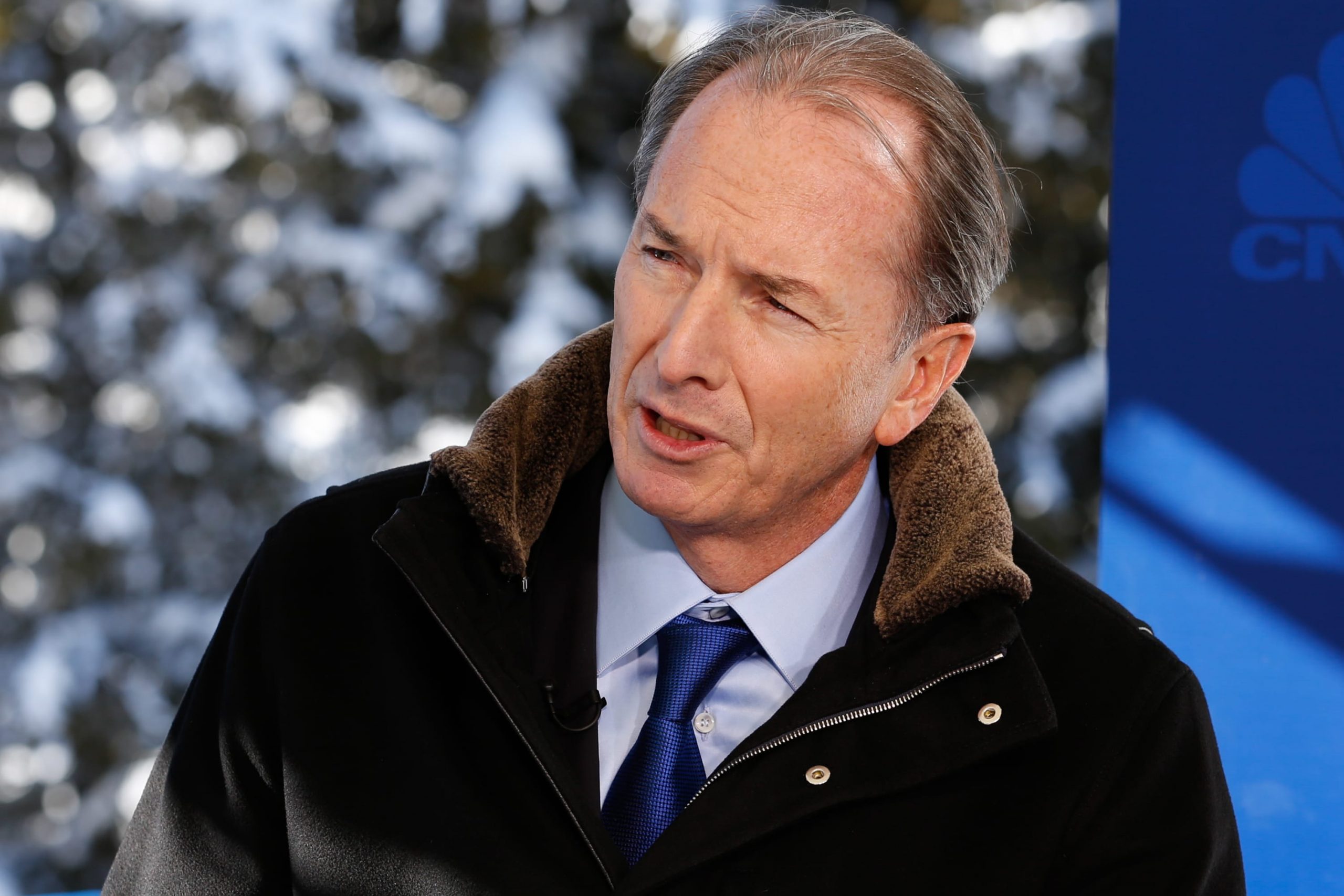

Morgan Stanley CEO James Gorman has simply accomplished a pivot that started greater than a decade in the past.With the announcement Thursday that

Morgan Stanley CEO James Gorman has simply accomplished a pivot that started greater than a decade in the past.

With the announcement Thursday that Morgan Stanley is buying funding supervisor Eaton Vance for $7 billion, Gorman is including heft and scale to the smallest of the New York-based financial institution’s three predominant companies: the producer of mutual funds and different investments.

It completes Morgan Stanley’s shift from being a agency dominated by merchants and funding bankers to 1 the place the extra subdued and reliable administration of cash guidelines.

The financial institution started that journey in early 2009 when Morgan Stanley bought Smith Barney from Citigroup within the throes of the monetary disaster, gaining 1000’s of economic advisors within the course of. This yr, Gorman went a step additional, saying the $13 billion takeover of low cost brokerage E-Commerce to additional its attain with the mass prosperous.

Now, after $20 billion value of latest offers, the financial institution will get nicely over half its income from charges associated to wealth and funding administration – proudly owning a mutual fund manufacturing facility with $1.2 trillion in property and one of many world’s largest armies of economic advisors to distribute them.

“We wished to make it possible for in very troublesome instances Morgan Stanley is regular within the water,” Gorman mentioned Thursday in a name with analysts. “A decade in the past, our asset administration and wealth administration companies had vibrant spots in them, however they weren’t large enough, they weren’t at scale sufficient the place they’ll present actual stability to the remainder of the group.”

When together with its two latest acquisitions, Morgan Stanley would’ve generated $26 billion in wealth and funding administration income in 2019, making it the most important such firm on the planet by income, the financial institution says. All advised, it’ll handle $4.Four trillion in consumer property.

However traders have but to acknowledge Morgan Stanley’s transformation, Gorman mentioned.

“Our expensive competitor Schwab, which is a good firm, is I feel buying and selling at one thing like 20 instances earnings in the meanwhile,” Gorman vented. “And we’re buying and selling as if we’re a pure buying and selling enterprise at about 9, 10 instances earnings. It makes completely no sense.”

If his firm traded on the midpoint between the 2 classes, at round 14 or 15 instances earnings, “this inventory could be $100” as an alternative of its present stage of about $49, Gorman mentioned. “You have to play the lengthy sport right here.”

For Eaton Vance, a medium-sized participant that focuses on actively managed funds, the deal relieves strain that every one asset managers not named Vanguard, BlackRock or Constancy face. The shift to cheap passive investments has compelled seismic adjustments all through the business.

“They’re buying a great asset in a troublesome business,” mentioned Devin Ryan, analyst at JMP Securities. “The one motive for a considerably muted response immediately is that they are paying what seems to be full value, and the near-term economics are modest when it comes to shifting the needle.”

In the meantime, at Morgan Stanley’s rival Goldman Sachs, CEO David Solomon has been way more consumed by restructuring the companies he already owns fairly than shopping for new ones. The financial institution just lately reshuffled the heads of his asset administration and shopper and wealth administration divisions.

Their focus could quickly change to rising through acquisition, Ryan mentioned. “Goldman Sachs aren’t precluded from doing issues which can be bigger,” he mentioned. “I would not be stunned in the event that they went that route.”