As Congress continues to barter over the $1.9 trillion stimulus bundle, a bunch of bipartisan lawmakers have proposed extra restricted funds by

As Congress continues to barter over the $1.9 trillion stimulus bundle, a bunch of bipartisan lawmakers have proposed extra restricted funds by reducing the earnings threshold for who will get the total $1,400 profit.

Their proposal would start phasing out the profit for people incomes over $50,000 and married {couples} incomes greater than $100,000. Earlier stimulus checks had phaseout thresholds at $75,000 per particular person and $150,000 per family.

A number of members of Congress, from each events, have argued for sticking to the unique concentrating on. President Joe Biden, in the meantime, has signaled he’s open to revisiting the earnings thresholds. On Sunday, Treasury Secretary Janet Yellen broached the thought of limiting checks to these making $60,000 or much less per 12 months.

A few of these advocating for extra focused assist say you will need to restrict checks to lower-income folks, who they see as probably to spend the cash shortly to assist stimulate the economic system and are additionally extra prone to want it to satisfy on a regular basis bills.

The restoration from the Covid-19 recession has been unequal. Larger-income People have been largely insulated from job losses. Owners have seen wealth develop. Private financial savings have elevated, too, over the course of the pandemic, partly on account of earlier stimulus measures. This has sparked concern amongst some lawmakers that the third spherical of checks ought to be extra focused so that they don’t go households who’re already financially safe.

However on the coronary heart of the political debate is one thing much less tutorial and extra visceral — who do lawmakers, and their constituents, suppose deserves a 3rd stimulus cost?

In a Vox/DFP ballot, 60 % of People supported means-testing the stimulus checks, agreeing with the assertion: “Checks ought to be phased out based mostly on earnings so larger earnings folks obtain much less cash.” Opposition to the rich receiving monetary help from the federal government isn’t shocking, however the reputation of means-testing this profit helps clarify why there’s such a fierce debate raging over what is going to seemingly be a comparatively small a part of Biden’s last bundle: Lawmakers and their constituents need “equity,” even when they’ve a tough time defining what that’s.

The financial debate over concentrating on the checks, defined

On the middle of the financial debate over the stimulus checks is the query: What are the $1,400 funds for?

These funds have generally come to be often known as “stimulus checks,” although their official identify is Financial Impression Funds. So the query of who will use the cash to positively have an effect on the economic system by instantly spending it has dominated the controversy.

The Covid-19 recession shouldn’t be like a traditional recession — in lots of locations, broad swaths of companies are closed or have restricted capability. Even the place they’re open, many sorts of in-person financial exercise, like eating indoors, attending giant occasions, or searching in crowded shops, are dangerous. Thus, many individuals are independently selecting to keep away from the very varieties of financial exercise which is required for stimulus to work.

Some economists, like Noah Smith, have argued that we should always as a substitute consider stimulus funds as social insurance coverage. The aim of those funds could possibly be to assist those that have suffered financially in unseen methods however possibly weren’t laid off (e.g., took a pay minimize at work, should pay elevated little one care prices, have coronavirus-related medical bills, give up their job to handle their children, and many others) and to make it much less horrible to remain house through the pandemic and maintain your self away out of your family and friends.

Different economists — and lots of lawmakers — don’t see the checks this manner. They speak about them as “stimulus checks” meant to stimulate the economic system by getting folks to spend extra. And a part of the political viability of applications like these is proving that there’s a macroeconomic payoff.

In an evaluation by Alternative Insights, a analysis and coverage institute based mostly at Harvard College, researchers Raj Chetty, John Friedman, and Michael Stepner suggest “concentrating on the following spherical of stimulus funds towards lower-income households would save substantial assets that could possibly be used to help different applications, with minimal affect on financial exercise.” Their findings indicated that individuals with incomes higher than $78,000 spent solely $45 of the $600 cost despatched out within the second spherical in January.

This analysis that has made the rounds on Capitol Hill, one senior Democratic aide informed Vox, who spoke of the recognition of a Washington Put up article which reported on the findings with the headline: “Slicing off stimulus checks to People incomes over $75,000 could possibly be sensible, new information suggests.”

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/22288657/Screen_Shot_2021_02_07_at_10.37.49_PM.png)

Alternative Insights

However some economists are pushing again for just a few causes.

First, there are questions over the info. Alternative Insights is taking a look at spending inside zip codes, not family information. Meaning the researchers aren’t truly evaluating higher-income people with lower-income people, they’re evaluating zip codes with residents whose common incomes are above $78,000 with these under $46,000. Thus, the within-zip code variation could possibly be clouding their outcomes.

Friedman, one of many researchers and a Brown College economist, argues that variation inside zip codes truly helps their speculation. He informed Vox that within the prime 25 % of zip codes by median earnings, half of households in zip codes make lower than $74,000. Since they observe such a small improve in spending following the distribution of the $600 checks, Friedman believes that decrease earnings residents are those who’re truly driving spending in wealthier zip codes.

The spending information comes solely from client credit score and debit card data. Meaning they haven’t any file of money funds or funds made by examine. And the info additionally doesn’t monitor paying down debt like scholar loans, automobile funds, back-rent, different hire or mortgage funds.

Friedman agreed one of these spending is effective, however identified that funds that go in the direction of servicing debt don’t have the direct stimulative impact that purchasing garments, meals, or different items and providers would.

There’s additionally a debate about whether or not the earnings and in the end spending the funds are actually as tightly linked because the Alternative Insights information suggests. Claudia Sahm, an economist who has labored on the Federal Reserve and the Council of Financial Advisors, argued in opposition to new earnings restrictions, pointing to research which discover a stronger reference to liquidity (basically, money available) than earnings.

“You possibly can have a household incomes $150,000 earlier than the disaster they usually could possibly be incomes $102,000 now … a $50,000 drop in earnings is a giant gap,” Sahm informed Vox. “Now, my coronary heart may not bleed for them in the identical manner that it does for a single mother with three children … however the actuality is each of them can not miss a paycheck with out inflicting issues.”

Jonathan Parker, an economist at MIT, emphasised this level in an e mail, including that Alternative Perception’s analysis “doesn’t reply the query as as to whether larger earnings folks spend over a month as a substitute of some days”: Individuals could possibly be placing apart that cash to spend later, as an illustration when there may be mass vaccination. However he nonetheless argued in opposition to sending funds that aren’t strictly focused to these with the best want.

“The standard family has extra earnings and extra wealth than earlier than the pandemic started,” he wrote. “Even in mixture, common earnings is up. Common and median account balances are up. … Bank cards debt in mixture is manner down. The standard American is in nice monetary form.”

Friedman emphasised that the economic system will rebound shortly when the Covid-19 outbreaks are underneath management. “As soon as the general public well being state of affairs recovers, my intuition is that the economic system will snap again fairly shortly given how a lot further financial savings folks have,” he informed me. “I’m unsure sending everybody a $1,400 examine will make that a lot of a distinction.”

That is the place the educational debate collides with the political one. Lawmakers have neither the data nor the state capability to completely goal assist in the best way that Alternative Insights would like (and there’s intensive analysis that placing necessities on folks to “show” they want the cash harms the individuals who want it most).

The political debate over concentrating on the checks, defined

The political debate over equity is a subset of a bigger debate over whether or not President Joe Biden’s $1.9 trillion stimulus bundle is just too huge.

A lot of the Republican caucus says it’s, and this query turned the middle of backwards and forwards between economists, the White Home, and Congress after former Treasury Secretary Larry Summers wrote an op-ed within the Washington Put up warning that the dimensions of the bundle may trigger inflation and scale back future spending on necessary priorities from “infrastructure to preschool training to renewable vitality.” Vox’s Emily Stewart has lined this debate extensively.

But when the issue actually is that Biden’s plan is just too huge, it doesn’t seem that limiting who will get stimulus checks would make it a lot smaller. A proposal floated by some Democrats to restrict examine eligibility to people making underneath $50,000 and {couples} making underneath $100,000 would solely save round $45 billion, based on reporting from the Washington Put up. (Alternative Insights estimates that limiting the checks to households incomes $78,000 or much less would save $200 billion, however that also leaves a really sizable stimulus bundle for these frightened about inflation.) Republicans have gone additional, proposing decreasing the profit to $1,000 as properly.

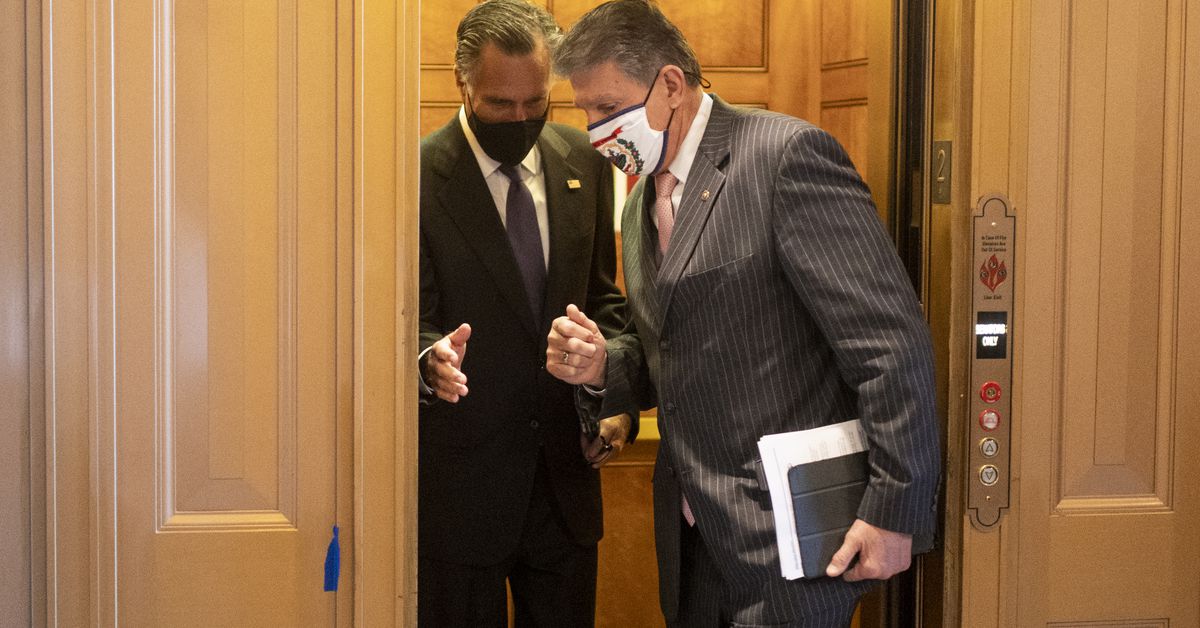

Greater than the deficit, what seems to be behind the “too huge” debate is an age-old query about equity. Final week, the Senate voted 99-1 in favor of a non-binding modification put forth by Manchin to “guarantee upper-income taxpayers will not be eligible” for $1,400 checks. The modification didn’t outline upper-income, however Manchin is likely one of the co-sponsors of a invoice to start phasing out the profit at $50,000.

No lawmaker desires to be seen as being on the aspect of the rich, or giving the “incorrect folks” cash when so many are struggling, however the optics of the controversy are threatening to overwhelm the precise insurance policies being put forth. The actual coverage debate ought to be whether or not an individual incomes $51,000 ought to get the total profit.

There isn’t any cause the federal authorities ought to be sending stimulus checks to households making upwards of $300,000.

#COVID19 aid must be focused at these people who want it probably the most.— Rob Portman (@senrobportman) February 3, 2021

Key Democratic leaders have steered that they’re are open to some degree of concentrating on. Sen. Ron Wyden, chair of the Finance committee, has signaled his want to maintain the checks on the present degree, telling reporters: “I’m all the time keen to hear, however I’m against it,” when requested about reducing the earnings threshold.

And Biden has made it clear that he feels Democrats owe People checks, after promising additional direct assist if the social gathering received each Senate seats (and management of the Senate) in Georgia’s January particular election.

Biden, in a name with Home Democrats early final week, stated “We will’t stroll away from extra $1,400 in direct checks we proposed as a result of folks want, and albeit, they’ve been promised it. Possibly we are able to — I believe we are able to higher goal that quantity. I’m okay with that.”

However concentrating on could have penalties — together with, maybe, electoral ones. Sahm has estimated that if Democrats select to decrease the brink to what Manchin and others are suggesting, roughly 40 million People who obtained the earlier two checks is not going to obtain one this time.

“It’s probably the most seen a part of the aid bundle,” one senior Democratic aide informed Vox. “It’s possible you’ll not see the spending on vaccines or on state and native assist, however when you’re anticipating a examine and don’t get one, you’ll know.”

Ella Nilsen contributed reporting.