Job development slowed additional final month, the most recent signal that the economic system’s spring momentum has light — and a warning that the

Job development slowed additional final month, the most recent signal that the economic system’s spring momentum has light — and a warning that the restoration might backtrack this fall with out additional authorities assist.

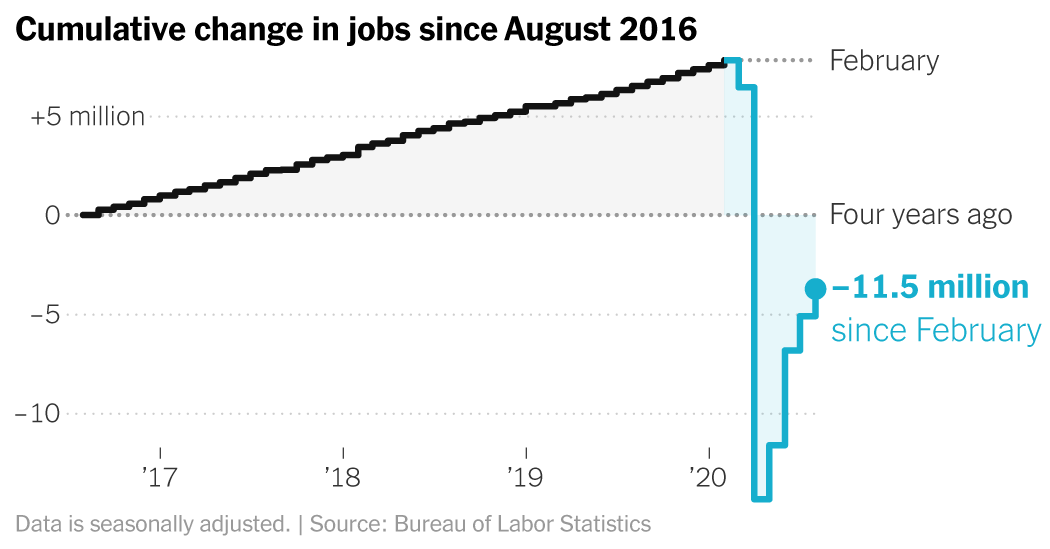

U.S. employers added 1.Four million jobs in August, the Labor Division stated Friday, down from the positive aspects within the three earlier months. The slowdown would have been extra pronounced with out the hiring of practically a quarter-million short-term census employees.

The report held some excellent news: The unemployment fee fell by greater than anticipated, to eight.Four p.c. In April — when joblessness was the best because the Nice Melancholy — forecasters on the Congressional Funds Workplace stated unemployment would stay within the double digits effectively into subsequent 12 months.

However an rising variety of folks reported within the Labor Division’s August survey that that they had misplaced their jobs completely, fairly than being quickly laid off or furloughed — an indication that the disaster is doing lasting harm.

“There’s a fragility within the numbers,” stated Diane Swonk, chief economist on the accounting agency Grant Thornton. “There are cracks within the underlying basis.”

These cracks are showing as trillions of {dollars} in federal spending, which helped maintain many households and companies early within the pandemic, are drying up.

A $600 weekly federal complement to unemployment advantages expired in July; a $300-a-week alternative, introduced by President Trump final month, has been sluggish to kick in and can final for only some weeks. The federal government’s marquee enterprise reduction effort, the Paycheck Safety Program, resulted in August.

The August jobs information was collected early within the month, and won’t replicate the total affect of the lack of advantages, economists warn. That calendar quirk might have political ramifications, easing stress on Congress to agree on a brand new spherical of emergency spending.

“If the labor market information proceed to carry, if we don’t see a giant destruction to shopper spending on the again of the lack of the unemployment advantages, that reduces the sense of urgency that one thing must be executed previous to the election,” stated Michelle Meyer, head of U.S. economics for Financial institution of America.

Economists warn that will set the stage for a giant drop in spending within the fall, resulting in extra job losses and a wave of small-business failures. Firms together with American Airways have introduced they’re shedding extra employees or, as within the case of the division retailer stalwart Lord & Taylor, going out of enterprise.

Purposes for unemployment advantages rose final week, and information from Homebase — which gives time-management software program to small companies — reveals that the variety of folks working has declined since early August. Economists say these figures counsel that job development might flip flat or unfavourable within the fall.

“Federal spending was meant to be a bridge,” stated Beth Ann Bovino, chief U.S. economist for S&P World. “Effectively, it appears to be like just like the ravine has widened and the bridge is midway constructed, so there are lots of people stranded.”

All informed, lower than half of the 22 million jobs misplaced early within the pandemic have been recovered. However the unemployment fee has fallen a lot sooner than most forecasters anticipated, from 10.2 p.c in July and 14.7 p.c in April. And the labor drive grew in August, a sign that jobless employees aren’t but giving up their searches as many did over the last recession a decade in the past. Some sectors that had been dealt a blow by the pandemic, such because the retail trade, continued to put up robust job positive aspects.

Mr. Trump cheered the report on Twitter. “Nice Jobs Numbers,” he declared, highlighting the unemployment fee’s decline into single digits as “sooner and deeper than thought doable.”

His Democratic opponent, former Vice President Joseph R. Biden Jr., stated in Wilmington, Del., that “any job added again is constructive.” However he stated that when working individuals are requested “how they really feel concerning the economic system coming again,” he stated, “you’ll discover they don’t really feel it.”

Economists stated the slowdown was a worrying signal that the low-hanging fruit of the restoration — the rehiring of hundreds of thousands of furloughed restaurant, lodge and leisure employees — may very well be largely gone.

Simply 174,000 jobs had been added final month in leisure and hospitality, a disappointing achieve for an trade that misplaced greater than eight million to the pandemic and has recovered solely half. And as corporations reopen, many are discovering that with demand nonetheless weak, they don’t want or can’t afford as many employees as earlier than the pandemic.

Marcus Resorts, which operates greater than a dozen motels, principally within the Midwest, started reopening its properties in June and has introduced again about 60 p.c of the practically 4,000 staff it had earlier than the pandemic. However in latest weeks, it has begun completely shedding most of the staff who remained on furlough.

“We held out so long as we might, ready to see what was going to occur,” stated Michael Evans, the president of Marcus, who added that it had paid advantages for workers so long as they had been furloughed.

Mr. Evans stated that he thought the lodge enterprise would bounce again finally, however that it might take years to return to its earlier stage. And even when it does, he stated, Marcus will in all probability not want as many employees.

“As we’ve deliberate for the reopenings, we re-evaluated our complete enterprise mannequin,” he stated. “If enterprise had been again to regular proper now, we’d nonetheless function extra effectively.”

Selections like those at Marcus imply that employees like Kara Hanley might have a tough time getting again to work.

Ms. Hanley, 23, was furloughed in March from her job as a room-service supervisor at a Marriott lodge in Orlando, Fla. At first, she anticipated the furlough to final just a few weeks. Then, as weeks handed and he or she didn’t get a name, she thought she could be ready till late summer time, or maybe Christmas.

When the telephone rang on Sept. 1, she assumed that Marriott was calling to inform her it was lastly time to return to work. As an alternative, she discovered she was being laid off, efficient Sept. 18.

“I actually didn’t assume that I used to be going to get let go,” she stated. “I simply stored considering, once they want me, they’re going to name me again.”

The emergency spending packages that Congress handed final spring had been meant to assist stop that sort of lasting financial hurt. Forgivable loans to small companies had been meant to assist avert bankruptcies and layoffs. Enhanced unemployment advantages had been meant not simply to stop starvation and homelessness among the many jobless, but additionally to attenuate the cascade of financial harm that will observe.

These packages, regardless of a rocky begin, had been largely profitable. A wave of foreclosures has but to happen. Client spending rebounded strongly in Could and June, and firms started recalling furloughed employees. However with no new spherical of help, a lot of that progress may very well be misplaced, with lasting financial penalties.

“I’m extra involved about the place the economic system is now than I used to be in April,” stated Martha Gimbel, an economist and labor market knowledgeable at Schmidt Futures, a philanthropic initiative. “In April, it was fixable. We’re simply letting the scars construct up now.”

H. Brandon Williams was alleged to spend this month celebrating the third anniversary of FishScale, his restaurant in Washington, D.C. As an alternative, he’s attempting to maintain his enterprise afloat.

The restaurant, which makes a speciality of burgers constructed from sustainably caught wild fish, survived the preliminary blow from the pandemic, which worn out many different Black-owned small companies.

However the enterprise isn’t out of the woods. Close by Howard College just lately introduced that it will shift its undergraduate courses on-line for the autumn semester and shut its dormitories. FishScale additionally relied on income from gross sales at a seasonal farmers’ market, which didn’t open this 12 months.

Now, with the federal unemployment complement and different help packages gone, Mr. Williams, 39, notices clients pinching their pennies — which is forcing him to do the identical. He has reduce to a few staff from six and has gained hire concessions from his landlord that he stated ought to get him by means of the top of the 12 months. He isn’t certain what is going to occur after that.

“We’re nonetheless at that space the place we might go both method,” Mr. Williams stated.

Julia Pollak, a labor economist for the employment web site ZipRecruiter, stated many companies had been dealing with related selections heading into the winter season, which is a problem for a lot of small companies in the very best of instances.

“There are a lot of corporations that after a summer time of gathering method too few acorns are going right into a hibernation that will not maintain them,” she stated.

Widespread enterprise failures, Ms. Pollak stated, “might have a cascading impact on these native economies.” That’s very true of Black neighborhoods that always battle to attract funding from giant companies.

Mr. Williams stated he needed to remain in enterprise not just for himself but additionally for his neighborhood. “There are lots of people who couldn’t get a job if it weren’t for Black-owned companies,” he stated. “I need younger girls and boys to look and see someone doing one thing that’s out of the field.”

Gillian Friedman contributed reporting.