Suppose you’re a single mum or dad elevating two younger youngsters, ages Three and 5. You have been furloughed within the spring, when the big-

Suppose you’re a single mum or dad elevating two younger youngsters, ages Three and 5. You have been furloughed within the spring, when the big-box retailer you labored at downsized. You began getting hours once more in the summertime, enduring substantial threat by going to work with prospects who didn’t all the time put on masks. Little one care was a large number, and also you needed to scrape collectively assist from household and associates.

It was a tough 12 months — however you stayed afloat. In whole, you ended up working about 1,000 hours final 12 months at $14 an hour, or $14,000 whole — plus there have been the 2 stimulus checks the federal government despatched out in April and December.

Much less heralded however no much less essential to serving to you pay the payments have been a few tax credit the federal government gives: You bought $1,725 by means of the sophisticated little one tax credit score (CTC) and one other $5,600 from the earned revenue tax credit score (EITC). That got here out to $7,325 — a badly wanted infusion. However as is the case yearly, it was additionally a ache — you mainly must go to a tax preparer each tax season that can assist you with the paperwork to assert the credit.

This week, your member of Congress, in an unprecedented act of constituent outreach, asks you to hop on a Zoom. She’s engaged on laws meant to make life simpler for single dad and mom such as you, together with a stimulus test. But it surely’s the 2 choices to reform the tax credit that she needs to ask you about.

The primary possibility: The federal government will enhance your CTC a ton, so that you get a whopping $7,200 a 12 months ($3,600 per little one), not simply $1,725. As a substitute of a lump sum at tax time, the federal government will ship you the cash each month or so. Underneath this situation, you’d nonetheless get the $5,600 from the EITC. The draw back? You’d nonetheless must undergo all that tax prep each spring.

The second possibility: The federal government will junk the CTC — and can simply ship you $700 monthly within the mail. That’s $350 per child below 6, each month, no matter whether or not you owe taxes or not. Maybe simply as interesting, there’s no tax-season paperwork to arrange. That’s $8,400 per 12 months whole, much more than the CTC in possibility one. The draw back on this situation: below this plan, the EITC shrinks — and your EITC goes right down to $2,000.

To recap: Each offer you more cash than you get now. Choice one offers you more cash than possibility two. However possibility two makes your life a lot simpler logistically. You get massive common month-to-month funds whose quantity doesn’t differ. And you’d now not be in a determined rush each spring to get your tax return in to your massive refund.

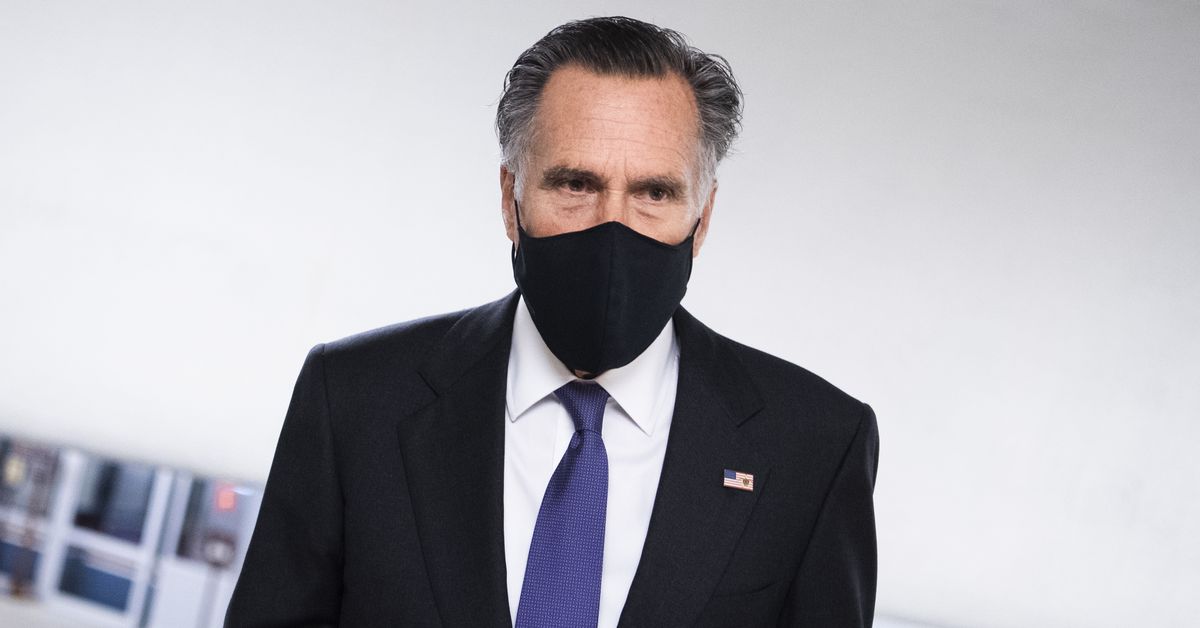

Choice one above is what Democrats in Congress and the Biden administration wish to do to deal with little one poverty. Choice two is Republican Sen. Mitt Romney’s plan to enact a brand new, simplified little one allowance.

The controversy over the previous month about which of those insurance policies to pursue has sometimes targeted on the full greenback quantities, and which individuals are higher or worse off below Democrats’ or Romney’s approaches. That’s essential, and price arguing about.

However underappreciated within the debate is which of the insurance policies is easier. Romney has thrown down a gauntlet not simply in proposing a serious new coverage to handle little one poverty, however in proposing a option to dramatically simplify the welfare state. Democrats can be lacking a serious alternative in the event that they have been to reject Romney’s simplification measures as a result of his general plan isn’t beneficiant sufficient for his or her style.

Congress has an opportunity to not simply debate these two choices however take the very best from every, and construct a baby profit that’s each extra beneficiant and easier than the present system. The consequence can be an enormous win for poor households, and an enduring constructive legacy for the Biden administration.

The dueling little one profit plans in Congress are extra consequential than you suppose

The present debate over the kid allowance has been formed by years of advocacy and proposals on the problem. In latest weeks, nonetheless, the concept has hit a brand new gear with competing legislative proposals from all sides of the aisle.

The Democrats’ proposal expands the kid tax credit score to be value $3,000 a 12 months per little one aged 6-17 and $3,600 a 12 months per little one below 6, and makes it accessible for the primary time to folks with low or zero earnings. Biden’s plan would make it accessible for one 12 months as a part of pandemic aid, however the American Household Act, newly reintroduced in Congress by main Democrats, would enact the growth completely. (Nonetheless, the Biden proposal is extensively understood as a primary step towards a everlasting growth.)

In the meantime, Romney (R-UT) has proposed possibility two: a simplified test within the mail for all American dad and mom, paid for partially by reducing again on different applications just like the EITC.

It’s not as beneficiant for a lot of working poor households because the Democratic plan, as within the instance above, however extra beneficiant for others. If you happen to had two younger youngsters and weren’t in a position to work any hours in 2020, and so had no “earned” revenue, you’d get $7,200 below the Democrats’ plan however $8,400 below Romney’s (that’s in comparison with $Zero below present legislation). In that situation, the EITC was doing nothing for you anyway, and so changing it with a extra beneficiant CTC is only a win. Identical factor when you’re a middle-class single mum or dad of two incomes $50,000 a 12 months; this mum or dad additionally at present will get nothing from the EITC and $4,000 from the CTC, however would get $7,200 from the Democratic plan and $8,400 from Romney’s.

The individuals who lose out in Romney’s plan relative to Biden’s are ones just like the mum or dad in our opening instance: working dad and mom who earn below $40,000 or so. A single mum or dad of two younger youngsters incomes $25,000 will get $8,341 below present legislation, $10,114 below Romney’s plan, and $12,026 below the Democrats’ plan.

The controversy over Romney’s plan has, predictably, concerned debates about which of those teams want roughly assist. Specialists on the Heart on Finances and Coverage Priorities, which has been one of many largest institutional backers of the EITC and thus deserves credit score for lifting thousands and thousands out of poverty for that work, are skeptical of giving up these hard-fought features for Romney’s plan, particularly when the precise individuals the EITC helps most (low-income working single dad and mom) stand to lose in Romney’s plan relative to Biden’s:

Please, liberal commentators, ask yourselves whether or not having house well being aides & grocery cashiers pay for or an expanded Little one Tax Credit score is healthier than some apparent progressive alternate options (e.g. rich heirs, actual property companions, rich shareholders)

— Chuck Marr (@ChuckCBPP) February 7, 2021

However there’s one other aspect right here that wants extra consideration, one which presents itself even in situations the place the Romney plan gives much less whole cash than the Biden plan: How simple do we would like it to be to entry the welfare state? How a lot of an overhaul does the person interface of our authorities want so as to be maximally helpful to residents? And the way a lot are we keen to consolidate or rework present applications to make the person interface as simple as attainable to work together with?

The Romney plan, by eliminating the convoluted tax-season routine of attempting to get these advantages, successfully points a problem to well-meaning liberals in DC who’ve targeted totally on increasing, not simplifying, advantages.

Increasing advantages is nice; increasing advantages greater than Romney needs is healthier nonetheless. Increasing and simplifying advantages can be better of all. And liberals and Democrats haven’t targeted sufficient on the second objective.

The issue with the American security internet

Let’s return to our hypothetical mum or dad.

If you happen to make $14,000 a 12 months, there are a bunch of state and federal applications on the market that can assist you. And by “a bunch,” I imply a bunch.

Relying on the state you’re in, you could qualify for Medicaid. It’s not so easy although — you’re eligible in each state that did the Obamacare growth however a bunch of states (Texas, Florida, Georgia, North Carolina, Mississippi) set the cutoff to be eligible a lot decrease. In Texas, single dad and mom must make lower than $277 a month to qualify, so on this situation, you’d be approach too “wealthy.” (And getting your youngsters coated by means of Medicaid or S-CHIP is an entire different can of worms.)

Want housing? You may apply for a housing alternative voucher below the Part Eight program, however it’s underfunded so you’ll have to navigate years or many years of waitlists.

Need assistance with little one care and early training? There’s Head Begin and Early Head Begin. As well as, there’s the federal Little one Care and Growth Block Grant — however you in all probability gained’t get it; solely about 15 % of income-eligible households do, and relying in your state you may need to be enrolled in a proper welfare-to-work program.

Talking of which, you may get some cash from Short-term Help for Needy Households (TANF). However once more, most don’t, and for individuals who do it’s strictly time-limited and requires tedious “work stories” to show you’re not too “lazy” to deserve it.

Within the winter, when you need assistance with warmth, there’s the Low Revenue Residence Power Help Program (LIHEAP) — however solely 20 % of eligible households get it.

You’ll in all probability have the ability to get Supplemental Diet Help Program (SNAP) advantages, or meals stamps, to assist with groceries. When you have an toddler you may in all probability get help from the diet program for ladies, infants, and youngsters. There are in all probability another applications I’m forgetting.

Conservatives and libertarians generally see this laundry record and suppose, “Take a look at how a lot we do for poor individuals!” I see it and suppose, “Take a look at how ridiculously sophisticated the system we make poor individuals navigate is.”

Georgetown political scientists Don Moynihan and Pamela Herd name these prices imposed on poor individuals by the security internet system “administrative burdens.” It’s a chief instance of what fellow political scientist Steve Teles has dubbed “kludgeocracy” — a authorities held collectively by means of “inelegant patch[es] put in place to unravel an sudden drawback” somewhat than designed to work cleanly from the beginning. Teles argues this piecemeal method additionally results in exorbitantly excessive compliance prices, makes authorities administration harder, and makes it simpler for companies to extract rents from the federal government.

It additionally has broader implications for the political system. Suzanne Mettler, a political scientist at Cornell, calls the method the “submerged state,” and argues it erodes public perception within the effectiveness of presidency by hiding the federal government advantages voters obtain from view. Center-class Individuals who acquired backed scholar loans to pay for faculty and deduct mortgage curiosity from their taxes are getting authorities advantages too, however these advantages aren’t perceived the identical approach as, say, Social Safety.

Biden’s plans proper now are too kludgey

Which brings us again to the kid allowance debate taking place at this time, and Democrats’ plans to bolster the welfare state extra broadly.

Romney’s little one allowance plan is beneficiant. The Democrats’ plan is much more so. However Romney’s plan has one edge: It simplifies issues for the individuals it’s supposed to profit.

It’s a function that Democrats ought to actually take note of — and, ideally, steal.

Biden has a whole lot of actually formidable plans to make the welfare state extra beneficiant for Individuals throughout the board. I’ve written so much about them, and customarily talking I feel they’re good concepts.

However an excessive amount of of it consists of fixing the prevailing kludgey system or making it much more kludgey, even because it makes it extra beneficiant.

Maybe the very best instance is Biden’s primary proposal on little one and elder care. This can be a actual level of ardour for Biden, who views higher caretaking as important “infrastructure” for the broader financial system. And his plan to increase it’s formidable.

At its middle is a proposal to vastly increase the kid and dependent care credit score. That credit score, because it at present stands, is frankly horrible. It’s not “refundable,” which suggests the roughly 43 % of Individuals who don’t owe revenue taxes get nothing. And it’s not despatched out upfront, so it doesn’t assist dad and mom pay their little one care prices as they’re incurred; it simply refunds a little bit of them come tax season.

Biden’s plan makes the kid care credit score greater and higher. He makes it totally refundable, so poor Individuals profit for the primary time, and vastly expands the utmost credit score, making it value as much as $8,000 for households with a number of youngsters, up from $2,100 now. The plan would cowl as much as half of kid care prices, whereas for many individuals at this time the credit score solely pays 20 % of prices.

However partially as a result of it’s achieved by means of the tax code, it’s nonetheless delivered suddenly, at tax season. That raises the weird specter that households may need to take out loans to pay little one care prices till they get their tax refund, one thing that occurs to a point with the EITC as effectively. It might be significantly better for the profit to be unfold out over the 12 months within the type of month-to-month funds, because the Tax Coverage Heart’s Elaine Maag and Nikhita Airi notice.

It might be higher nonetheless to take it out of the tax code altogether. The federal authorities might simply provide a baby care profit to individuals each month that’s completely unrelated to individuals’s taxes. It has the expertise; that is mainly how meals stamps work now. Individuals who qualify might use their EBT card to pay at little one care facilities instantly somewhat than working by means of the tax code. If Biden needed to get extra formidable, he might undertake a plan like Elizabeth Warren’s to arrange government-run little one care facilities nationwide, much like Head Begin or, certainly, to public faculties.

The identical kludginess might be present in Biden’s tax plan. The extra portion of the $3,000/$3,600 per 12 months little one credit score he’s proposing, on high of present legislation, has a special phaseout schedule than the prevailing credit score, because the Folks’s Coverage Challenge’s Matt Bruenig notes. It phases out first at $112,500 for single dad and mom right down to $2,000 per little one, after which phases out once more to $Zero per little one beginning at $200,000 for singles (the married phaseouts are larger).

That is, suffice it to say, extremely complicated. The plan, as written by Home Methods and Means Chair Richard Neal (D-MA), additionally has one thing of a “clawback” drawback. It pays out to households based mostly on their taxes the earlier 12 months, so if a baby aged out of the credit score, or the household begins making more cash, they may get a test that’s too massive and must pay it again at tax time. The Neal plan has a “secure harbor” provision to stop these clawbacks, however meaning there must be an entire new algorithm round what that secure harbor seems to be like.

The plan nonetheless requires submitting tax returns each tax season, each for the kid credit score and for the earned revenue tax credit score, which might live on in its present type. As Bruenig likes to notice, this reduces take-up charges — which means many individuals who would profit find yourself not getting it due to the complexity of the method. Social Safety’s take-up fee for outdated age insurance coverage is about 100 %, as a result of it is aware of how a lot everybody made of their profession and is excellent at monitoring that and sending out checks. The EITC’s take-up fee is extra like 78 %. Biden’s plan doesn’t do a lot to maneuver from 78 to 100 %.

Kludgiest of all, Biden is proposing his little one profit plan for just one 12 months. Everybody, and I imply everybody, I speak to within the DC tax credit score world thinks that’s a bluff and that he needs to make it everlasting. So why not simply say that? Why ask the IRS to set one thing this sophisticated up with the idea it’ll instantly go away?

What Biden can take from Romney

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/22323261/1299853618.jpg)

What I want to see is Biden adopting the very best elements of Romney’s plan, and its name for better simplicity, and marry it along with his better ambition on tax credit.

Right here’s one option to do it:

If Biden needs to win bipartisan assist by paying for a few of this by eliminating less-used social help applications like LIHEAP and TANF, I might be superb with that. These applications are largely failing anyway and with advantages as beneficiant as these above, nobody would truly be made worse off. I’ll be joyful as long as the entire bundle is financed by means of deficit spending or upper-income tax hikes, and profit cuts in older applications are made up for by hikes within the new, simplified applications.

However the important thing in regards to the above mannequin is that it’s not remotely kludgey. It takes the executive burden away from poor households and places it the place it must be: the federal authorities. Poor households wouldn’t must file taxes anymore, and would as an alternative get common, dependable checks within the mail each month.

That world is feasible, and I feel the Biden administration and its allies in Congress know that world is healthier than a large number of tax credit. Right here’s hoping they work towards it.