In the summertime of 2017, I made a decision it was time to place my big-girl pants on and attempt to discuss to my web supplier about my invoic

In the summertime of 2017, I made a decision it was time to place my big-girl pants on and attempt to discuss to my web supplier about my invoice. It had been progressively ticking up over the previous a number of months with out clarification — not to mention higher service — and I needed to know what was up. Once I referred to as the corporate’s customer support line, the girl on the top of the opposite telephone knew one thing I didn’t: I didn’t actually produce other service choices obtainable in my space. And so, no, my invoice wouldn’t be lowered.

Greater than two years later, I’m nonetheless mad about it. And sure, that might appear just a little petty. However that month-to-month annoyance speaks to a broader pattern that each one Individuals ought to pay attention to — and indignant about. Throughout business after business, sector after sector, energy and market share have been consolidated into the fingers of handful of gamers.

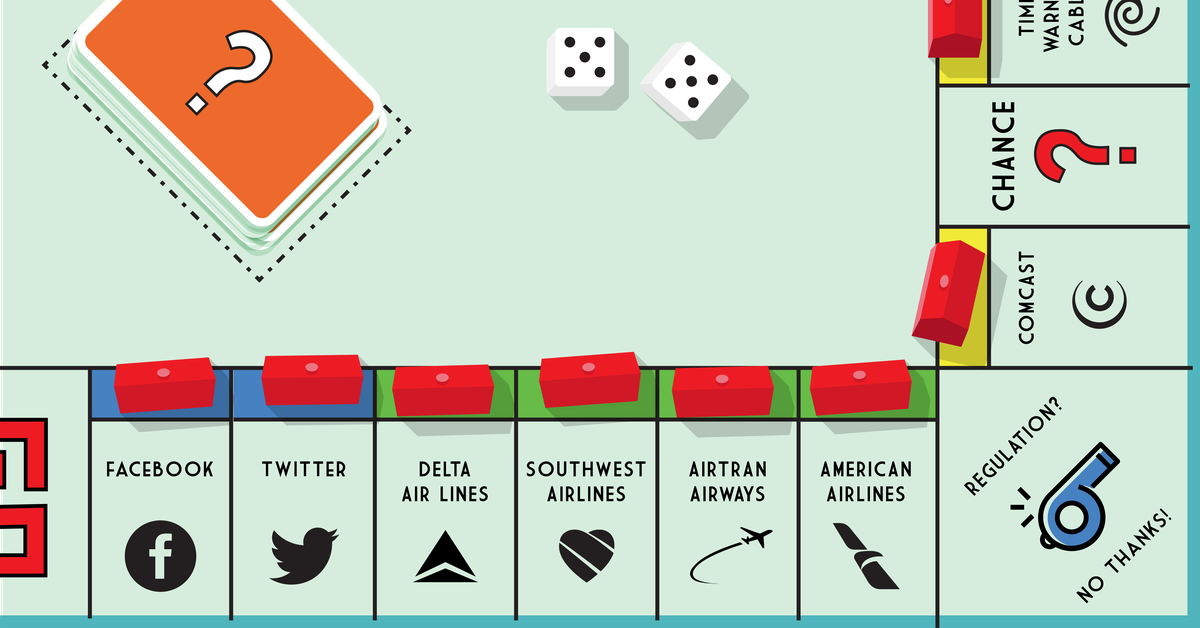

Currently, you’ve in all probability heard plenty of complaints concerning the measurement and scope of huge tech corporations: Fb, Google, Amazon, and Apple. However competitors is missing throughout numerous industries, together with airlines, telecommunications, mild bulbs, funeral caskets, hospitals, mattresses, child formulation, agriculture, sweet, chocolate, beer, porn, and even cheerleading, simply to call some examples. If you look, monopolies and oligopolies (that means as a substitute of 1 dominant firm, there are a number of) are all over the place. They’re a systemic characteristic of the economic system.

There’s little denying that for the reason that 1970s, the way in which antitrust has been approached in the USA has led to a panorama the place a smaller variety of huge gamers dominate the economic system. Incumbents — corporations that exist already — are rising their market shares and changing into extra secure, and so they’re changing into tougher and tougher to compete with. That has affected shoppers, communities, opponents, and staff in a wide range of methods.

Proponents of the laissez faire, free-market considering of current a long time will say that the markets have mainly labored themselves out — if an entity grows large enough to be a mega-corporation, it deserves its standing, and only a handful of gamers in a given house is sufficient to preserve costs down and everybody completely satisfied. A rising group of vocal critics of assorted political stripes, nevertheless, are more and more warning that we’ve gone too far. Development and success on the prime often doesn’t translate to success for everyone, and there’s an argument to made that strong antitrust policies and other measures that curb concentration, mixed with authorities investments that focus on job-creating know-how, may spur redistribution and doubtlessly enhance the economic system for extra folks general.

If two pharmaceutical corporations make a patent-protected drug after which raise their prices in tandem, what does that imply for sufferers? When two cellphone corporations speak about efficiencies of their merger, what does that imply for his or her staff, and the way lengthy does their subsequent promise to not increase costs for shoppers truly final? And truthfully, wouldn’t it’s rather a lot simpler to delete Fb if there was one other, equally enticing social media platform on the market apart from Fb-owned Instagram?

We needs to be asking the federal government and company America how we obtained right here. As an alternative, we simply preserve handing over our cash.

Critically, be mad about your web invoice

In 2019, New York College economist Thomas Philippon did a deep dive into market focus and monopolies in The Great Reversal: How America Gave Up on Free Markets. And one in every of his contact factors for the guide is the web. Trying on the information, he discovered that the USA has fallen behind different developed economies in broadband penetration and that costs are considerably greater. In 2017, the typical month-to-month price of broadband in America was $66.17; in France, it was $38.10, in Germany, $35.71, and in South Korea, $29.90. How did this occur? In his view, plenty of it comes all the way down to competitors — or, somewhat, lack thereof.

To a sure extent, telecommunications corporations and web service suppliers are a form of pure monopoly, that means excessive infrastructure prices and different limitations to entry give early entrants a big benefit. It prices cash to put in a cable system, as a result of you must dig up streets, entry buildings, and so on., and as soon as one firm does that, there’s not a ton of incentive to do it once more. On prime of that, telecom companies paid what were often super low fees — maybe enough to create a public access studio — to wire up cities and cities in change for, primarily, getting a monopoly.

However that’s the place the federal government may are available in by regulating the community or forcing the corporate that constructed it to lease out elements of it to rivals. As Philippon notes, that’s what occurred in France — an incumbent service was compelled to lease out the “last mile” of its community — mainly, the final little bit of cable that will get to your hours or house constructing — and subsequently letting opponents have an opportunity at additionally interesting to prospects.

Within the US, nevertheless, only a few huge corporations, typically with out overlap, control much of the telecom industry, and the result’s excessive costs and uneven connectivity. In 2018, Harvard regulation professor Susan Crawford examined the case of, what are you aware, New York Metropolis in an article for Wired. The town was presupposed to be “a mannequin for big-city high-speed web,” she defined, after Mayor Mike Bloomberg struck a cope with Verizon to put in its FiOS fiber service in residential buildings in 2008, ending what was then Time Warner Cable’s native monopoly. In 2015, 1 / 4 of New York Metropolis’s residential blocks nonetheless didn’t have FiOS, and one in 5 New Yorkers nonetheless don’t have web entry at dwelling.

“New York Metropolis might be in a really totally different place as we speak if these Bloomberg officers had referred to as for a city-overseen fiber community. The creation of a impartial, unlit ‘final mile’ community that reaches each constructing within the metropolis, like a avenue grid, would have allowed town to make sure fiber entry to everybody,” Crawford wrote.

As an alternative, a number of states (although not New York) have put up roadblocks to municipal broadband to maintain cities from offering options to and competing with native entities. It’s an instance of lobbying at its best, in order that highly effective companies can preserve opponents out and cost no matter they need.

And it’s hardly simply the web. Philippon discovered related phenomena in cellphone plans, airline costs, and a number of different arenas, as a consequence of an absence of competitors. In an interview with the New York Times, he estimated that company consolidation is costing American households an additional $5,000 a yr.

“Broadly talking, during the last 20 years within the US, we see earnings of incumbents changing into extra persistent, as a result of they’re much less challenged, their market share has turn into each bigger and extra secure, and on the similar time, we see plenty of lobbying by incumbents, specifically to get their mergers permitted or to guard their rents,” Philippon instructed me.

Incumbents have gotten good at conserving opponents out — and so they’ve been allowed to do it

The federal government is meant to make use of antitrust regulation to make sure competitors and cease corporations from changing into so huge they push everybody else out. Principally, antitrust is meant to stop anti-competitive monopolies. Within the US in current a long time, regulators, enforcers, and the courts have taken a extra lax angle towards antitrust, which has resulted in additional mergers, or corporations rising to the purpose that it’s arduous for rivals to remain within the sport.

“We mainly had a complete authorized framework previous to the 1970s that was devoted to creating certain that our companies have been protected against concentrated capital, and so producers have been allowed to collaborate in plenty of alternative ways via unions or coops or numerous associations, and so they obtained assist in the type of lending, helps, patents, copyrights, and so on.,” mentioned Matt Stoller, a fellow at left-leaning assume tank the Open Markets Institute and writer of Goliath: The 100-Year War Between Monopoly Power and Democracy. “These have been all issues that have been devoted to defending the producer from the capitalist, and we simply reversed these assumptions.”

Principally, the prevailing viewpoint has been that the market, by and huge, can care for itself, and the federal government doesn’t have to take such a hands-on method. And that’s led to gradual focus over time.

For instance, conventional financial considering is that if earnings in a sure business turn into very excessive, it turns into enticing for brand new incumbents to enter the market, and people extra earnings get competed away. However that’s turn into much less and fewer true over time in the USA. “It’s true typically, you might even argue that it’s true typically, nevertheless it’s not all the time true — and should you’re not cautious, you’ll be able to find yourself in a state of affairs the place it’s not true anymore, and that’s precisely the place we’re as we speak,” Philippon mentioned.

Incumbents have plenty of mechanisms to make it arduous for opponents to enter, and so they use a wide range of ways to maintain them out — predatory pricing, patents, contracts, and so on.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/19717617/GettyImages_954304196.jpg)

In 2016, Lina Khan, now counsel on the Home subcommittee on antitrust, penned an influential paper on the antitrust points surrounding Amazon. In it, she used the instance of Amazon and Quidsi, an e-commerce firm that ran Diapers.com. Amazon tried to purchase Quidsi in 2009, and after its founders declined, Amazon lower its costs for diapers and different child merchandise and launched a brand new…