And within the weeks for the reason that election shares have climbed steadily, primarily due to encouraging vaccine information. Pfizer, Moderna a

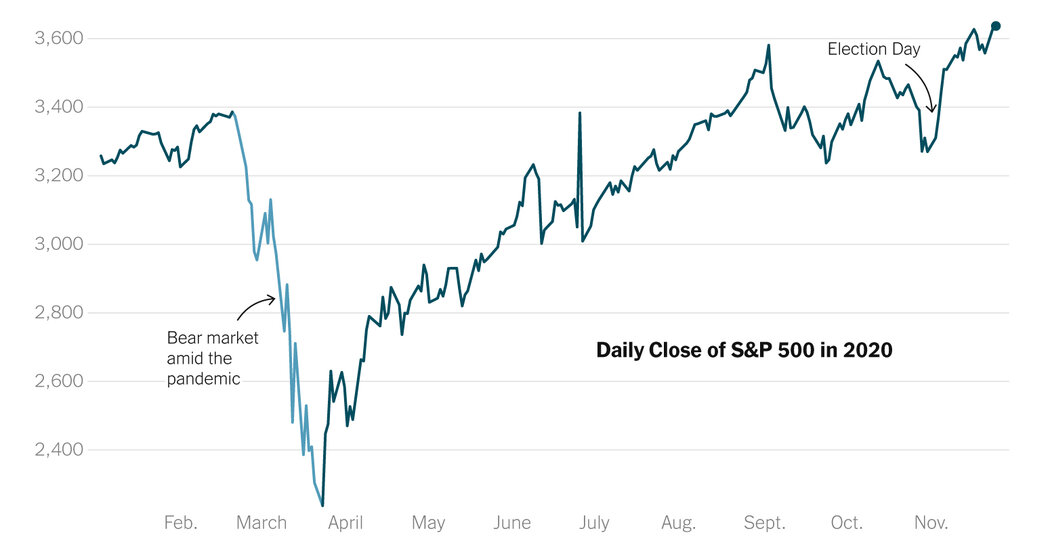

And within the weeks for the reason that election shares have climbed steadily, primarily due to encouraging vaccine information. Pfizer, Moderna and Astra-Zeneca have all introduced that their vaccine candidates confirmed favorable leads to trials. The S&P 500 has risen roughly eight % for the reason that election. Some traders imagine that with Mr. Biden within the White Home, and Republicans more likely to retain management of the Senate, they may depend on political gridlock to dam tax will increase that would roil the markets.

“You’ve gotten a Biden administration doubtless ruled by a break up Congress and a conservative Supreme Court docket so it eliminates among the most excessive insurance policies both on the appropriate or left,” mentioned Michael Arone, chief funding strategist at State Road International Advisors. “So markets are celebrating that.”

The excellent news about vaccines has bolstered shares that had been hit arduous by the outbreak. Shares of airways and oil corporations have soared this month. United Airways, American Airways and Delta Air Traces have all climbed by greater than 30 %. The oil large Chevron is up practically 38 %. The Russell 2000 — an index of smaller capitalization corporations closely influenced by the shorter-term outlook for the U.S. economic system, is up greater than 20 % this month alone.

However many analysts imagine that the market may have achieved even higher with out the political uncertainty in regards to the end result of the election. The president’s baseless claims that there was fraud within the election and that he would finally win a second time period helped maintain a lid on good points by injecting uncertainty into the markets.

The choice on Monday by Emily W. Murphy, the administrator of the Basic Companies Administration, to permit the presidential transition course of to maneuver ahead made traders really feel assured that the election was lastly over, Ms. Hooper mentioned. “I believe that was creating a big overhang and raised questions on how lengthy this may drag on,” she mentioned.

Markets additionally appeared to welcome the return of politics as standard underneath a future Biden administration, and had been reassured by the information that Ms. Yellen will likely be Mr. Biden’s nominee to go the Treasury Division. She is a recognized amount on Wall Road, nicely revered for her regular management on the head of the central financial institution, from 2014 to 2018.

“There had been some concern that Mr. Biden would decide a Treasury secretary with a powerful anti-Wall Road bias,” wrote analysts with Excessive Frequency Economics in a consumer be aware on Tuesday. “Janet Yellen isn’t that.”