A viral chart made the rounds as a result of, as Christopher Ingraham of the Washington Post mentioned, it appeared to elucidate “why folks real

A viral chart made the rounds as a result of, as Christopher Ingraham of the Washington Post mentioned, it appeared to elucidate “why folks really feel financially confused in a booming economic system.”

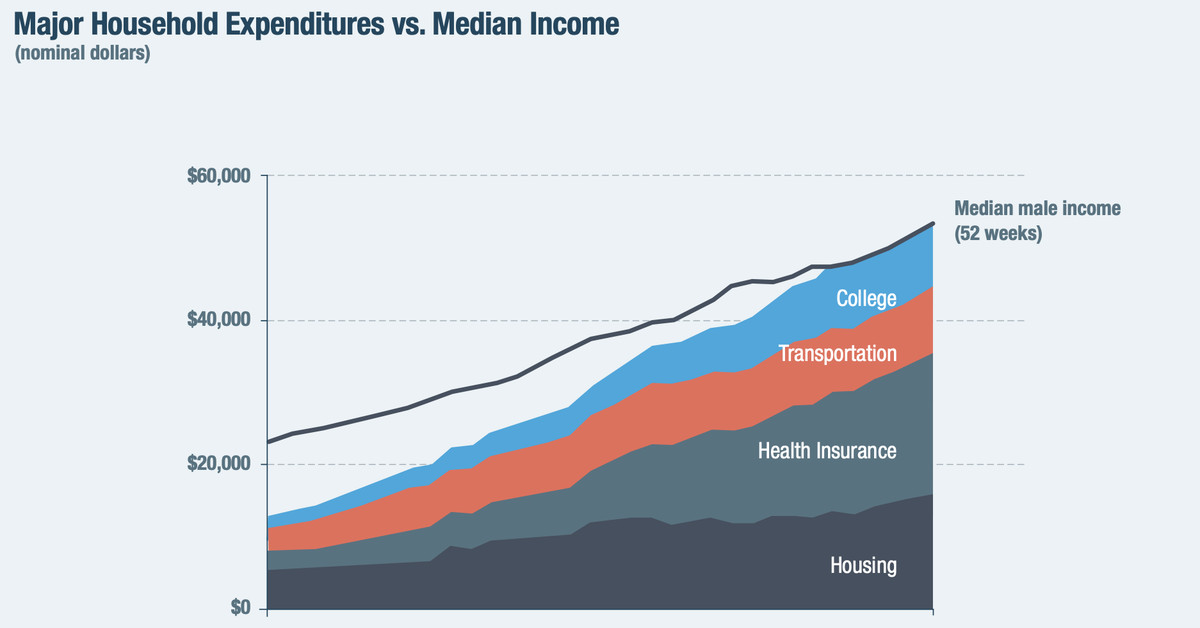

The chart comes from Oren Cass, a former prime coverage adviser to Mitt Romney who’s now reconceptualized himself as a wonkish face of populist conservatism. He has a brand new report on middle-class dwelling requirements, full with a putting chart that purports to indicate that the fundamental parts of the great life — housing, faculty tuition, transportation, and medical health insurance, all as soon as simply inexpensive — have now fallen out of the grasp of the standard American household.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/19743248/Screen_Shot_2020_02_24_at_2.28.49_PM.png)

Cass’s methodology is to plot median male wages in opposition to the typical value of every of those to indicate that in 2018, you’d must work greater than 52 weeks a 12 months to purchase all of them. In contrast, in response to the chart, in 1985 these expenditures had been simply inexpensive.

The intervening years have seen massive enhancements within the high quality and worth of telecommunications providers, residence leisure, and different points of life. However, so the speculation goes, that doesn’t matter as a lot because the core requirements. The power to stream The Empire Strikes Again in your cellphone or have your child FaceTime along with his grandparents is trivial in comparison with the flexibility to afford these massive 4 commodities.

For a sure kind of middle-class American, which may really feel true. However it doesn’t actually clarify the “monetary stress” Ingraham referred to, partly as a result of it’s actually not clear that folks do really feel financially confused in a booming economic system.

Faculty and medical health insurance are cheaper than this chart says

The school portion of the “value of thriving” index is probably the most clearly problematic merchandise on the listing, just because only 30 percent of young people enrolled in a four-year faculty — a share that’s mainly at a report excessive.

In different phrases, the median wage earner could not have children who’re attending a four-year faculty, so it’s not clear why you’ll make this comparability. Cass’s statistic additionally contains room and board together with tuition, which, once more, many students don’t pay. However maybe most egregiously, he’s wanting on the sticker value of school, though most students receive grants to partially defray the price of faculty.

The determine for medical health insurance, which the median American household does have, suffers from a extra delicate however critically essential flaw. As Stan Veuger of the American Enterprise Institute pointed out on Twitter, Cass compares wages (excluding fringe advantages like employer contributions to medical health insurance plans) to the entire value of employer-provided medical health insurance (together with each what the worker pays and what the employer pays).

Consequently, rising employer-side spending on employees’ well being plans registers on this chart as medical health insurance turning into much less inexpensive. For the reason that rising value of well being care is the primary driving power behind this chart, the truth that it isn’t calculated appropriately is a large downside.

Vehicles have really gotten cheaper and higher

Cass additionally contains an odd argument about the best way the federal government calculates inflation to drive his conclusion that automotive possession has develop into much less inexpensive when official information says it’s develop into extra inexpensive.

His fundamental argument is that the BLS deflates the worth of vehicles on the grounds that the standard has improved, however that this doesn’t show you how to in case you’re strapped for money. The truth that a bespoke swimsuit could be in some quality-adjusted sense a “good purchase” doesn’t change the truth that it’s costly, and the identical, Cass thinks, applies to vehicles.

4/ For instance, our inflation-adjusted information say automotive costs haven’t elevated for the reason that mid-1990s. Clearly, that is not remotely true. What economists are saying is that vehicles have gotten higher so the upper sticker value does not mirror inflation, it displays greater high quality.

— Oren Cass (@oren_cass) February 20, 2020

5/ Honest sufficient. However, in case you’re a household that should purchase a minivan, whereas it is good that the 2018 Grand Caravan ($26,300 in 2018) has many options the 1996 Grand Caravan ($17,900 in 1996) didn’t, you continue to face the issue that you simply want an additional $8,500 to purchase one.

— Oren Cass (@oren_cass) February 20, 2020

6/ A key assumption of our inflation-adjusted analyses is that previous merchandise are nonetheless out there. Do not like / cannot afford the $26Okay 2018 Grand Caravan, go purchase the $18Okay 1996 one as a substitute. Besides you possibly can’t. Similar downside is much more pernicious in areas like housing and well being care.

— Oren Cass (@oren_cass) February 20, 2020

However this isn’t proper.

The explanation automakers don’t promote low-end new vehicles like an $18,000 minivan is that the low-end is now served completely effectively by pre-owned vehicles — as a result of vehicles have gotten higher. You’ll be able to’t journey again in time to get a brand-new $18,000 Grand Caravan from 1996, however you possibly can go on Carvana and purchase a 2018 Dodge Caravan for $16,800.

It is a lot of automotive discuss, however the level is that in 2020, you should buy a 2018 Dodge Grand Caravan for much less cash in nominal phrases than you’ll have paid in 1996. And it will have means higher options like Bluetooth, superior airbags, and a backup digicam.

The truth that the variety of vehicles per family has gone up since 1985 might be an excellent signal that vehicles have gotten extra inexpensive. Homes are larger, too, for that matter. And the kicker is that polls say many individuals are proud of the present state of the economic system and their present funds.

There’s not a lot financial anger to elucidate

The putative function of those inquiries is to elucidate why individuals are so upset in regards to the state of the economic system regardless of the low headline unemployment charge and regular GDP development.

However in response to Gallup, a record-high 90 percent of the public says they’re happy with their personal life. Gallup additionally says there’s “Record-High Optimism on Personal Finances in U.S.” Client confidence is high and rising.

Certainly, if something, you could possibly make the case that the subjective “smooth” information is extra optimistic than the target numbers warrant. Regardless of low unemployment, for instance, the share of Americans ages of 25 to 55 with a job nonetheless hasn’t recovered to its 1999 degree. So wage development, whereas actual, has been pretty modest since there continues to be slack within the labor market. However the economic system is doing higher than it’s been in practically 20 years, and folks appear fairly blissful about it.

What this implies for the presidential election

We’re doubtlessly dealing with a normal election between President Donald Trump and sophistication warrior Sen. Bernie Sanders, so this might all develop into extremely related in November. It’s price contemplating the likelihood that each the Trump and Sanders phenomena are kind of about what their leaders say they’re about.

Trump talks loads in regards to the economic system, however he talks about immigration extra. The foreign-born share of the inhabitants is far greater immediately than it was in 1985, and the rise of Trump reveals many Individuals have anxieties about that.

By the identical token, Sanders usually talks about the way it’s outrageous that the richest nation on earth has a excessive baby poverty charge and that it’s weird the US can’t present common well being care when each different massive wealthy nation (plus many not-so-rich ones) does it.

Sanders’s fundamental level in regards to the threadbare nature of the American welfare state is clearly true, as is Trump’s fundamental level that the character of American society is altering. It’s not shocking that they could trigger worries for folks.

Certainly, one would possibly anticipate to see folks fear extra about this sort of factor throughout a interval of prosperity, which permits them to vote their values and beliefs reasonably than worrying a lot about financial administration.