WASHINGTON — From California to Virginia, many states that confronted devastating shortfalls within the depths of the pandemic recession now discov

WASHINGTON — From California to Virginia, many states that confronted devastating shortfalls within the depths of the pandemic recession now discover themselves flush with tax revenues due to a rebounding economic system and a hovering inventory market. Lawmakers who anxious about funds cuts are actually proposing profitable will increase in class spending, tax cuts and direct funds to their residents.

That turnaround is partly the product of sturdy earnings tax receipts, significantly in states that closely tax excessive earners and the rich, whose funds have fared effectively within the disaster. The unexpectedly rosy image is elevating strain on President Biden to repurpose lots of of billions of {dollars} of federal support authorized this yr, in an effort to assist fund a possible bipartisan infrastructure deal.

Final week, Senator Mitt Romney, Republican of Utah, urged that Mr. Biden and Republican negotiators look to “a few of the funding that’s been despatched to states already underneath the previous couple of payments” to assist pay for that settlement. “They don’t know the best way to use it,” Mr. Romney stated. “They might use that cash to finance a part of the infrastructure regarding roads and bridges and transit.”

Some economists and funds specialists assist that push, arguing that the cash might be higher spent elsewhere and that states’ spending plans may add to a threat of speedy inflation breaking out throughout the nation. Different researchers and native funds officers say that the federal support is rescuing harder-hit cities and states, like New York Metropolis and Hawaii, from a cascade of layoffs and spending cuts.

Biden administration officers say they proceed to assist distributing the total $350 billion in state, native and tribal support that was contained within the $1.9 trillion financial help bundle that Mr. Biden signed in March. They are saying the help will assist be sure that the financial rebound doesn’t repeat the years of state and native funds reducing that adopted the 2008 monetary disaster, which slowed the restoration from recession and contributed to tens of millions of Individuals ready years to reap its advantages.

“We nonetheless really feel strongly that the state and native plan is vital to making sure we’ve got a robust insurance coverage coverage for the kind of sturdy progress we wish, the kind of equitable restoration the nation deserves,” Gene Sperling, a senior adviser to Mr. Biden who oversees achievement of the March help bundle, stated in an interview, “and to getting back from the 1.three million jobs misplaced on the state and native stage.”

Even when the administration wished to recoup or divert the funds, it’s unlikely that it may repurpose the cash or make important adjustments to how it’s used with out congressional motion.

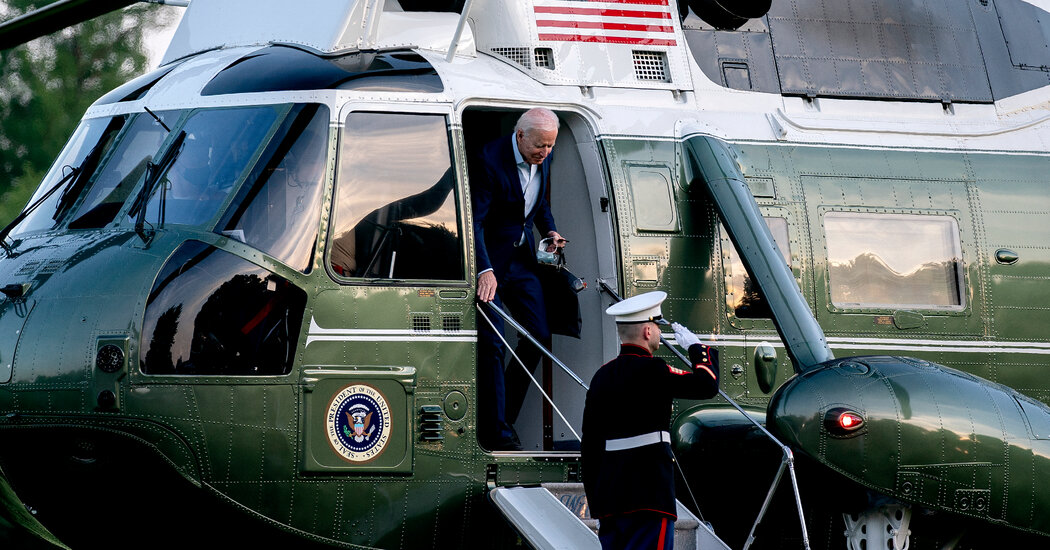

The controversy over the state and native funding comes as Mr. Biden navigates a vital week of negotiations with Republicans over infrastructure searching for a deal, and as he prepares to journey to Cleveland on Thursday to talk about the economic system. The way to pay for any new spending is a main hurdle within the talks, with Mr. Biden pushing to boost taxes on firms and Republicans preferring elevated consumer charges just like the fuel tax.

Repurposing unspent funds may assist advance an settlement, significantly given Republican opposition to bankrolling state support in earlier rescue packages. Democrats pushed arduous to incorporate profitable monetary help for states, cities and tribes in Mr. Biden’s rescue invoice. Republicans fought these efforts, warning they might function a “bailout” to high-tax, high-spend liberal states. In addition they cited a sequence of projections from Wall Avenue corporations and different analysts suggesting that many states’ revenues had been faring higher than officers had feared within the early months of the pandemic.

It more and more appears like many liberal states are usually not being “bailed out” — but additionally that a few of them don’t want extra federal cash. That’s significantly true in states that don’t rely totally on the tourism or hospitality industries for tax revenues. These with progressive tax techniques which have caught surging revenues from funding earnings loved by rich residents — like Silicon Valley moguls — are additionally faring effectively.

California officers anticipate a $15 billion surplus this fiscal yr, after fearing a $54 billion shortfall. Virginia has seen almost $2 billion in unanticipated revenues. As has Oregon, the place economists just lately upgraded the state’s income forecasts — shifting it from projected deficits to surplus — in a report that shocked and delighted many lawmakers.

“It’s extraordinarily shocking,” stated Mark McMullen, the Oregon state economist.

“Clearly, when the shutdowns first set in and we noticed these catastrophic employment losses, we handled them as a standard recession in our forecasts,” he stated.

However surging earnings tax revenues and several other rounds of federal help have now put the state “above our prepandemic forecasts,” Mr. McMullen added.

The sturdy income figures come as extra federal aid cash is simply starting to roll out the door. The Treasury Division started sending funds to states this month and has to this point distributed greater than $100 billion — about half of what’s accessible to be disbursed instantly. Native governments are anticipated to obtain the remainder subsequent yr, though states nonetheless experiencing a pointy rise in unemployment will get a lump sum instantly.

The Committee for a Accountable Federal Price range estimates that state and native governments have obtained a complete of almost $1 trillion in aid cash up to now yr. State and native revenues had been operating about 7 p.c above their prepandemic ranges within the final quarter — excluding the federal support they’ve obtained.

Marc Goldwein, the senior coverage director for the committee, stated that states like Hawaii and Nevada that rely closely on tourism clearly wanted the help, however that for a lot of others, the cash was pointless.

As we speak in Enterprise

The explanations fluctuate, however Mr. Goldwein famous that residence values have been surging across the nation, offering a lift to property taxes; that states that had been struggling from sagging oil costs have seen these costs choose up; and that customers have been spending at a wholesome clip due to stimulus checks and expanded jobless advantages.

“State and native governments, by and enormous, are frankly swimming in income,” Mr. Goldwein stated. “It’s fairly clear to me that we spent some huge cash on states that we didn’t must.”

Some economists, like Harvard’s Lawrence H. Summers, a former Treasury secretary underneath President Invoice Clinton, have pushed Mr. Biden to repurpose the state and native support for longer-term infrastructure tasks, in hopes of easing what Mr. Summers warns is a harmful buildup of inflationary strain. Administration officers view excessive inflation as a a lot decrease threat than Mr. Summers does.

Different analysts warn that state funds conditions may bitter if the inventory market dips sharply or financial progress fizzles. Many cities, like New York, have struggled with sluggish tax revenues and nonetheless are reliant on federal to assist keep away from additional layoffs.

New York expects to obtain greater than $22 billion in Covid-19 federal support, in accordance with the nonpartisan Residents Price range Fee. Regardless of the funds, town remains to be anticipating funds gaps within the coming years, the results of declining revenues like property taxes.

On reflection, stated Lucy Dadayan, a senior analysis affiliate on the Tax Coverage Heart, the March legislation ought to have included “extra focused funding” for the states and cities that want it most.

“I might nonetheless be all for serving to state and native governments — extra native governments than state governments, given what we all know,” Ms. Dadayan stated.

Treasury Division officers say the Biden administration desires states to have ample sources to cowl quick prices associated to rising from the pandemic and to have the ability to pay for extra expansive providers to assist individuals who had been hardest hit.

However many states and cities are eyeing windfall spending plans that go effectively past repairing their security nets. Gov. Gavin Newsom of California, a Democrat dealing with a recall vote, has proposed a sequence of spending will increase, together with $1,100 stimulus checks to people and tax credit for filmmakers.

In Florida, the income forecast for 2021 has been revised upward twice up to now yr. The state is now anticipated to get $8.Eight billion from the federal authorities. Ben Watkins, the director of the Florida Division of Bond Finance, stated the state was utilizing the aid cash to spend money on infrastructure and water high quality tasks and directing a few of its surplus funds to hurricane preparedness.

He described the windfall as staggering.

“It’s a superb downside to have,” Mr. Watkins stated, “however that doesn’t imply that it’s not extreme.”

States have substantial leeway in how they use the cash, although they’re prohibited from utilizing the funds to subsidize tax cuts. A number of Republican-led states have sued the Treasury Division, arguing that the restriction infringes on state sovereignty.

The lawsuits don’t look like slowing the supply of the funds. Ohio didn’t win an injunction blocking the restrictions from being enforced this month, and Missouri had its case thrown out of courtroom after a federal choose stated the state didn’t exhibit that the legislation induced it hurt.

The Treasury Division plans to intently monitor how the cash is spent and whether or not states are utilizing funds gimmicks to truly fund tax cuts. The company maintains that the federal authorities has a proper to put situations on how federal funds are used and that states are allowed to say no the cash. A Treasury Division official stated that no state had indicated but that it might reject the funds.

Within the meantime, states which might be flush with revenues are urgent forward with their plans. Nebraska authorized a $26 million company tax lower final week, and lawmakers have advised The Omaha World-Herald that they imagine that by conserving the federal funds in a separate account from the state’s basic fund, they are going to be in compliance with the legislation.

Nicholas Fandos and Dana Goldstein contributed reporting.