The small quantity of federal earnings taxes President Trump paid in each 2016 and 2017 — simply $750 every year — has turn out to be the main focu

The small quantity of federal earnings taxes President Trump paid in each 2016 and 2017 — simply $750 every year — has turn out to be the main focus of a lot consideration because it was revealed in a New York Occasions investigation. The figures beneath, drawn from Mr. Trump’s tax-return knowledge for 2017, present how his accountants arrived at that determine for a type of years.

Donald J. Trump’s earnings in 2017

Though Mr. Trump donates his wage to the federal government, it’s topic to earnings tax alongside together with his different earnings. However as a result of Mr. Trump’s general earnings was unfavourable, he didn’t owe common earnings tax on any of it.

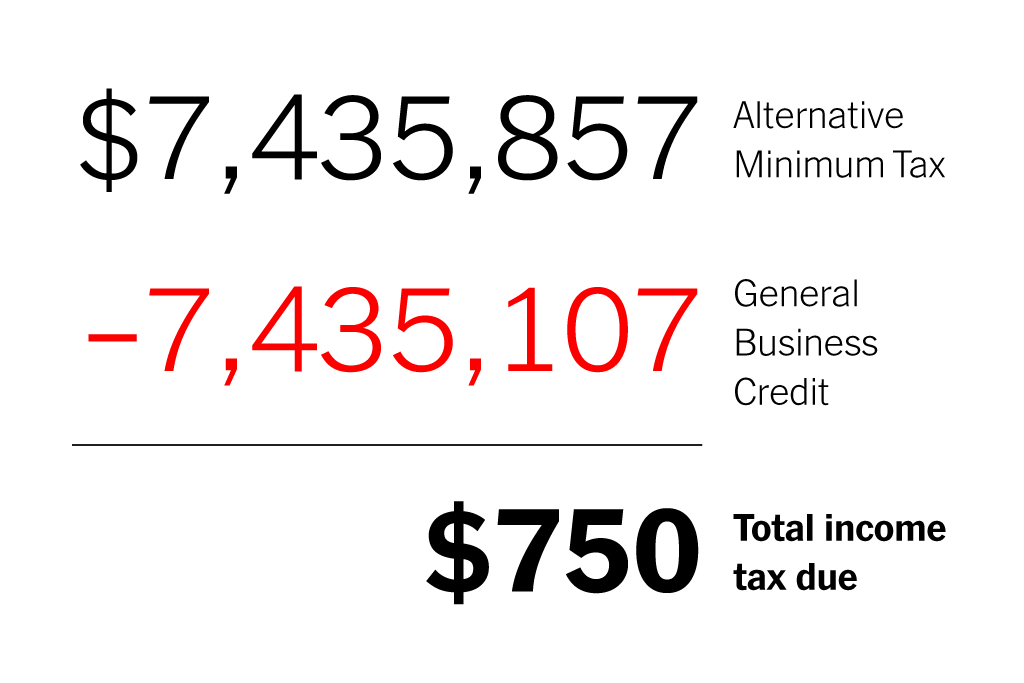

He was, nevertheless, nonetheless topic to the Various Minimal Tax, a parallel tax system that reduces the advantage of some deductions, stopping rich individuals from erasing their tax legal responsibility altogether. Most importantly, the A.M.T. components disallowed $45 million in losses that Mr. Trump had carried over from prior years.

However tax legal guidelines gave him yet another line on which to cut back the A.M.T. Mr. Trump had $22.7 million in Normal Enterprise Credit score, a lot of it carried ahead from prior years, that he might apply. The credit score is a smorgasbord of tax incentives and givebacks to enterprise homeowners, and in Mr. Trump’s case they ranged from credit of $322,926 for Social Safety and Medicare taxes paid on worker tricks to a minimum of $1.5 million associated to rehabilitating the Previous Put up Workplace in Washington.

The enterprise credit score can’t be used to get a refund; it will probably solely be utilized in opposition to taxes owed. Mr. Trump had greater than sufficient to cancel out his $7,435,857 tax invoice. However on the Type 3800 for the Normal Enterprise Credit score, his accountants subtracted $750 from his allowable credit score. Why they did that’s not clear. However the outcome was a complete federal earnings tax legal responsibility of $750.