In the end, Congress has reached a deal on a brand new coronavirus stimulus invoice. After eight months of backwards and forwards, Democratic a

In the end, Congress has reached a deal on a brand new coronavirus stimulus invoice.

After eight months of backwards and forwards, Democratic and Republican leaders introduced on Sunday that they’ve arrived at an settlement on a roughly $900 billion plan. The Home of Representatives will vote on the invoice Monday, based on Home Majority Chief Steny Hoyer.

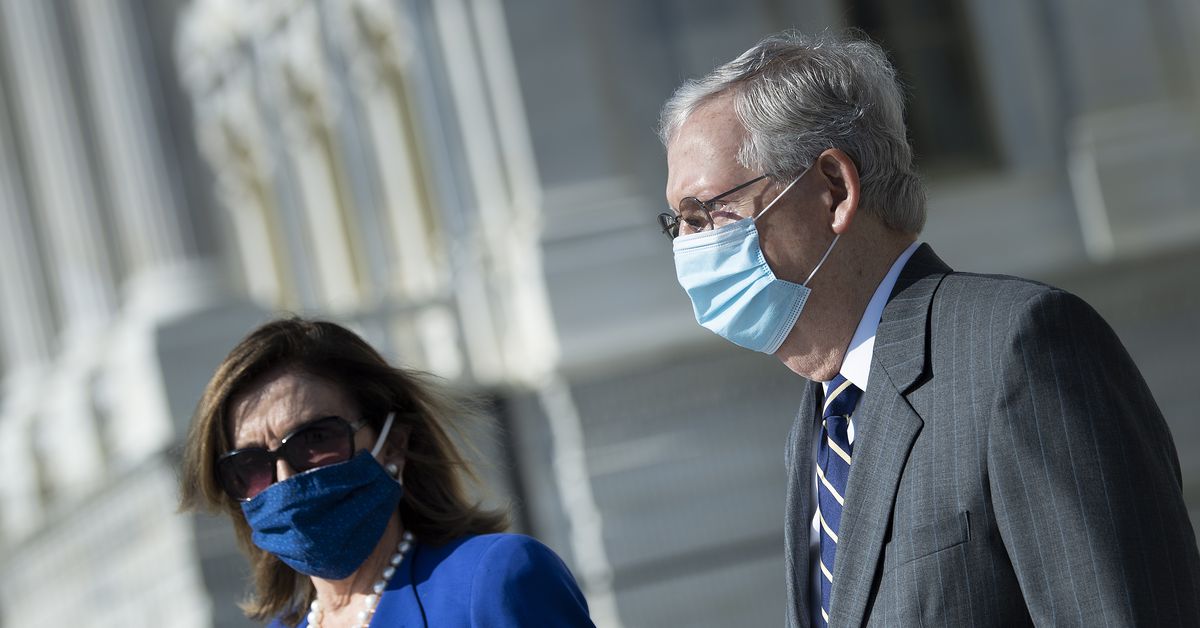

“We are able to lastly report what our nation has wanted to listen to for a very long time: Extra assistance is on the best way,” Senate Majority Chief Mitch McConnell confirmed Sunday.

The laws is anticipated to include much-needed coronavirus aid together with a weekly $300 enhancement in unemployment insurance coverage, a second spherical of stimulus checks, and renewed help for small companies.

Lawmakers in each chambers may have an opportunity to evaluate the invoice — which is being connected to the annual authorities spending package deal — earlier than they take a vote. Since they’re planning a vote on Monday, lawmakers are anticipated to cross a unbroken decision Sunday night time that retains the federal government funded past the December 20 deadline they beforehand confronted.

Lawmakers have labored by means of a number of sticking factors to get right here: Contentious provisions (together with state and native support, in addition to legal responsibility protections for companies) have been stripped from the laws, and a last-minute disagreement over the Federal Reserve’s emergency lending authorities — one which appeared as if it would fully derail negotiations — has additionally been resolved.

The ultimate $900 billion invoice lands between the $2.2 trillion proposal Home Democrats had put forth of their newest model of the HEROES Act and the a lot narrower $550 billion invoice that Senate Republicans have favored. It comprises far much less support than many Democrats hoped to see. As an illustration, it’s anticipated to incorporate a spherical of $600 stimulus checks, based on the Washington Submit, as a substitute of one other wave of the $1,200 ones that have been distributed earlier this 12 months.

For now, nonetheless, this deal is the one possibility for added coronavirus aid as tens of millions of Individuals grapple with unemployment, looming evictions, and hovering coronavirus case counts.

What the stimulus deal comprises

Whereas there’s lots that the stimulus settlement omits, it’s anticipated to supply much-needed support on a number of totally different fronts. Lawmakers have but to launch the ultimate invoice textual content, so right here’s what we all know to this point:

Stimulus checks: There’s a second spherical of stimulus checks, based on the Washington Submit. These direct funds embody $600 for people who make $75,000 a 12 months or much less in adjusted gross earnings, slightly than the $1,200 offered underneath the primary stimulus package deal. {Couples} who make $150,000 or much less in complete could be eligible for $1,200 in direct funds. People and {couples} with kids who qualify for these stimulus checks would obtain a further $600 per little one. Funds might be incrementally decreased for individuals who make extra in annual earnings, very similar to they have been earlier this 12 months.

Unemployment insurance coverage (UI): The plan contains a further $300 in weekly federal UI funds, although it’s not but clear how lengthy these funds would final. This supplemental fee is about to bolster the weekly fee that recipients would get from their state unemployment applications, very similar to a previous provision did within the CARES Act. The invoice would additionally prolong the pandemic unemployment insurance coverage applications which might be expiring on the finish of December. These pandemic-specific applications at the moment present roughly 12 million Individuals with UI advantages.

Small-business help: A large quantity of the invoice is devoted to small-business support together with repurposed funding for the Paycheck Safety Program, a forgivable mortgage program that enterprise house owners can apply for to cowl payroll and operational prices. These loans are geared toward companies with 300 or fewer workers which have seen a 30 % or greater lower in income in any quarter this 12 months. For a lot of, nonetheless, this support comes too late — based on a Fortune report, nearly 100,000 small companies have already closed completely in the course of the pandemic.

The laws additionally comprises plenty of different provisions, together with: meals support, funding to assist colleges reopen, cash to facilitate vaccine distribution, and support for airways, which might be required to carry furloughed workers again.

It additionally has new tips for the Federal Reserve after Republicans — led by Sen. Pat Toomey (R-PA) — demanded emergency lending applications on the Fed be canceled in any ultimate model of the invoice.

As Vox’s Emily Stewart has defined, the Fed might be pressured to eradicate a number of emergency lending applications created with CARES Act funding within the spring, and might be barred from restarting them with out congressional approval. It’ll additionally return the unused portion of the $454 billion Congress allotted it underneath the CARES Act to the Treasury Division, one thing the Fed had agreed to do in November.

At this level, it’s unclear whether or not the invoice will prolong paid sick go away protections established by the Households First Coronavirus Response Act earlier this 12 months, which assured go away for individuals who have been sick with Covid-19, taking good care of relations with the sickness, or taking good care of kids who have been navigating college closures. It additionally doesn’t present further support for state and native governments, a Democratic precedence, or the legal responsibility protections that defend companies from coronavirus-related lawsuits Republicans had advocated for.

How lengthy it is going to take folks to obtain assist

Based mostly on the timing of support from the CARES Act, it may very well be a number of weeks earlier than folks see direct aid from the laws.

Earlier this 12 months, the primary spherical of direct funds was deposited in folks’s financial institution accounts round mid-April: “Inside two weeks of the CARES Act going into impact in March, greater than 81 million funds have been disbursed, totaling greater than $147 billion, all by means of digital transfers to recipients’ financial institution accounts, based on the Authorities Accountability Workplace,” CNBC experiences.

Individuals who should not have financial institution accounts, or whose info isn’t on file with the IRS, will probably see a extra delayed distribution of the funds.

The timing of the implementation of enhanced unemployment insurance coverage funds may even depend upon the state. States started distributing $600 in supplemental UI roughly two weeks after the CARES Act was authorised this previous spring, which implies the weekly $300 addition may start in early January.

And with regards to the Paycheck Safety Program, banks and different monetary establishments started taking purposes a few week after the funds have been authorised by Congress in March. That would arrange purposes for a brand new spherical of loans to kick off on the finish of December or early January.

This lag time may very well be expensive for these ready on help; as Stewart has written, by the point a lot of this cash will get to those that want it, the applications they’re meant to increase may have been expired for weeks.

Nonetheless, such support comes at a vital time: Based on the most recent Labor Division report, 19 million individuals are at the moment receiving unemployment insurance coverage. In November, job development slowed considerably in comparison with the prior month, suggesting that the unemployed are dealing with restricted alternatives for brand new work. And this winter, coronavirus circumstances are projected to soar — forcing hundreds of companies to shutter or gradual their operations to be able to stop the unfold of the sickness.