One of many conservative authorized motion’s oddest obsessions entails one thing often called the “unitary government,” the concept that all fed

One of many conservative authorized motion’s oddest obsessions entails one thing often called the “unitary government,” the concept that all federal officers who execute federal legislation have to be accountable to the president of the USA, which incorporates the president’s proper to fireside many senior authorities officers at will.

This obsession birthed a $124 billion Supreme Courtroom case, Collins v. Yellen, that threatened to throw your complete US housing market into turmoil, until a majority of the Courtroom was prepared to take a pair steps again away from its virtually spiritual devotion to the unitary government doctrine.

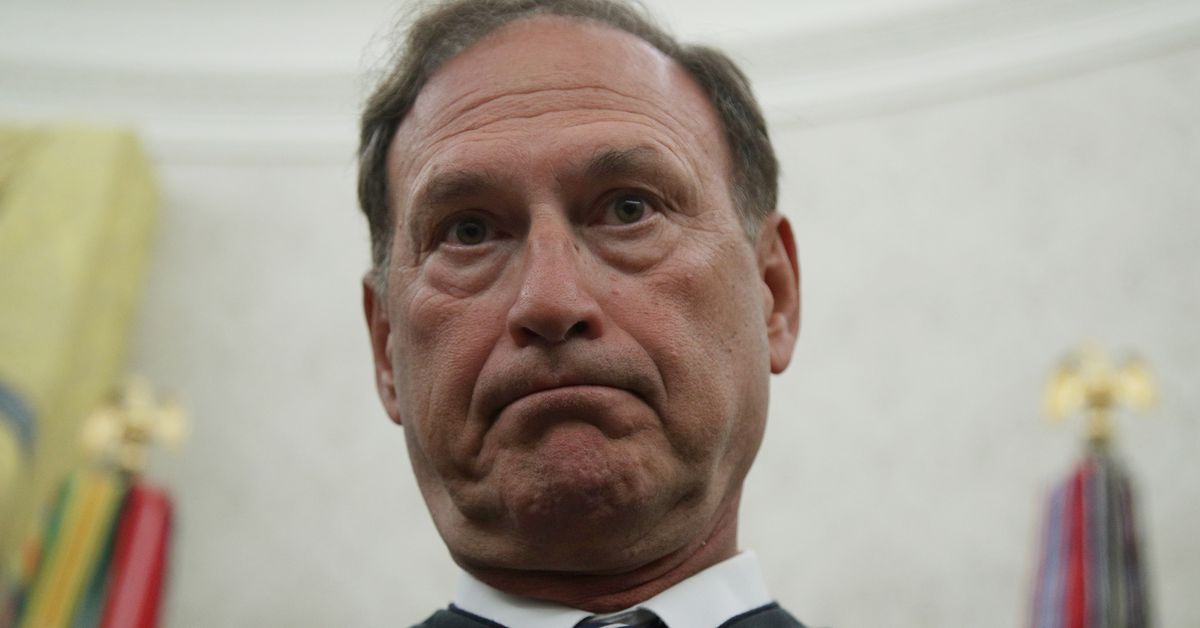

On Wednesday, the Courtroom did simply that. Though Justice Samuel Alito enthusiastically supported the unitary government doctrine previously, he wrote a majority opinion in Collins that walks again a few of that doctrine’s most frightful implications. The vote in Collins was a bit messy, with totally different justices becoming a member of totally different elements of Alito’s opinion, however each member of the Courtroom apart from Justice Neil Gorsuch agreed that the plaintiffs in Collins requested for a lot an excessive amount of.

Alito’s choice doesn’t abandon the unitary government, but it surely steps again from a number of the extra alarming elements of the Courtroom’s earlier selections making use of this and related doctrines. The Collins plaintiffs made a completely believable argument below these selections that may have had devastating real-world penalties — on this case, an earthquake for the housing sector — however the Courtroom selected to keep away from that path.

The unitary government had a earlier check in entrance of the Supreme Courtroom in Seila Regulation v. CFPB (2020). In that case, the Supreme Courtroom struck down a federal legislation that gave the director of the Shopper Monetary Safety Bureau a level of independence from the president. Beneath that legislation, the CFPB director served a five-year time period and will solely be fired for “inefficiency, neglect of responsibility, or malfeasance in workplace.”

The premise of the unitary government doctrine is that each one officers who execute federal legislation have to be accountable to the president. That signifies that the president sometimes should have the ability to hearth company leaders and different high authorities officers at will — a view that the Supreme Courtroom upheld in 2020. After Seila Regulation, President Joe Biden or whoever else occupies the White Home can hearth the pinnacle of the CFPB each time they need.

Collins entails a unique company, often called the Federal Housing Finance Company, but it surely entails the very same situation as Seila Regulation. A federal legislation gives that the pinnacle of the FHFA might solely be fired “for trigger.” The Courtroom’s choice in Collins applies the Courtroom’s holding in Seila Regulation, and holds that the president will need to have the facility to fireside the FHFA director at will.

However that’s just one a part of the Collins choice. The actual query in Collins is what penalties circulate from the truth that, from 2008, when the FHFA was created, till the Courtroom’s choice in Collins, the president didn’t have the facility to fireside the pinnacle of that company. And the plaintiffs on this case claimed that some really outlandish penalties comply with.

The FHFA was created to restore the housing market turmoil that sparked the 2008 recession, and to forestall related crises from occurring once more. In finishing up this mission, the company successfully took over Fannie Mae and Freddie Mac, two semi-public corporations that play an essential function in stabilizing the mortgage trade. Then it oversaw a whole lot of billions of {dollars}’ price of transactions with the Treasury Division to maintain these two corporations afloat.

The Courtroom’s earlier selections, nevertheless, have some language suggesting that any motion taken by an company led by a director who’s unconstitutionally shielded from presidential accountability is void — and that’s actually how the plaintiffs in Collins learn these selections. They argued that actually each motion taken by the FHFA since its creation 13 years in the past have to be declared invalid.

Had the Supreme Courtroom agreed with this method, it might have meant that all the a whole lot of billions spent to prop up Fannie and Freddie had been spent illegally. It’s exhausting to even think about the way to unravel these transactions, and the method of doing so may have sparked one other housing disaster just like the catastrophic 2008 meltdown.

In any occasion, when confronted with the potential of being chargeable for one of many best monetary crises in trendy American historical past, Justice Alito blinked, as did most of his colleagues. Collins didn’t result in an apocalyptic occasion; as an alternative, it can stand as a warning of what can go mistaken if the Courtroom is just too cavalier about remaking our constitutional system in a conservative picture.

Why was a lot at stake on this case?

To grasp the dire penalties of a ruling for the plaintiffs in Collins, it’s essential to return and recount what occurred throughout the 2008 housing disaster — and the way the federal authorities responded to that disaster in ways in which benefited hundreds of thousands of Individuals, however that additionally price sure traders a very good amount of cash.

Fannie and Freddie (also referred to as the Federal Nationwide Mortgage Affiliation and the Federal House Mortgage Mortgage Company) function in an uncommon grey space between the private and non-private sectors. Though each corporations are publicly traded and have some personal shareholders, they had been chartered by Congress and are closely regulated by the federal authorities. Amongst different issues, the FHFA was given the facility to successfully take management over each corporations.

The 2 corporations purchase residence loans from banks and different lenders, pool these loans collectively, after which promote shares of those pooled loans as “mortgage-backed securities” to non-public traders. As Alito explains in his Collins opinion, this course of “relieve[s] mortgage lenders of the danger of default and free[s] up their capital to make extra loans.” Quite than having to attend 30 years for a borrower to repay a mortgage, Fannie and Freddie permit banks to obtain an instantaneous infusion of money that they will re-lend.

Fannie and Freddie, nevertheless, will not be the one gamers on this mortgage-backed securities market. Within the lead-up to the 2008 housing disaster, many banks made costly subprime loans to debtors who lacked the means to pay them again. Some funding banks then purchased up these dangerous loans and packaged them collectively as high-risk securities. And Fannie and Freddie received into this sport within the mid- to late 2000s.

Then, within the late 2000s, housing costs began to drop. Many subprime debtors discovered themselves with a mortgage they couldn’t afford to pay again, and a house that had misplaced a lot worth it was price lower than the quantity they nonetheless owed on their mortgage. A wave of defaults ensued, driving housing costs even decrease. The lending market began to dry up, and Fannie and Freddie misplaced $108 billion — extra money than they’d made within the earlier 37 years mixed.

On the time, Fannie and Freddie both owned or assured about $5 trillion price of mortgage belongings, or about half of all residence loans in the USA. Many feared they had been teetering on the point of insolvency, and that they might have taken your complete US housing market with them in the event that they did collapse.

To forestall such a cataclysm, the FHFA invoked its energy to take cost of Fannie and Freddie. It then entered right into a sequence of agreements with the Treasury Division to inject a whole lot of billions of {dollars} into Fannie and Freddie’s coffers. The settlement between the 2 corporations and the Treasury was amended a number of instances, and, below the model that was in impact from 2012 till this January, the businesses agreed to pay all cash that they earned in extra of a $three billion reserve again to the Treasury Division.

Because it seems, the businesses’ fortunes improved shortly after this 2012 modification went into impact, and Fannie and Freddie wound up paying the federal government $124 billion greater than they might have below a earlier model of their settlement with the Treasury Division. These misplaced income enraged lots of the two corporations’ personal traders, who wished a share of that cash for themselves.

And so the Collins litigation started. The plaintiffs hoped to invalidate the 2012 modification to Fannie and Freddie’s settlement with Treasury, however they superior a authorized principle that was so sweeping in its implications that it may have thrown Fannie, Freddie, the FHFA, the Treasury Division, and your complete housing market into chaos.

Once more, their argument was that any motion taken by the FHFA whereas the company’s director was shielded from termination is void. That will have meant that the FHFA and the Treasury Division would in some way have needed to unravel greater than a decade’s price of transactions — transactions involving extra money than the gross home product of Ecuador — that had been taken for the specific function of stopping an financial disaster unparalleled for the reason that Nice Melancholy.

Alito and the Courtroom’s “unitary government” believers blink

If that prospect sounds bonkers, that’s as a result of it’s bonkers. The Collins case was the authorized equal of a nuclear bomb set to detonate in the midst of the US housing market, until no less than 5 justices agreed to disarm it.

And but the plaintiffs’ arguments had been solely affordable throughout the context of earlier Supreme Courtroom precedents.

To begin with, there was completely no query, after Seila Regulation, that the federal legislation defending the FHFA director from being fired by the president is unconstitutional. As Alito writes in Collins, “the Restoration Act’s for-cause restriction on the President’s elimination authority violates the separation of powers. Certainly, our choice final Time period in Seila Regulation is all however dispositive.”

Second, earlier Supreme Courtroom selections suggest that when an company head is badly shielded from being fired by the president, the right plan of action is to invalidate that company’s actions until they had been later ratified by an official who’s accountable to the president. Because the Courtroom prompt in Bowsher v. Synar (1986), an official who just isn’t correctly accountable to the president “will not be entrusted with government powers.”

Or, as Justice Neil Gorsuch mentioned, in a partial dissent in Collins that’s Joker-esque in its nihilism, “unconstitutionally put in or improperly unsupervised” officers “can not wield government energy,” and any “makes an attempt to take action are void.”

However no different justice joined Gorsuch’s opinion, and Alito’s opinion for the Courtroom may be summarized in a single tweet:

Me sowing: Haha fuck yeah!!! Sure!!

Me reaping: Properly this fucking sucks. What the fuck.

— The Golden Sir (@screaminbutcalm) March 12, 2019

To be clear, the unitary government doctrine remains to be the legislation. And it may nonetheless create mischief sooner or later. Amongst different issues, if all officers who train government energy have to be topic to termination on the president’s whim, unbiased boards just like the Federal Reserve may probably lose that independence, permitting the president to stress these boards into handing down purely political selections.

However, on the very least, the Courtroom seems unwilling to permit hyper-technical violations of this doctrine to convey down greater than a dozen years of labor that will have saved us all from a melancholy.

Although the pinnacle of the FHFA have to be detachable at will by the president, Alito argues in his opinion that “there was no constitutional defect within the statutorily prescribed technique of appointment to that workplace” — that’s, an FHFA director who’s nominated by the president and confirmed by the Senate should train government energy. Their earlier actions will not be void.

It’s pretty much as good a cause as any to not gentle the nation’s economic system on hearth.