On the small yellow sticky notice that 20-year-old Alex Kearns left on his bed room door was an ominous message saying to activate the pc.Daniel Ke

On the small yellow sticky notice that 20-year-old Alex Kearns left on his bed room door was an ominous message saying to activate the pc.

Daniel Kearns powered up his son’s laptop computer of their dwelling in Naperville, Ilinois. Inside seconds, a four-paragraph letter flashed on the display. “In the event you’re studying this, then I’m lifeless,” the notice began.

It was lower than 24 hours after Alex had checked his account on the wildly well-liked buying and selling app, Robinhood. In his notice, he mentioned he thought he had shortly racked up a adverse $730,165 money steadiness. However Alex might have misunderstood the Robinhood monetary assertion, based on a relative.

“He thought he was uncovered, he thought that ending his life would shield his household from the publicity,” Invoice Brewster, a cousin by marriage and an analyst at Sullimar Capital, instructed CNBC in a cellphone interview. “He received on his bike and by no means got here dwelling.”

Alex’s physique was discovered on Friday subsequent to coach tracks in close by Plainfield by a pedestrian who referred to as the fireplace division. Plainfield Fireplace Chief Jon Stratton instructed CNBC that Alex’s bike was close by. Alex, a sophomore at College of Nebraska at Lincoln, was finding out administration and had a rising curiosity in monetary markets, based on his household.

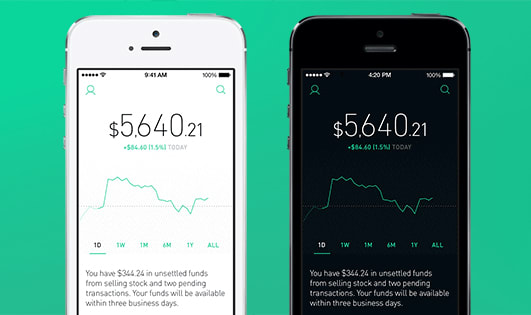

The free-trading app Alex was utilizing has change into a preferred entry level to the inventory marketplace for first-time traders. It has grown from 1 million customers in 2016, to 10 million firstly of this yr, with a loyal following on social media. On one Reddit discussion board, Wall Road Bets, merchants usually joke about main losses on Robinhood and publish screenshots of their positive aspects.

Over the weekend, Brewster took to social media to share the story to warn others concerning the pitfalls of day buying and selling. The occasions present the danger of massive losses that may include difficult buying and selling devices corresponding to choices.

“That is investing, this is not a sport. It is folks’s lives,” Brewster mentioned.

Within the notice to his household seen by CNBC, Alex accused Robinhood of permitting him to pile on an excessive amount of threat. He claimed the places he purchased, and the shares offered “ought to have cancelled out” however in hindsight, he mentioned he had “no clue” what he was doing.

“How was a 20 yr previous with no revenue capable of get assigned virtually one million {dollars} price of leverage?” the notice reads. “There was no intention to be assigned this a lot and take this a lot threat, and I solely thought that I used to be risking the cash that I truly owed.”

In an announcement to CNBC, a spokesperson for Robinhood mentioned they “are deeply saddened to listen to this horrible information and we reached out to share our condolences with the household.” The spokesperson confirmed that Kearns did have an account with the brokerage start-up however wouldn’t present any extra particulars.

Robinhood can be reviewing its choices providing “to find out if any modifications could also be applicable,” based on the spokesperson.

Alex Kearns

Supply: Invoice Brewster, Kearns household

An choices contract provides a dealer the correct — however not the duty — to purchase or promote an asset at a particular worth, on or earlier than a sure date. Merchants use it to hedge threat, or speculate.

Robinhood is required by its regulator, FINRA, to approve every particular person shopper that wishes to commerce choices. The identical is required of any regulated brokerage agency. Within the case of Robinhood, merchants fill out a questionnaire on the app that certifies investing expertise and degree of sophistication of the dealer, in addition to an acknowledgement of the danger. Robinhood doesn’t help uncovered choice promoting.

Brewster mentioned Alex might have misinterpreted the state of his Robinhood account. CNBC has not seen particulars of Kearn’s buying and selling account and couldn’t independently affirm the extent of the losses.

A screenshot shared by Brewster reveals adverse money and shopping for energy:

However adverse shopping for energy and adverse money should not the identical as regular debt. The $730,000 quantity might have been reflecting the opposite aspect of an choices commerce not settled but and the worth of shares tied to these choices.

A corresponding commerce to cowl a purchase order is commonly not executed till the next buying and selling day, which Robinhood tells its customers through e-mail and notifications. In that case, money and shopping for energy will come up as adverse till the opposite aspect has not been processed. The momentary adverse show shouldn’t be a steadiness of debt and the general portfolio worth would replicate the worth of the account.

Daniel Kearns confirmed to CNBC in an e-mail that Alex did have a Robinhood account, and he started buying and selling shares earlier than this spring. He mentioned the start-up reached out via Brewster, however “he wasn’t prepared to speak to them.” The Kearns household requested that in lieu of flowers, memorials in Alex’s identify could also be made to the American Basis for Suicide Prevention.

Brewster mentioned he is advocating for extra transparency and safeguards for brand spanking new merchants.

“I might like them to repair the way in which that they are exhibiting publicity — I need them to behave like a monetary platform ought to act,” Brewster mentioned. “Once you’re coping with retail cash and actively soliciting merchants underneath 30 years previous to have errors like that is inexcusable and on the minimal negligence.”

In the event you or somebody is in disaster, name the Nationwide Suicide Prevention Lifeline at 800-273-8255