The American financial system produced little aid final month because the winter pandemic surge continued to stymie a rebound within the labor mark

The American financial system produced little aid final month because the winter pandemic surge continued to stymie a rebound within the labor market. The weak displaying comes within the midst of a recent effort in Washington to offer a giant infusion of support to foster a restoration.

U.S. employers added 49,000 jobs in January, the Labor Division stated Friday. The quantity mirrored a disappointing month of hiring even because it supplied hope of renewed financial momentum.

The unemployment price fell to six.three p.c, from 6.7 p.c.

President Biden, talking later on the White Home, referred to the roles knowledge in laying out a case for his $1.9 trillion financial aid proposal. “It’s very clear our financial system continues to be in hassle,” he stated. “Lots of of us are dropping hope.”

The restricted January positive factors adopted an outright setback in December, when the financial system shed jobs for the primary time since April. December’s loss, initially acknowledged at 140,000, was revised on Friday to 227,000. The acquire for November was revised from 336,000 to 264,000.

There was a small victory in avoiding a second consecutive month of job losses, a prospect that some economists had feared given the one-two punch of rising coronavirus circumstances and waning federal support.

“It’s a optimistic signal that we bought over these velocity bumps and the wheels haven’t utterly come off the automobile,” stated Nick Bunker, head of analysis for the job web site Certainly.

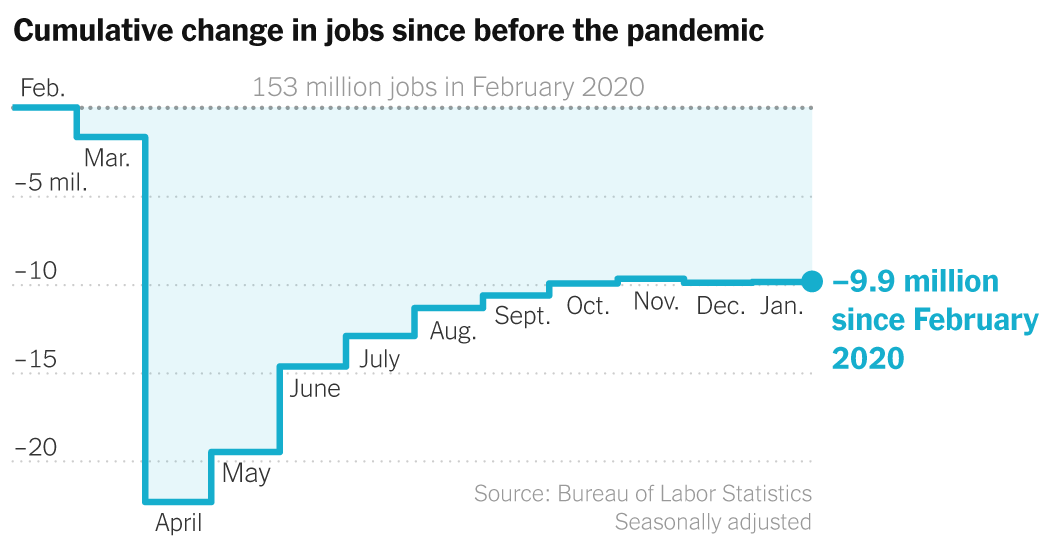

However Mr. Bunker stated the positive factors have been nothing to rejoice. The financial system nonetheless has greater than 9 million fewer jobs than it did earlier than the pandemic, and progress has slowed considerably because the summer season. In contrast to in December, when job losses have been concentrated in a couple of pandemic-exposed sectors, the weak spot in January was broad-based, with producers, retailers and transportation firms all reducing jobs.

“It’s not clear that this one month assuages these issues,” he stated. “100 thousand right here, 100 thousand there’s regular progress, nevertheless it’s not the kind of positive factors we have to see.”

Mr. Biden’s aid proposal took a step towards congressional approval early Friday when the Senate narrowly handed a funds decision that may subsequent go to the Home, the place Democrats won’t want Republican assist to approve it.

Some Republicans have stated a smaller package deal would suffice, and others have stated it’s too quickly for an additional spherical of support.

Almost a 12 months after the pandemic devastated the job market, many forecasters predict that the financial system will strengthen from right here on. The $900 billion federal aid package deal enacted in December is predicted to bolster the financial system, with extra support probably on the way in which. The vaccination push, although slower than hoped, is paving the way in which for wider reopenings whilst coronavirus mutations world wide make the rollout extra pressing.

“There ought to be a tailwind on the financial system’s again,” stated Julia Pollak, a labor economist on the on-line job web site ZipRecruiter. “We’ll want all of the tailwinds we are able to get.”

However the winter slowdown might depart lasting wounds. Although the financial system has regained greater than half of the 22 million jobs misplaced final spring, tens of millions of individuals have been unemployed for an extended interval — probably making it more durable to rejoin the work power — or are now not labeled as unemployed as a result of they’ve stopped in search of a job.

“It’s troublesome on a month-to-month foundation to essentially see what the long-term impacts can be,” stated Daniel Zhao, an economist with the profession web site Glassdoor. “However definitely the long-term financial scarring is one thing that could be a large concern for the restoration.”